5 Ways to Maximize Your Auto Insurance Savings in Vietnam

Learn 5 ways to maximize your auto insurance savings in Vietnam. Get local advice to lower your car insurance costs.

Learn 5 ways to maximize your auto insurance savings in Vietnam. Get local advice to lower your car insurance costs.

5 Ways to Maximize Your Auto Insurance Savings in Vietnam

Navigating the world of auto insurance in Vietnam can feel a bit like driving through Ho Chi Minh City traffic – a lot to take in, and you want to make sure you're protected without breaking the bank. Whether you're a local resident, an expat, or a business owner with a fleet, finding ways to save on your car insurance is always a smart move. This comprehensive guide will walk you through five effective strategies to significantly reduce your auto insurance costs in Vietnam, offering practical advice, product recommendations, and a deep dive into the local market.

Understanding Vietnam's Auto Insurance Landscape Key to Savings

Before we dive into savings, it's crucial to understand the basics of auto insurance in Vietnam. Unlike some Western countries, third-party liability insurance is mandatory. This covers damages and injuries you might cause to other people or their property. Beyond that, comprehensive insurance (often called 'material damage' or 'physical damage' insurance) is optional but highly recommended, especially given Vietnam's driving conditions and accident rates. This covers damage to your own vehicle from accidents, theft, fire, and natural disasters. The market is dominated by both state-owned and private insurers, with a growing presence of international players. Key players include Bao Viet Insurance, PVI Insurance, PTI Insurance, Liberty Insurance, and Bao Minh Insurance. Each has its strengths, whether it's competitive pricing, extensive branch networks, or specialized services.

Strategy 1 Compare Quotes from Multiple Insurers for Best Rates

This might seem obvious, but it's the single most effective way to save money on auto insurance anywhere, and Vietnam is no exception. Insurance companies use different algorithms and risk assessments, meaning the same coverage can vary wildly in price from one provider to another. Don't just renew with your current insurer out of habit; always shop around.

How to Compare Effectively in Vietnam

- Online Comparison Tools: While not as prevalent or sophisticated as in some Western markets, some Vietnamese insurers and brokers are starting to offer online quote tools. Websites like Bao Viet Online or PTI Insurance allow you to get initial quotes. However, for comprehensive coverage, direct contact is often necessary.

- Insurance Brokers: Engaging an independent insurance broker is highly recommended. They work with multiple insurers and can provide unbiased comparisons, often securing better deals than you might find on your own. Reputable brokers in Vietnam include Aon, Marsh, and local firms specializing in personal lines. They understand the nuances of local policies and can help you navigate the fine print.

- Direct Contact: Don't hesitate to call or visit the offices of major insurers. Prepare your vehicle details (make, model, year, engine size, license plate), your driving history, and desired coverage levels.

Recommended Insurers for Comparison

- Bao Viet Insurance: As the largest state-owned insurer, Bao Viet has an extensive network and offers competitive rates, especially for basic third-party liability and comprehensive packages. They are known for their reliability and widespread presence.

- PVI Insurance: Another strong contender, PVI is often praised for its customer service and efficient claims processing. They offer a range of products suitable for various vehicle types.

- Liberty Insurance: An international player, Liberty often provides more comprehensive packages with additional benefits, which can be attractive for those seeking higher levels of protection, though sometimes at a slightly higher premium. They are particularly popular among expats.

- PTI Insurance: Known for its competitive pricing and user-friendly online platforms, PTI is a good option for those looking for quick quotes and straightforward policies.

Comparison Scenario Example

Let's say you own a 2020 Toyota Vios. You're looking for mandatory third-party liability and comprehensive coverage with a sum insured of VND 500 million (approximately USD 20,000). You contact three insurers:

- Bao Viet: Quotes VND 8 million/year (approx. USD 320) with a VND 1 million deductible.

- PVI: Quotes VND 7.5 million/year (approx. USD 300) with a VND 1.5 million deductible.

