5 Best Practices for Bundling Home and Auto Insurance in America

Implement 5 best practices for bundling home and auto insurance in America. Save significantly by combining your policies with one provider.

5 Best Practices for Bundling Home and Auto Insurance in America

Hey there, savvy American consumer! Are you looking for smart ways to cut down on your monthly expenses without sacrificing essential protection? Well, you've landed in the right spot. Today, we're diving deep into one of the most effective money-saving strategies in the insurance world: bundling your home and auto insurance. It's not just about convenience; it's about unlocking significant savings that can add up to hundreds, or even thousands, of dollars a year. We're going to walk you through five best practices to make sure you're getting the absolute most out of bundling your policies. We'll cover everything from understanding the discounts to picking the right provider and even looking at some real-world examples. So, buckle up, because your wallet is about to get a whole lot happier!

Understanding the Power of Bundling Home and Auto Insurance Discounts

First things first, let's talk about why bundling is such a big deal. Insurance companies love it when you bring more of your business to them. It means more revenue for them and less chance of you taking your business elsewhere. To reward this loyalty, they offer what's known as a 'multi-policy discount' or 'bundling discount.' This isn't just a small token; these discounts can range anywhere from 5% to 25% off your total premium, sometimes even more! Imagine saving 15% on both your home and auto insurance just by having them with the same company. That's real money back in your pocket.

But it's not just about the percentage. Bundling often simplifies your financial life. Instead of dealing with two different companies, two different billing cycles, and two different sets of paperwork, you have one point of contact. This can be a huge time-saver, especially if you ever need to file a claim. Plus, having a single insurer means they have a more complete picture of your risk profile, which can sometimes lead to even better rates or more tailored coverage options.

Think of it this way: if you're a good customer for one type of insurance, you're likely a good customer for another. Insurers see you as a lower risk overall, and they're willing to pass some of those savings on to you. It's a win-win situation!

