5 Smart Ways to Use Telematics for Auto Insurance Savings

Uncover the top 7 lesser known auto insurance discounts you need. Find hidden savings that can significantly reduce your car insurance costs.

Top 7 Lesser Known Auto Insurance Discounts You Need

Hey there, savvy driver! We all know about the common auto insurance discounts, right? Good driver, multi-car, bundling home and auto – those are practically household names. But what if I told you there are a bunch of other, less obvious ways to slash your car insurance premiums? We're talking about those hidden gems that most people overlook, but can seriously add up to significant savings. In this deep dive, we're going to uncover the top 7 lesser-known auto insurance discounts that you absolutely need to know about. Get ready to put some extra cash back in your pocket!

Unlocking Hidden Savings Exploring Obscure Auto Insurance Discounts

It's a common misconception that once you've got your basic discounts, that's it. But insurance companies are constantly evolving their offerings, and many have niche discounts designed to reward specific behaviors, vehicle features, or even your profession. The trick is knowing what to ask for and where to look. These aren't always advertised front and center, so a little digging and a direct conversation with your insurer can go a long way. Let's break down some of these fantastic, often-missed opportunities.

Discount 1 Low Mileage Discount Driving Less Saving More

Are you working from home more often? Do you primarily use public transport or walk for your daily commute? If your car spends more time in the garage than on the road, you might be eligible for a low mileage discount. Many insurers offer reduced rates for drivers who log fewer miles annually. The exact threshold varies by company, but typically, if you drive less than 7,500 to 10,000 miles a year, you could qualify.

How to Qualify for Low Mileage Discounts

- Track Your Mileage: Keep a record of your odometer readings. Some insurers might ask for this.

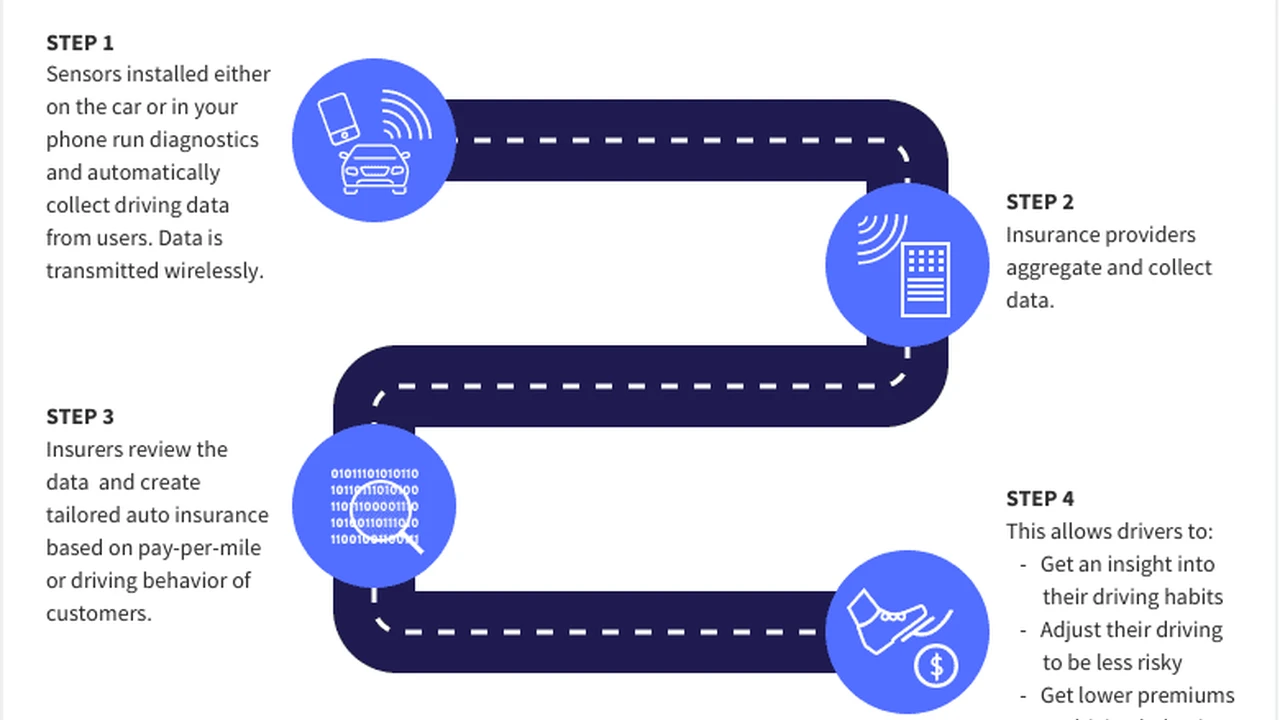

- Telematics Programs: Many companies use telematics devices (like a plug-in dongle or a smartphone app) that track your actual mileage and driving habits. This can be a great way to prove your low mileage.