- Liberty: Quotes VND 9 million/year (approx. USD 360) but includes roadside assistance and a lower deductible of VND 500,000.

By comparing, you can see that PVI offers the lowest premium, but Liberty offers more benefits for a slightly higher cost. Your choice depends on your budget and desired level of service. Always consider the deductible amount, as a lower deductible means less out-of-pocket expense in case of a claim, but usually a higher premium.

Strategy 2 Increase Your Deductible to Lower Premiums

The deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in for a claim. By choosing a higher deductible, you signal to the insurer that you're willing to bear more of the initial risk, which in turn reduces their potential payout per claim. As a result, they reward you with a lower annual premium.

How Deductibles Work in Vietnam

In Vietnam, deductibles are typically expressed as a fixed amount (e.g., VND 500,000, VND 1 million, VND 2 million). For example, if you have a VND 1 million deductible and your car sustains VND 5 million in damage, you pay VND 1 million, and the insurer covers the remaining VND 4 million.

When to Consider a Higher Deductible

- Good Driving Record: If you're a careful driver with a low likelihood of making claims, a higher deductible can be a smart way to save.

- Emergency Fund: Ensure you have enough savings to comfortably cover your chosen deductible amount in case of an accident. Don't choose a deductible you can't afford.

- Older Vehicles: For older cars with lower market value, a higher deductible might make sense as the cost of minor repairs could be close to or even less than the deductible itself.

Product Examples and Impact on Price

Let's revisit our 2020 Toyota Vios example with Bao Viet Insurance:

- Standard Deductible (VND 1 million): Premium VND 8 million/year.

- Higher Deductible (VND 2 million): Premium might drop to VND 7 million/year (approx. USD 280).

- Even Higher Deductible (VND 3 million): Premium could be as low as VND 6.5 million/year (approx. USD 260).

This shows a potential saving of VND 1 million to VND 1.5 million (USD 40-60) annually just by adjusting your deductible. Always weigh the potential savings against your financial comfort level for out-of-pocket expenses.

Strategy 3 Utilize Available Discounts and Bundling Options

Many insurers in Vietnam offer various discounts, though they might not always be heavily advertised. It pays to ask and see what you qualify for. Bundling your insurance policies is another powerful way to save.

Common Discounts to Look For

- No Claims Discount (NCD): This is the most common and significant discount. If you don't make any claims for a certain period (usually 12 months), your premium for the next year will be reduced. The NCD can accumulate over several years, leading to substantial savings. For example, after 1 year claim-free, you might get 10% off; after 5 years, it could be 50%.

- Multi-Car Discount: If you insure more than one vehicle with the same company, you might qualify for a discount on all policies. This is particularly useful for families or businesses with small fleets.

- Good Driver Discount: Some insurers offer discounts for drivers with a clean record (no accidents or traffic violations) over a specified period.

- Loyalty Discount: Staying with the same insurer for several years can sometimes earn you a loyalty discount.

- Security Features Discount: If your car has advanced security features like an alarm system, immobilizer, or GPS tracker, some insurers might offer a small discount.

- Low Mileage Discount: If you don't drive much, some insurers might offer a discount based on your annual mileage. This is less common in Vietnam but worth asking about.

Bundling Insurance Policies

Bundling involves purchasing multiple types of insurance (e.g., auto, home, health, travel) from the same provider. Insurers often offer a significant discount for this, as it helps them retain customers and increase their overall business.

Bundling Scenario Example

Consider a family in Hanoi:

- Auto Insurance (Bao Viet): VND 8 million/year.

- Home Insurance (Bao Viet): VND 2 million/year.

- Health Insurance (Bao Viet): VND 10 million/year.

Total standalone cost: VND 20 million/year. If bundled, Bao Viet might offer a 10-15% discount on the total premium, saving the family VND 2-3 million (USD 80-120) annually. Companies like Bao Viet, PVI, and Liberty are good candidates for bundling due to their diverse product offerings.