Comparing Top Insurance Providers for Home and Auto Bundles in the USA

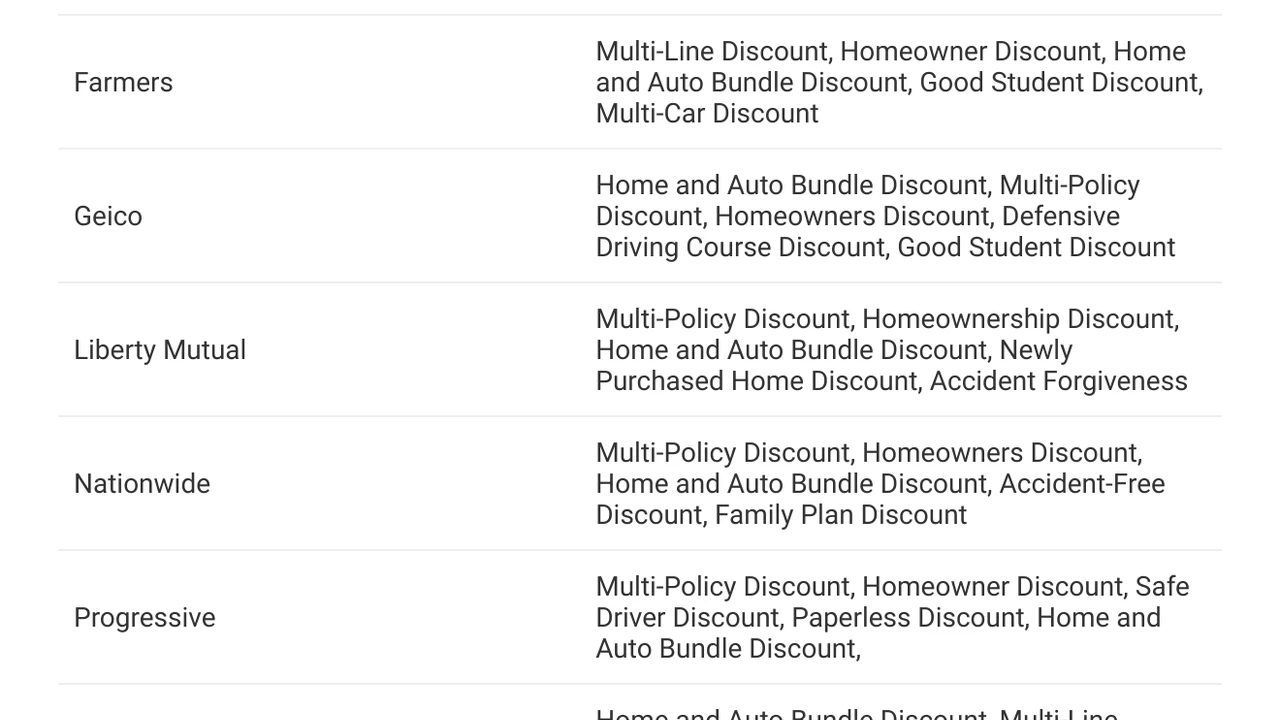

Now, this is where the rubber meets the road. Not all insurance companies are created equal when it comes to bundling. Some offer fantastic discounts and seamless service, while others might be less competitive. It's crucial to shop around and compare. Here are some of the top players in the American market known for their bundling options, along with a general idea of what they offer:

State Farm Home and Auto Insurance Bundles

State Farm is a giant in the insurance industry, and for good reason. They have a massive network of local agents, which many people appreciate for personalized service. Their bundling discounts are competitive, often ranging from 10-15% on both policies. They are particularly strong in states with a large rural and suburban population. For example, a homeowner in Ohio with a 2018 Honda Civic and a $300,000 home might see an annual auto premium of $1,200 and a home premium of $900. Bundling could bring that total down from $2,100 to around $1,785, saving $315 annually. State Farm also offers various other discounts like good driver, multi-car, and home safety features, which can further reduce your combined premium. Their online tools are decent, but many customers prefer the in-person agent experience.

GEICO Home and Auto Insurance Bundles

GEICO is famous for its catchy commercials and often very competitive online quotes. They are a direct-to-consumer insurer, meaning you'll primarily interact with them online or over the phone. Their bundling discounts can be quite aggressive, sometimes reaching up to 20% or more, especially for customers with good driving records and newer homes. A customer in Florida with a 2020 Toyota Camry and a $250,000 home might find an auto premium of $1,500 and a home premium of $1,100. Bundling could reduce this from $2,600 to approximately $2,080, a saving of $520. GEICO excels in offering quick quotes and a streamlined digital experience, making it a favorite for those who prefer managing their policies online. They also partner with various home insurance providers, so while you bundle through GEICO, your home policy might be underwritten by another company, which is something to be aware of.

Allstate Home and Auto Insurance Bundles

Allstate, with its 'You're in Good Hands' slogan, offers a strong combination of agent support and online tools. Their bundling discounts are typically in the 10-15% range. They are known for their 'Drivewise' program, which can offer additional auto savings based on your driving habits. For a family in Texas with two cars (e.g., a 2019 Ford F-150 and a 2021 Subaru Outback) and a $350,000 home, their combined unbundled premium might be $3,500 ($2,000 for auto, $1,500 for home). With bundling, this could drop to around $2,975, saving $525. Allstate also offers a 'Claim-Free Bonus' and 'Deductible Rewards' which can be very attractive for long-term customers. They have a good balance for those who want both digital convenience and the option of local agent support.

Progressive Home and Auto Insurance Bundles

Progressive is another major player, known for its 'Name Your Price' tool and Snapshot program. While they are primarily an auto insurer, they offer bundling by partnering with various home insurance providers. Their bundling discounts can be significant, often up to 15-20%. A renter in California with a 2022 Tesla Model 3 and a $50,000 renters insurance policy might pay $1,800 for auto and $150 for renters. Bundling could bring this down from $1,950 to around $1,657, saving $293. Progressive's strength lies in its innovative tools and competitive pricing, especially for those who are comfortable with a more digital-first approach. They are also very transparent about how their rates are calculated.

Farmers Insurance Home and Auto Bundles

Farmers Insurance offers a wide range of coverage options and personalized service through their agents. Their bundling discounts are competitive, often around 10-15%. They are particularly strong in offering customizable policies to fit specific needs. Consider a customer in Washington with a 2017 Jeep Grand Cherokee and a $400,000 home. Their unbundled premiums might be $1,400 for auto and $1,000 for home. Bundling could reduce this to approximately $2,040, saving $360. Farmers also offers a 'Signal' program for auto insurance that can provide additional discounts based on driving behavior. They are a good choice for those who value a more consultative approach to their insurance needs.

