5 Essential Auto Insurance Coverage Types Explained

Learn about the 5 essential auto insurance coverage types you need to protect yourself and your vehicle. Understand liability, collision, and comprehensive coverage.

Learn about the 5 essential auto insurance coverage types you need to protect yourself and your vehicle. Understand liability, collision, and comprehensive coverage.

5 Essential Auto Insurance Coverage Types Explained

Navigating the world of auto insurance can feel like deciphering a complex code. With so many terms, policies, and options, it's easy to get lost. But understanding the core components of auto insurance is crucial for protecting yourself, your vehicle, and your finances. This comprehensive guide will break down the five essential auto insurance coverage types, explaining what they are, how they work, and why they're indispensable. We'll also delve into specific product recommendations, usage scenarios, comparisons, and pricing considerations to help you make informed decisions.

Understanding Liability Coverage Your Foundation of Protection

Liability coverage is the bedrock of any auto insurance policy. In most places, it's legally mandated, and for good reason. It protects you financially if you're at fault in an accident that causes bodily injury or property damage to others. Think of it as your safety net against the costs of an accident you cause.

Bodily Injury Liability What It Covers and Why It Matters

Bodily Injury Liability (BIL) covers the medical expenses, lost wages, and pain and suffering of anyone injured in an accident where you are deemed responsible. This can include passengers in your car, occupants of other vehicles, pedestrians, or cyclists. Without adequate BIL, you could be personally responsible for these costs, which can quickly escalate into hundreds of thousands, or even millions, of dollars. Imagine causing a multi-car pile-up with severe injuries; your personal assets could be at risk.

Property Damage Liability Protecting Others' Property

Property Damage Liability (PDL) covers the cost of repairing or replacing property you damage in an accident. This most commonly refers to other vehicles, but it can also include fences, mailboxes, buildings, or other structures. Just like BIL, if you're at fault and don't have sufficient PDL, you'll be on the hook for the repair or replacement costs. A simple fender bender can easily cost thousands, and damaging a luxury vehicle or commercial property can be far more expensive.

Recommended Liability Coverage Levels and Product Examples

While minimum liability requirements vary by state and country, it's almost always advisable to carry more than the legal minimum. A common recommendation is 100/300/50, meaning $100,000 for bodily injury per person, $300,000 for bodily injury per accident, and $50,000 for property damage per accident. For higher net worth individuals, even higher limits or an umbrella policy are often recommended.

- Geico: Known for competitive rates, Geico offers various liability limits. Their online quote system makes it easy to compare different coverage levels and see the price difference.

- Progressive: Progressive often provides options for higher liability limits and allows for easy bundling with other insurance types, potentially leading to discounts.

- State Farm: A traditional insurer with a strong agent network, State Farm can help you assess your individual risk and recommend appropriate liability coverage.

Usage Scenario: You're driving in a busy city and accidentally rear-end another car, causing significant damage to their vehicle and minor injuries to the driver. Your liability coverage would pay for the other driver's car repairs and medical bills, up to your policy limits.

Collision Coverage Repairing Your Vehicle After an Accident

Collision coverage is designed to pay for the damage to your own vehicle if it collides with another car or object, regardless of who is at fault. This is a crucial coverage if you want your car repaired or replaced after an accident.

How Collision Coverage Works Deductibles and Claims

When you file a collision claim, you'll typically pay a deductible, which is the amount you agree to pay out of pocket before your insurance kicks in. Common deductibles range from $250 to $1,000. A higher deductible usually means a lower premium, but it also means you'll pay more upfront if you have an accident. After your deductible is met, your insurer covers the remaining repair costs, up to the actual cash value of your vehicle.

When is Collision Coverage Essential New Cars and Loans

Collision coverage is almost always required if you have a car loan or lease, as the lender wants to protect their investment. Even if you own your car outright, it's highly recommended for newer or more valuable vehicles. If your car is older and its value is low, you might consider dropping collision coverage to save on premiums, but be prepared to pay for repairs out of pocket.

Product Comparisons and Pricing Factors for Collision

The cost of collision coverage is influenced by several factors, including your vehicle's make, model, age, and safety features, as well as your driving record and location.

- Allstate: Offers various deductible options and often provides discounts for safe driving and vehicle safety features.

- Farmers Insurance: Known for personalized service, Farmers can help you tailor your collision coverage to your specific vehicle and budget.

- USAA (for military members and families): Consistently ranks high for customer satisfaction and offers competitive rates for collision coverage.

Usage Scenario: You swerve to avoid an animal and hit a guardrail, causing significant damage to the front of your car. Your collision coverage would pay for the repairs after you pay your deductible.

Comprehensive Coverage Protection Against Non Collision Incidents

Comprehensive coverage protects your vehicle from damages not caused by a collision. This includes a wide range of incidents that are often beyond your control.

