Comparing Auto Insurance for Autonomous and Semi Autonomous Vehicles

Explore comparing auto insurance for autonomous and semi autonomous vehicles. Understand emerging coverage needs for self-driving technology.

Explore comparing auto insurance for autonomous and semi autonomous vehicles. Understand emerging coverage needs for self-driving technology.

Comparing Auto Insurance for Autonomous and Semi Autonomous Vehicles

Hey there, future driver! Or should I say, future passenger? The world of cars is changing super fast, right? We're moving from just driving ourselves to cars that can pretty much drive themselves. This isn't just cool tech; it's also shaking up how we think about auto insurance. If you're eyeing a Tesla with Autopilot, a Cadillac with Super Cruise, or even just a car with advanced driver-assistance systems (ADAS) like adaptive cruise control and lane-keeping assist, you're probably wondering: how does insurance work for these smart vehicles?

It's a big question, and honestly, the insurance industry is still figuring a lot of it out. But let's dive into what we know, what's changing, and what you should consider when insuring your autonomous or semi-autonomous ride.

Understanding Autonomous and Semi Autonomous Vehicle Technology and Levels

Before we talk insurance, let's get on the same page about what we mean by 'autonomous' and 'semi-autonomous.' It's not just a fancy way of saying 'self-driving.' There are actually six levels of driving automation, defined by the Society of Automotive Engineers (SAE International). Knowing these levels helps us understand who's responsible when something goes wrong, which is key for insurance.

SAE Levels of Driving Automation Explained

- Level 0 No Automation: This is your classic car. You do all the driving.

- Level 1 Driver Assistance: Think cruise control or lane-keeping assist. The car helps with one task, but you're still fully in charge.

- Level 2 Partial Automation: This is where most 'semi-autonomous' cars are today. Features like adaptive cruise control combined with lane centering. The car can handle steering and acceleration/deceleration in specific situations, but you must remain engaged and ready to take over at any moment. Tesla's Autopilot and GM's Super Cruise often fall into this category.

- Level 3 Conditional Automation: The car can handle most driving tasks under certain conditions (e.g., on highways). The driver doesn't need to monitor the environment constantly but must be ready to intervene if the system requests it. This is a tricky level for insurance because responsibility can shift.

- Level 4 High Automation: The car can perform all driving tasks and monitor the environment under specific conditions (e.g., within a geofenced area or specific weather). If the system encounters a situation it can't handle, it will safely pull over if the driver doesn't take over.

- Level 5 Full Automation: The car can drive itself under all conditions, everywhere, all the time, with no human intervention needed. Think robotaxis.

Most cars on the road today with 'self-driving' features are Level 1 or Level 2. Level 3 is starting to appear in some high-end models, but Level 4 and 5 are still largely in testing or limited deployment.

The Shifting Landscape of Liability and Auto Insurance

This is where it gets really interesting for insurance. Traditionally, if your car gets into an accident, it's usually the driver's fault. But what happens when the car is driving itself?

Who is at Fault Driver or Manufacturer?

With Level 0-2 vehicles, the driver is almost always considered responsible. Even if your lane-keeping assist drifts, you're expected to correct it. However, as we move to Level 3 and beyond, the lines blur. If a Level 3 car crashes while its autonomous system is engaged and the driver wasn't prompted to take over, is it the driver's fault, or the car manufacturer's?

This shift from driver liability to potentially manufacturer liability (or even software provider liability) is a huge headache for insurance companies. They're used to assessing risk based on human behavior, not algorithms.

Emerging Coverage Needs for Autonomous Vehicles

As cars get smarter, new types of coverage might become necessary:

- Product Liability for Software: If a software glitch causes an accident, who pays? This moves into product liability territory, which is usually handled by manufacturers, not individual car owners' auto insurance.

- Cybersecurity Insurance: What if your autonomous car is hacked and causes an accident? This is a growing concern, and traditional auto policies don't typically cover cyber risks.