When comparing, don't just look at the discount percentage. Get actual quotes for bundled policies from at least three different providers. The total bundled price is what truly matters. Also, consider customer service ratings, claims handling efficiency, and the overall financial stability of the company. Websites like J.D. Power and Consumer Reports can be excellent resources for this.

Maximizing Your Savings with Multi Policy Discounts and Other Bundling Strategies

Bundling isn't just a one-and-done deal. There are several strategies you can employ to squeeze every last drop of savings out of your policies. It's about being proactive and understanding all the levers you can pull.

Review Your Coverage Annually for Optimal Bundling

Your life changes, and so should your insurance. Did you get married? Have a new baby? Install a security system? Buy a new car? All these factors can impact your rates and eligibility for discounts. Make it a habit to review your home and auto policies with your insurer at least once a year, especially before renewal. This ensures you're not over-insured or under-insured, and that you're taking advantage of every possible discount. For example, if you've paid off your car, you might consider adjusting your collision and comprehensive coverage. If you've added a new roof, your home insurance premium might decrease.

Explore Additional Bundling Opportunities Beyond Home and Auto

While home and auto are the most common bundle, many insurers offer discounts for bundling even more policies. Think about life insurance, renters insurance, motorcycle insurance, RV insurance, or even umbrella policies. The more policies you have with one provider, the greater your potential savings. For instance, if you add a life insurance policy to your home and auto bundle, you might get an additional 5% off your entire premium. This is where companies like Nationwide, Liberty Mutual, and Travelers often shine, as they offer a broader range of insurance products.

Leverage Technology and Telematics Programs for Extra Auto Savings

Many insurers now offer telematics programs (like Progressive's Snapshot, Allstate's Drivewise, or State Farm's Drive Safe & Save) that monitor your driving habits. If you're a safe driver, these programs can lead to significant additional discounts on your auto insurance, which then further enhances your bundled savings. These programs typically track things like mileage, braking habits, acceleration, and time of day you drive. If you're confident in your driving skills, this is a fantastic way to prove it and get rewarded.

Improve Your Home Security and Safety Features

Just as safe driving lowers auto premiums, a safe home lowers home premiums. Installing security systems, smoke detectors, carbon monoxide detectors, smart home devices, or even upgrading your roof can qualify you for additional discounts. When you bundle, these home-related savings indirectly contribute to the overall attractiveness of your combined package. Always inform your insurer about any significant home improvements that enhance safety or reduce risk.

Maintain a Good Credit Score

In many states (though not all, like California, Hawaii, and Massachusetts), your credit score can significantly impact your insurance rates. Insurers use credit-based insurance scores as a predictor of how likely you are to file a claim. A higher credit score often translates to lower premiums for both home and auto insurance. So, maintaining good credit isn't just good for loans; it's good for insurance too, and it amplifies your bundling savings.

Navigating the Claims Process with a Bundled Policy for American Consumers

One of the often-overlooked benefits of bundling is the potential for a smoother claims process. When you have both your home and auto with the same insurer, they have a holistic view of your situation, which can be incredibly helpful if you ever experience an incident that involves both policies, like a car crashing into your garage.

Single Point of Contact for Claims

Imagine this scenario: a tree falls on your car in your driveway, damaging both your vehicle and your home. If you have separate insurers, you'd be dealing with two different companies, two different adjusters, and potentially two different sets of paperwork. With a bundled policy, you typically have one point of contact. This streamlines communication, reduces confusion, and can often lead to a faster resolution. Your insurer already has all your policy details in one place, making it easier for them to assess the damage and coordinate repairs.

Potential for Deductible Waivers or Reductions

In some cases, if an incident affects both your home and auto, your bundled insurer might offer a single deductible or even waive one of the deductibles. This isn't universal, so it's crucial to check your specific policy terms, but it's a definite perk to look out for. For example, if your car is damaged in a fire that also damages your garage, you might only pay one deductible instead of two separate ones for your auto and home policies.

Consistent Customer Service Experience

When you bundle, you get to know one company's customer service culture. If you've had a positive experience with their auto claims, you can generally expect a similar level of service for your home claims. This consistency can provide peace of mind during stressful times. You're not rolling the dice with a new company's claims department every time something goes wrong.