What Comprehensive Coverage Includes Theft Vandalism and More

Comprehensive coverage typically covers:

- Theft

- Vandalism

- Fire

- Falling objects (e.g., tree branches, hail)

- Animal collisions (e.g., hitting a deer)

- Natural disasters (e.g., floods, hurricanes, earthquakes)

- Glass breakage (windshield, windows)

Deductibles and When to Consider Comprehensive Coverage

Similar to collision coverage, comprehensive coverage usually comes with a deductible. It's often required by lenders for financed or leased vehicles. For older cars, the decision to keep comprehensive coverage depends on the vehicle's value and your risk tolerance. If your car is worth less than the cost of your deductible plus a few years of premiums, it might not be cost-effective.

Comparing Comprehensive Coverage Options and Costs

The cost of comprehensive coverage is influenced by your vehicle's value, the likelihood of theft in your area, and your chosen deductible.

- Liberty Mutual: Offers customizable comprehensive plans and often provides discounts for anti-theft devices.

- Nationwide: Known for strong claims service, Nationwide provides comprehensive coverage that can be easily bundled with other policies.

- Erie Insurance: Often praised for its customer service and competitive rates, Erie offers comprehensive coverage with various deductible options.

Usage Scenario: You wake up one morning to find your car's window smashed and your stereo stolen. Your comprehensive coverage would pay for the repairs and replacement of the stolen items, after your deductible.

Uninsured Underinsured Motorist Coverage Protecting Yourself from Others

Uninsured/Underinsured Motorist (UM/UIM) coverage is a critical but often overlooked component of auto insurance. It protects you and your passengers if you're involved in an accident with a driver who either has no insurance (uninsured) or not enough insurance (underinsured) to cover your damages.

Uninsured Motorist Bodily Injury UMBI What It Covers

UMBI covers your medical expenses, lost wages, and pain and suffering if an uninsured driver injures you or your passengers. This is especially important because many drivers, despite legal requirements, operate vehicles without insurance. If you're hit by an uninsured driver, your UMBI acts as their liability coverage, protecting you from significant out-of-pocket costs.

Uninsured Motorist Property Damage UMPD Protecting Your Vehicle

UMPD covers the damage to your vehicle if an uninsured driver is at fault. In some states, this is a separate coverage, while in others, it might be included with UMBI or covered by your collision policy with a waiver. It's essential to understand how this works in your specific location.

Underinsured Motorist Coverage When Others Don't Have Enough

Underinsured Motorist (UIM) coverage kicks in when the at-fault driver has insurance, but their liability limits aren't high enough to cover all your damages. For example, if their policy only covers $25,000 in bodily injury, but your medical bills are $50,000, your UIM coverage would pay the remaining $25,000.

Why UM UIM is Essential and Product Recommendations

UM/UIM coverage is vital because it protects you from the financial irresponsibility of others. It's often relatively inexpensive compared to the protection it offers. Many states require or offer UM/UIM as an option, and it's almost always a good idea to accept it.

- Amica Mutual: Known for excellent customer service and strong coverage options, Amica offers robust UM/UIM protection.

- Travelers: Provides comprehensive UM/UIM options and allows for customization to fit your specific needs.

- GEICO: Offers competitive rates for UM/UIM coverage, making it an affordable way to add this crucial protection.

Usage Scenario: An uninsured driver runs a red light and T-bones your car, causing significant injuries to you and your passenger, and totaling your vehicle. Your UMBI would cover your medical bills and lost wages, and your UMPD (or collision, depending on your policy) would cover the damage to your car.

Personal Injury Protection PIP or Medical Payments MedPay Covering Your Medical Bills

Personal Injury Protection (PIP) and Medical Payments (MedPay) coverage are designed to cover medical expenses for you and your passengers, regardless of who is at fault for an accident. The availability and specifics of these coverages vary significantly by state, particularly in 'no-fault' states.

Personal Injury Protection PIP What It Entails

PIP is typically found in 'no-fault' states. It covers medical expenses, lost wages, and sometimes even essential services (like childcare or household help) if you or your passengers are injured in an accident, regardless of who caused it. The idea behind no-fault systems is to streamline the claims process for minor injuries, reducing the need for lawsuits. PIP can also cover funeral expenses.

Medical Payments MedPay A Simpler Medical Coverage

MedPay is a more basic form of medical coverage, available in 'at-fault' states. It covers reasonable and necessary medical and funeral expenses for you and your passengers, regardless of fault, up to a specified limit. Unlike PIP, MedPay typically doesn't cover lost wages or essential services.

Why PIP or MedPay is Important and Product Considerations

Even if you have health insurance, PIP or MedPay can be incredibly valuable. They often pay out faster than health insurance after an accident, and they can cover deductibles and co-pays that your health insurance might not. They also cover passengers who may not have their own health insurance.

- State Farm: Offers strong PIP/MedPay options, especially in states where these coverages are prominent. Their agents can help you understand the specific requirements and benefits in your area.

- Progressive: Provides flexible PIP/MedPay limits, allowing you to choose coverage that complements your existing health insurance.

- Allstate: Known for comprehensive coverage, Allstate offers robust PIP/MedPay options to ensure you and your passengers are protected.

Usage Scenario: You're involved in a minor accident that's your fault, and you and your passenger sustain whiplash. Your PIP or MedPay coverage would pay for your initial doctor visits, physical therapy, and any necessary medications, regardless of your fault.