Strategy 4 Maintain a Clean Driving Record and Drive Safely

This is perhaps the most straightforward and impactful strategy. Your driving record is a primary factor insurers use to assess your risk. A history of accidents or traffic violations will almost certainly lead to higher premiums, while a clean record can unlock significant savings through No Claims Discounts and good driver incentives.

Impact of Driving Record on Premiums

- Accidents: Even minor at-fault accidents can cause your premiums to jump significantly, sometimes by 20-50% or more, and you might lose your accumulated NCD.

- Traffic Violations: Speeding tickets, illegal parking fines, or other moving violations, especially if they are frequent, can also negatively impact your rates.

- No Claims Bonus (NCB): As mentioned, a clean record allows you to build up your NCB, which can eventually lead to a 50% discount on your comprehensive premium.

Tips for Safe Driving in Vietnam

- Defensive Driving: Always assume other drivers might make unexpected moves. Be prepared to react.

- Adhere to Traffic Laws: While traffic enforcement can sometimes seem lax, adhering to speed limits and road rules is crucial for safety and avoiding fines.

- Avoid Distractions: Put away your phone. Distracted driving is a major cause of accidents.

- Regular Vehicle Maintenance: A well-maintained car is less likely to break down or be involved in an accident due to mechanical failure.

- Consider a Dashcam: A dashcam can be invaluable in proving fault in case of an accident, potentially saving you from higher premiums or a lost NCD. Popular brands available in Vietnam include Xiaomi, 70mai, and BlackVue, with prices ranging from VND 1 million to VND 5 million (USD 40-200).

Strategy 5 Choose Your Vehicle Wisely and Consider its Value

The type of car you drive significantly influences your insurance premium. More expensive cars, high-performance vehicles, and those with a higher theft risk will generally cost more to insure. When purchasing a car, consider its insurance implications.

Factors Related to Vehicle Choice

- Vehicle Value: The higher the market value of your car, the more expensive it will be to insure, as the potential payout for total loss or significant damage is higher.

- Repair Costs: Cars with expensive parts or those that are difficult to repair (e.g., imported luxury brands with limited local service centers) will have higher premiums.

- Theft Risk: Certain car models are more frequently targeted by thieves. Insurers track this data, and if your car is on a high-risk list, your premium will reflect that.

- Safety Features: Cars equipped with advanced safety features (e.g., ABS, airbags, stability control, collision avoidance systems) can sometimes qualify for discounts, as they reduce the likelihood and severity of accidents.

- Age of Vehicle: Older vehicles generally have lower market values, which can lead to lower comprehensive premiums. However, some insurers might charge more for very old cars due to higher maintenance and breakdown risks.

Vehicle Examples and Insurance Impact

- Economical Sedans (e.g., Toyota Vios, Hyundai Accent): These are popular in Vietnam, have readily available parts, and are generally less expensive to insure. A comprehensive policy for a new Vios might be around VND 7-10 million/year.

- Mid-Range SUVs (e.g., Mazda CX-5, Honda CR-V): Slightly higher premiums due to higher value and potentially more complex repairs. Expect VND 10-15 million/year.

- Luxury Sedans/SUVs (e.g., Mercedes-Benz C-Class, BMW X3): Significantly higher premiums due to high value, expensive parts, and specialized repair requirements. Premiums could easily exceed VND 20-30 million/year, sometimes much more.

If you're on a tight budget, opting for a popular, reliable, and moderately priced vehicle will almost always result in lower insurance costs. If you already own a high-value car, focus even more on the other savings strategies.

Additional Tips for Maximizing Savings in Vietnam

Review Your Policy Annually

Your insurance needs change over time. Your car's value depreciates, your driving habits might change, or new discounts might become available. Review your policy annually to ensure your coverage still meets your needs and you're not overpaying. For example, if your car is now 5 years old, you might consider increasing your deductible or even dropping certain optional coverages if the car's market value has significantly decreased.

Pay Annually if Possible

Many insurers offer a small discount (typically 2-5%) if you pay your premium in one lump sum annually rather than in monthly or quarterly installments. If you have the financial means, this is an easy way to save a little extra.