- Ask Your Insurer: Don't assume they know! Proactively ask if they offer a low mileage discount and what their specific requirements are.

Example Products and Scenarios for Low Mileage Discounts

Most major insurers offer some form of low mileage discount. Here are a few examples:

- Progressive Snapshot: This program tracks your driving habits, including mileage. If you drive less, you save more.

- State Farm Drive Safe & Save: Similar to Snapshot, this program uses a device or app to monitor mileage and other factors.

- Allstate Drivewise: Rewards safe driving and lower mileage with discounts.

Scenario: Sarah, a freelance writer, used to commute 30 miles each way. Now, she works from home five days a week and only drives her car for errands and weekend trips, totaling about 6,000 miles a year. By informing her insurer and enrolling in their telematics program, she saved 15% on her annual premium.

Discount 2 Professional or Occupational Discounts Rewarding Your Career Choice

Believe it or not, your job can sometimes get you a discount on car insurance! Many insurance companies offer special rates for individuals in certain professions, as these groups are often statistically considered lower risk. Common professions that qualify include teachers, engineers, scientists, nurses, doctors, first responders (police, firefighters, EMTs), and active military personnel or veterans.

Who Qualifies for Occupational Discounts

- Educators: Teachers, professors, and school administrators.

- Healthcare Professionals: Nurses, doctors, medical technicians.

- First Responders: Police officers, firefighters, paramedics.

- Engineers and Scientists: Often seen as meticulous and responsible.

- Military Personnel: Active duty, reserves, and veterans.

Example Insurers and Their Professional Discounts

- GEICO: Known for offering discounts to federal employees, military personnel, and members of various professional organizations.

- USAA: Exclusively serves military members and their families, offering highly competitive rates.

- Farmers Insurance: Offers discounts for certain professional groups, including teachers and engineers.

Scenario: Mark, a high school teacher, switched to a new insurance provider after learning they offered a 10% discount for educators. He simply had to provide proof of his employment, and his savings were applied immediately.

Discount 3 Good Student Discount Academic Excellence Pays Off

This one isn't just for college kids! If you have a young driver on your policy who maintains good grades, you could be eligible for a significant discount. Insurers view students with good academic performance as more responsible, and therefore, less likely to be involved in accidents. Typically, a B average (3.0 GPA) or higher is required.

Requirements for Good Student Discounts

- Age Limit: Usually applies to drivers under 25.

- GPA: A minimum GPA (e.g., 3.0 or B average) is required.

- Proof: You'll need to provide a copy of the student's report card or transcript.

Insurers Offering Good Student Discounts

- Allstate: Offers a good student discount for drivers under 25 with a B average or better.

- State Farm: Provides a Steer Clear discount for young drivers who complete a safe driving program and maintain good grades.

- Liberty Mutual: Offers a discount for full-time students under 25 who maintain a B average.

Scenario: Emily, 18, just got her driver's license. Her parents were bracing for a huge increase in their premium. However, because Emily maintained a 3.5 GPA, they qualified for a good student discount, reducing the impact of adding a new driver by 12%.

Discount 4 Anti Theft Device Discount Protecting Your Ride Saving Your Wallet

Installing certain anti-theft devices in your vehicle can not only deter thieves but also earn you a discount on your comprehensive coverage. Insurers appreciate any measures you take to reduce the risk of your car being stolen, as it lowers their potential payout.

Types of Anti Theft Devices That Qualify

- Passive Alarms: Automatically arm when the car is turned off.

- Active Alarms: Require you to activate them.

- Vehicle Recovery Systems: GPS-based systems like LoJack or OnStar that help locate a stolen vehicle.

- Immobilizers: Prevent the engine from starting without the correct key or transponder.

Popular Anti Theft Systems and Their Impact on Premiums

- LoJack: A well-known stolen vehicle recovery system. Many insurers offer discounts for vehicles equipped with LoJack.

- OnStar: Offers stolen vehicle assistance and can also qualify for discounts.

- Aftermarket Alarms: Brands like Viper or Clifford, when professionally installed, can also lead to savings.

Scenario: David recently purchased a new car and decided to install a LoJack system for added security. When he informed his insurance company, they applied a 5% discount to his comprehensive coverage, effectively offsetting a portion of the LoJack installation cost over time.

Discount 5 Defensive Driving Course Discount Sharpening Skills Lowering Rates

Taking an approved defensive driving course can not only make you a safer driver but also qualify you for a discount. Insurers often reward drivers who voluntarily enhance their driving skills, as it demonstrates a commitment to safety and reduces the likelihood of accidents. This is particularly beneficial for older drivers or those looking to offset points on their license.