- Data Privacy Concerns: Autonomous cars collect a ton of data. How is that data used, and what are the privacy implications, especially if it's used to determine fault in an accident?

Current Auto Insurance for Semi Autonomous Vehicles What to Expect

For now, if you own a car with ADAS features (Level 1 or 2), your standard auto insurance policy is generally what covers you. However, these features can impact your premiums in a few ways.

Potential Discounts for Advanced Safety Features

Many insurers offer discounts for cars equipped with ADAS features. Why? Because these systems are designed to prevent accidents, which means fewer claims for the insurance company. Look for discounts related to:

- Automatic Emergency Braking (AEB): Systems that detect an impending collision and apply the brakes automatically.

- Lane Departure Warning (LDW) / Lane Keeping Assist (LKA): Systems that warn you if you drift out of your lane or actively steer you back.

- Blind Spot Monitoring (BSM): Alerts you to vehicles in your blind spots.

- Adaptive Cruise Control (ACC): Maintains a set speed and distance from the car ahead.

- Forward Collision Warning (FCW): Warns you of an impending frontal collision.

These discounts can vary significantly by insurer and by the specific features your car has. It's always worth asking your insurance provider about them.

Higher Repair Costs and Potential Premium Increases

On the flip side, while ADAS features can prevent accidents, they can also make repairs much more expensive if an accident does occur. Those sensors, cameras, and radar units embedded in bumpers and windshields are costly to replace and recalibrate. A simple fender bender that used to cost a few hundred dollars to fix might now cost thousands because of damaged sensors. This can lead to higher comprehensive and collision premiums.

Specific Products and Scenarios for Autonomous and Semi Autonomous Vehicles

Let's look at some real-world examples and how insurance might play out.

Tesla Autopilot and Full Self-Driving FSD Insurance Considerations

Tesla's Autopilot and the optional Full Self-Driving (FSD) package are probably the most well-known semi-autonomous systems. While FSD aims for Level 5, it's currently considered Level 2 or Level 3 in limited scenarios, meaning the driver must remain attentive. Tesla even offers its own insurance in some states, which uses real-time driving data to calculate premiums.

Tesla Insurance

- How it works: Tesla Insurance uses a 'Safety Score' based on your driving behavior (hard braking, aggressive turning, unsafe following, etc.) to determine your premium. The safer you drive, the lower your rate.

- Pros: Potentially lower rates for safe Tesla drivers, seamless integration with your car's data.

- Cons: Only available in certain US states, privacy concerns for some drivers, rates can fluctuate monthly based on driving.

- Scenario: You have a Tesla Model 3 with FSD. You're using Autopilot on the highway, and it fails to detect a sudden lane change by another vehicle, leading to a collision. Since Autopilot is Level 2, you are expected to be attentive and intervene. Your standard collision coverage would apply, and your rates might increase due to the at-fault accident. If Tesla Insurance is used, your Safety Score would likely drop, increasing your premium.

General Motors Super Cruise and Ultra Cruise Insurance Implications

GM's Super Cruise is another prominent Level 2 system, allowing hands-free driving on compatible highways. Ultra Cruise, currently in development, aims for more extensive hands-free capabilities. Like Tesla, GM emphasizes that the driver must remain engaged.

Standard Insurers for GM Vehicles

- How it works: Traditional insurers like Geico, Progressive, State Farm, Allstate, etc., will cover your GM vehicle with Super Cruise under a standard policy. They might offer ADAS discounts.

- Pros: Wide availability, established claims processes.

- Cons: May not fully account for the unique risks/benefits of semi-autonomous driving, potential for higher repair costs due to complex sensors.

- Scenario: You're driving a Cadillac CT5 with Super Cruise engaged on an approved highway. The system disengages unexpectedly due to poor road markings, and you don't react quickly enough, resulting in a minor accident. Again, as a Level 2 system, the expectation is driver intervention. Your standard collision coverage would kick in.