Understanding Your Policy Documents

Even with a bundled policy, it's vital to understand the specifics of both your home and auto coverage. While they are with the same company, they are still distinct policies with their own terms, conditions, deductibles, and limits. Take the time to read through your policy documents or ask your agent to explain them in detail. Knowing what's covered and what's not before an incident occurs will save you a lot of headaches later.

When Bundling Home and Auto Insurance Might Not Be the Best Option

While bundling is often a fantastic way to save money, it's not always the absolute best choice for everyone. There are a few scenarios where you might find better deals by keeping your policies separate. It's all about doing your homework and understanding your unique situation.

When One Policy is Significantly More Expensive

Sometimes, one of your policies might be exceptionally expensive due to specific risk factors. For example, if you have a very high-value home in a high-risk area for natural disasters, your home insurance might be astronomical. Or, if you have a very poor driving record, your auto insurance could be through the roof. In these cases, the bundling discount on the cheaper policy might not offset the higher cost of the expensive one, even with the discount. You might find a specialized insurer who offers better rates for that particular high-risk policy, and then find a separate, competitive insurer for your other policy.

If You Qualify for Niche Discounts with Separate Insurers

Some insurance companies specialize in certain types of coverage or cater to specific demographics. For instance, USAA offers incredible rates and benefits for military members and their families. If you qualify for such a niche discount with a specialized insurer for one of your policies, that discount might be larger than any bundling discount you'd get from a general provider. Similarly, some companies might offer unique discounts for specific car brands (e.g., Tesla insurance) or home types (e.g., historic homes) that a bundled policy might not match.

Poor Customer Service or Claims Experience with a Bundled Provider

If you've had a terrible experience with a particular insurer's claims department or customer service for one policy, you might not want to entrust them with another. The convenience of bundling isn't worth the headache of dealing with a company that doesn't meet your expectations when you need them most. Always prioritize good service, especially when it comes to something as important as insurance.

Lack of Competitive Bundling Discounts

Believe it or not, some insurers just don't offer very attractive bundling discounts. Or, their base rates might be so high that even with a discount, their bundled price is still more expensive than getting separate policies from two different, more competitive companies. This is why getting multiple quotes is absolutely essential. Don't assume bundling is always cheaper; verify it with actual numbers.

When You Have Very Unique or Complex Insurance Needs

If you have very complex insurance needs, such as multiple properties, exotic cars, or a home-based business with specific liability requirements, a single bundled policy might not offer the specialized coverage you need for each asset. In such cases, working with different insurers who specialize in those particular areas might provide more comprehensive and tailored protection, even if it means sacrificing a bundling discount.

The key takeaway here is to always compare. Get quotes for bundled policies, but also get quotes for separate home and auto policies from different companies. Do the math. Sometimes, the sum of two separate, highly competitive policies can be less than a bundled one, even with the discount. It's all about finding the sweet spot for your individual circumstances.

Final Thoughts on Bundling Home and Auto Insurance for American Households

Alright, so we've covered a lot of ground, haven't we? From understanding the core benefits of bundling to comparing top providers and exploring advanced strategies, you're now equipped with a wealth of knowledge to make informed decisions about your home and auto insurance in America. Remember, the goal isn't just to save a few bucks; it's to ensure you have comprehensive protection for your most valuable assets at the most competitive price possible.

Bundling your home and auto insurance is, for most American households, a no-brainer. It offers convenience, significant savings through multi-policy discounts, and often a smoother claims experience. Companies like State Farm, GEICO, Allstate, Progressive, and Farmers all offer compelling reasons to consider them for your bundled needs, each with their own strengths in terms of customer service, digital tools, and discount structures.

But don't stop there! Be proactive. Review your policies annually, explore additional bundling opportunities (think life insurance, renters, RVs!), and leverage technology like telematics programs. Keep your home safe and your credit score healthy, as these factors indirectly contribute to your overall savings. And while bundling is great, always remember to compare. Get multiple quotes, both bundled and separate, to ensure you're truly getting the best deal for your unique situation.

Your insurance needs are personal, and what works best for your neighbor might not be ideal for you. So, take these best practices, apply them to your own research, and confidently choose the insurance solution that provides you with peace of mind and a fatter wallet. Happy bundling, and drive safe!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)