Understand Your Coverage Limits

While it's tempting to reduce coverage to save money, ensure you're not underinsured. In Vietnam, where accident severity can be high, having adequate third-party liability is crucial. For comprehensive coverage, ensure the sum insured reflects the current market value of your vehicle. Don't pay for coverage you don't need, but don't skimp on essential protection.

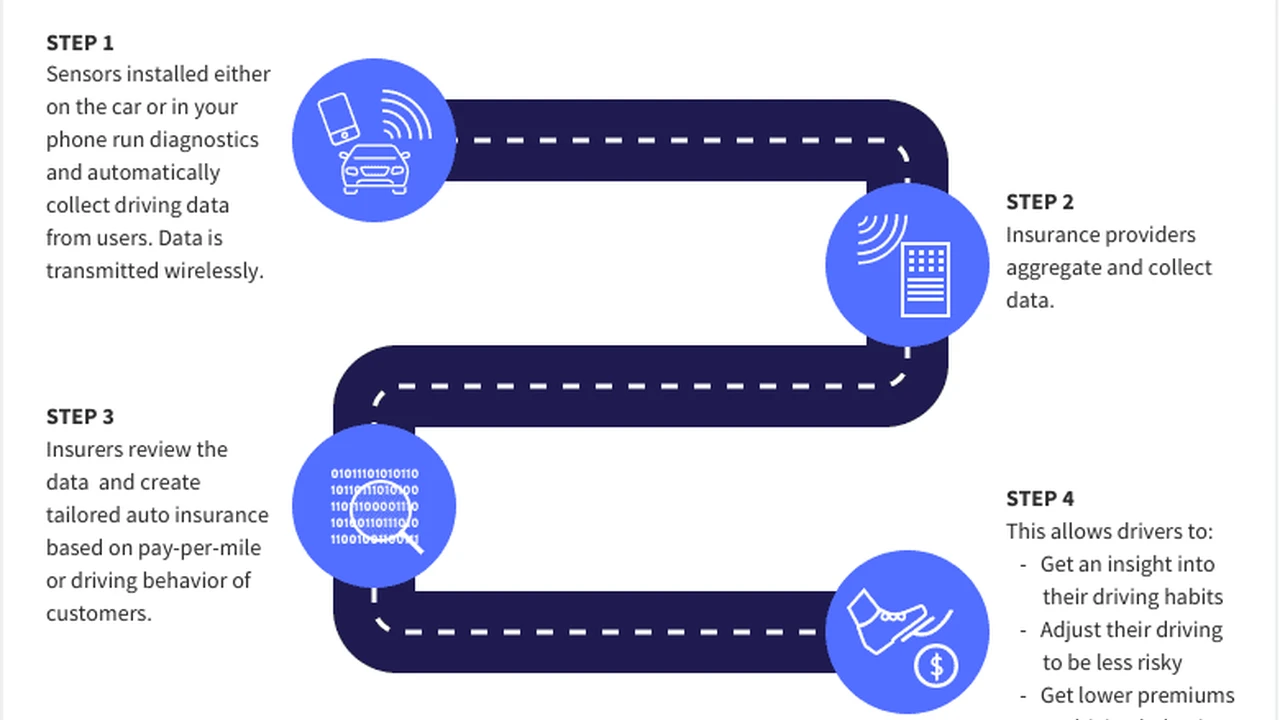

Consider Telematics Insurance (Emerging Trend)

While not yet widespread in Vietnam, telematics (usage-based insurance) is an emerging trend globally. This involves installing a device in your car or using a smartphone app to monitor your driving habits (speed, braking, mileage). Safe drivers can then receive discounts. Keep an eye out for this option from more innovative insurers like Liberty or some local players as the market evolves.

By diligently applying these five strategies and keeping these additional tips in mind, you can significantly reduce your auto insurance costs in Vietnam without compromising on essential protection. Remember, a little research and proactive engagement with insurers can go a long way in keeping more money in your pocket.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)