Putting It All Together Building Your Ideal Auto Insurance Policy

Understanding these five essential coverage types is the first step toward building an auto insurance policy that truly protects you. The best policy isn't necessarily the cheapest; it's the one that provides adequate protection for your specific needs and financial situation. Always consider your vehicle's value, your driving habits, your financial assets, and the legal requirements in your area.

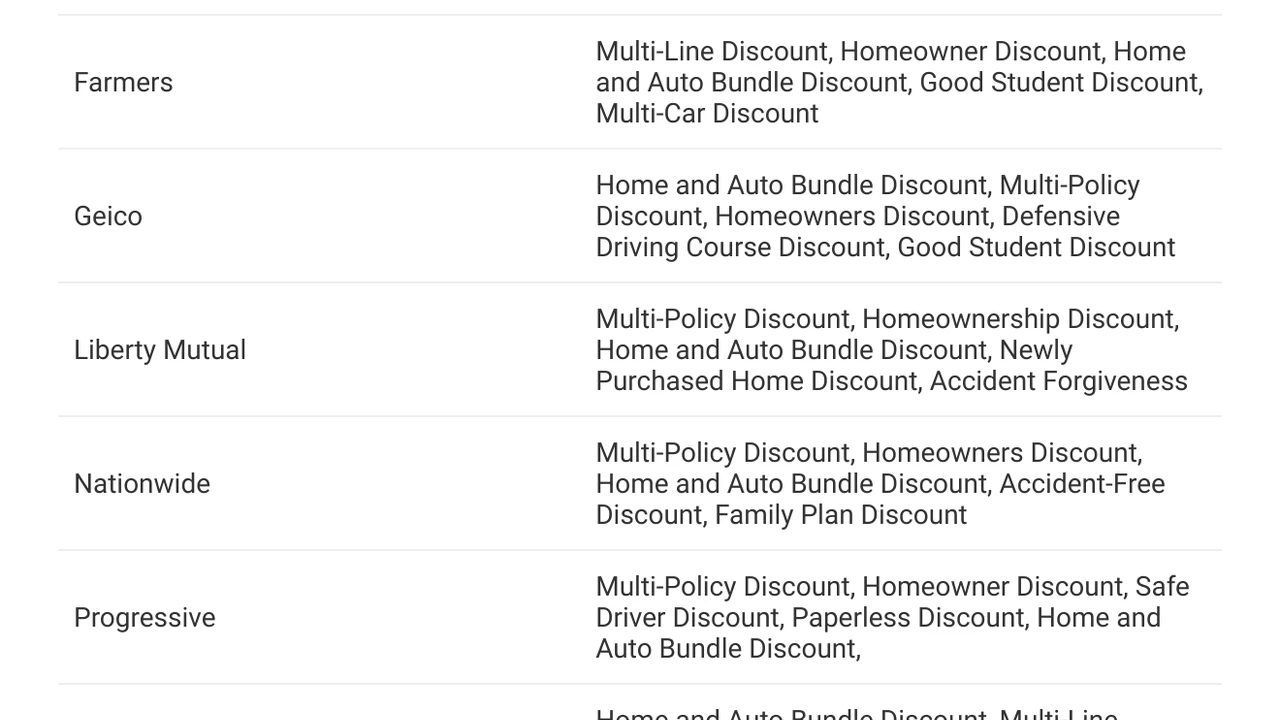

Comparing Insurance Providers and Bundling Options

Many insurance companies offer all these coverage types, and often provide discounts for bundling multiple policies (e.g., auto and home insurance). It's always a good idea to get quotes from several providers to compare rates and coverage options.

- Lemonade Car: A newer player, Lemonade offers a tech-forward approach to insurance, often with competitive pricing and a focus on social impact. Their car insurance includes comprehensive coverage options.

- Root Insurance: Uses telematics (tracking your driving habits) to offer personalized rates, potentially saving safe drivers a lot on their premiums. They offer all standard coverage types.

- Erie Insurance: Known for strong customer service and competitive rates, Erie often provides excellent value for comprehensive policies.

The Importance of Regular Policy Review

Your insurance needs can change over time. Buying a new car, moving to a new area, getting married, or having a teen driver in the household all impact your insurance requirements. Review your policy annually with your agent or insurer to ensure you have the right coverage at the best price. Don't just set it and forget it!

Additional Coverage Options to Consider

While we've focused on the five essentials, many insurers offer additional coverages that might be beneficial:

- Rental Car Reimbursement: Covers the cost of a rental car while yours is being repaired after a covered claim.

- Roadside Assistance: Provides help with flat tires, dead batteries, towing, and lockouts.

- Gap Insurance: Crucial for new cars, it covers the difference between what you owe on a car loan and its actual cash value if it's totaled.

- New Car Replacement: If your new car is totaled, this coverage pays for a brand-new car of the same make and model, rather than just its depreciated value.

By understanding these core components and regularly reviewing your policy, you can drive with confidence, knowing you're adequately protected on the road.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)