Who Benefits from Defensive Driving Discounts

- Drivers of All Ages: While often associated with younger or older drivers, anyone can benefit.

- Drivers with Minor Infractions: Can sometimes help reduce points or prevent premium increases.

- Older Drivers: Many states mandate or encourage discounts for seniors who complete these courses.

Approved Courses and Potential Savings

- Online Courses: Many state-approved online defensive driving courses are available (e.g., through AAA, AARP, or independent providers).

- In-Person Classes: Local driving schools or community centers often offer these.

Scenario: Maria, 68, completed an AARP Smart Driver course online. She received a certificate of completion, which she submitted to her insurer. This resulted in a 7% discount on her liability and collision coverage, saving her a noticeable amount each year.

Discount 6 Early Shopper or Advance Quote Discount Planning Ahead Pays Off

This is one of the easiest discounts to snag! Many insurance companies offer a discount if you get a quote and purchase your policy a certain number of days before your current policy expires or before you need coverage. This rewards you for being proactive and gives the insurer more time to process your application.

How to Get the Early Shopper Discount

- Plan Ahead: Start shopping for new insurance at least 7-10 days (sometimes up to 30 days) before your current policy renews or before you buy a new car.

- Get Multiple Quotes: Even if you plan to stay with your current insurer, get quotes from others to see if you can leverage this discount.

Insurers Known for Advance Quote Discounts

- GEICO: Often offers a discount for getting a quote in advance.

- Progressive: Known for its 'early quote' discount.

- Esurance: Frequently provides discounts for purchasing a policy ahead of time.

Scenario: John knew his auto insurance was renewing in three weeks. He decided to get a few comparison quotes online. When he got a quote from a new provider 15 days before his renewal, they automatically applied an 'advance quote' discount, saving him 8% on his new policy.

Discount 7 New Car Discount Driving a Modern Vehicle for Modern Savings

While newer cars are generally more expensive to insure due to their higher value, some insurers offer a specific 'new car' discount. This might seem counterintuitive, but modern vehicles often come equipped with advanced safety features (like automatic emergency braking, lane departure warning, and adaptive cruise control) that reduce the likelihood and severity of accidents. Insurers recognize these safety advancements.

Qualifying for New Car Discounts

- Vehicle Age: Typically applies to cars that are 1-3 model years old.

- Safety Features: The discount is often tied to the presence of specific advanced driver-assistance systems (ADAS).

Example Vehicles and Insurers Offering New Car Discounts

- Vehicles with ADAS: Cars like the Toyota Camry (with Toyota Safety Sense), Honda Civic (with Honda Sensing), or Subaru Outback (with EyeSight) are prime candidates.

- Insurers: Many major insurers, including Farmers, Liberty Mutual, and Travelers, offer some form of new car or advanced safety feature discount.

Scenario: Lisa bought a brand new 2023 Honda CR-V, which came standard with Honda Sensing. When she insured it, her agent informed her about a new car discount and an additional discount for the advanced safety features, collectively saving her 10% on her collision and medical payments coverage.

Maximizing Your Savings A Holistic Approach to Auto Insurance Discounts

Finding these lesser-known discounts is fantastic, but the real magic happens when you combine them with the more common ones. Think of it like building a discount stack! You might qualify for a low mileage discount because you work from home, an occupational discount because you're a teacher, and a good student discount for your college-aged child. Add in a multi-car discount and a bundling discount, and suddenly your premiums are looking much more manageable.

Tips for Uncovering All Possible Discounts

- Review Your Policy Annually: Life changes, and so do your potential discounts. Make it a habit to review your policy and discuss new circumstances with your insurer every year.

- Ask Direct Questions: Don't wait for your insurer to offer discounts. Ask them directly, 'What discounts am I eligible for?' or 'Do you offer discounts for [specific profession/device/course]?'

- Be Honest and Detailed: Provide accurate information about your driving habits, vehicle features, and personal circumstances.

- Compare Quotes Regularly: Even with all the discounts, it's always a good idea to compare quotes from different providers every 6-12 months. A new insurer might offer a better base rate or different discount structures that work better for you.

- Consider Telematics Programs: If you're a safe driver, these programs can unlock significant savings by tracking your actual driving behavior, including mileage, braking, and acceleration.

So, there you have it! Seven fantastic, often-overlooked auto insurance discounts that can help you save a bundle. Don't leave money on the table. Take the time to investigate these options with your insurance provider, and you might be pleasantly surprised by how much you can reduce your car insurance costs. Happy saving!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)