Mercedes-Benz DRIVE PILOT Level 3 System and Insurance

Mercedes-Benz has made headlines with its DRIVE PILOT system, which is certified for Level 3 conditional automation in certain regions (like Germany and Nevada, USA). This is a game-changer because, under specific conditions, the car takes legal responsibility.

Specialized Coverage for Level 3

- How it works: For Level 3 systems, the manufacturer (Mercedes-Benz in this case) takes on liability when the system is active and operating within its design domain. This means your personal auto insurance might not be solely responsible for damages if the car is at fault while DRIVE PILOT is engaged.

- Pros: Reduced driver liability in specific scenarios, potentially lower personal insurance premiums if the manufacturer assumes more risk.

- Cons: Very limited availability, complex legal framework, still early days for insurance models.

- Scenario: You're in a Mercedes-Benz S-Class with DRIVE PILOT active in a traffic jam on a Nevada highway. The system is fully engaged, and you're legally allowed to take your eyes off the road. The car then misjudges a sudden stop and rear-ends the vehicle in front. In this specific scenario, Mercedes-Benz would likely be held liable, and their product liability insurance would cover the damages, not necessarily your personal auto policy. This is a significant shift!

Vehicles with Advanced Driver Assistance Systems ADAS

Most new cars today, even non-luxury ones, come with a suite of ADAS features. Think Honda Sensing, Toyota Safety Sense, Subaru EyeSight, etc. These are typically Level 1 or Level 2 systems.

Standard Auto Insurance with ADAS Discounts

- How it works: Your regular auto insurance policy from any major provider (e.g., Progressive, Farmers, Liberty Mutual, AAA) will cover these vehicles. You'll likely qualify for safety feature discounts.

- Pros: Widely available, discounts can offset some costs.

- Cons: Higher repair costs for damaged sensors, driver still fully responsible.

- Scenario: You're driving a Toyota Camry with Toyota Safety Sense. The lane departure warning alerts you, but you don't correct, and you sideswipe a guardrail. Your collision coverage would pay for the damage, and you'd be considered at fault.

Comparing Insurance Providers for Smart Cars

When it comes to insuring your autonomous or semi-autonomous vehicle, it's not just about finding the cheapest rate. You need to consider how different insurers are adapting to this new technology.

Traditional Insurers Adapting to New Technology

Most major insurers are actively researching and adapting their policies. They're offering discounts for ADAS and trying to understand the liability shifts. Some are even partnering with car manufacturers.

- Geico: Known for competitive rates and often offers discounts for various safety features. Good for drivers who want straightforward coverage.

- Progressive: Offers usage-based insurance (Snapshot) which could be interesting for semi-autonomous vehicles, though it primarily tracks human driving behavior. Also provides ADAS discounts.

- State Farm: A large, established insurer with a strong agent network. They are generally slower to adopt radical changes but offer solid, reliable coverage and ADAS discounts.

- Allstate: Offers Drivewise, a telematics program, and various safety feature discounts. They are actively involved in autonomous vehicle research.

- Liberty Mutual: Provides discounts for advanced safety features and has been exploring new insurance models for AVs.

Specialized or Manufacturer-Backed Insurance

As seen with Tesla Insurance, some manufacturers are stepping into the insurance game themselves. This trend might grow as vehicles become more autonomous.

- Tesla Insurance: Directly tied to your Tesla's driving data. Best for Tesla owners who are comfortable with data sharing and want potentially lower rates based on their driving habits.

- Waymo Insurance (Future): While not for individual car owners yet, Waymo (Google's self-driving car company) has its own insurance for its robotaxi fleet. This shows how Level 4/5 vehicles will likely have very different insurance models.

Factors to Consider When Choosing an Insurer

- ADAS Discounts: How generous are they?

- Repair Network: Do they have a network of repair shops equipped to handle complex sensor calibrations?

- Claims Process: How do they handle claims involving autonomous features? Do they have a clear process for determining fault?

- Future Adaptability: Are they actively researching and adapting to the evolving AV landscape?

- Customer Service: Always important, especially when dealing with potentially complex claims.

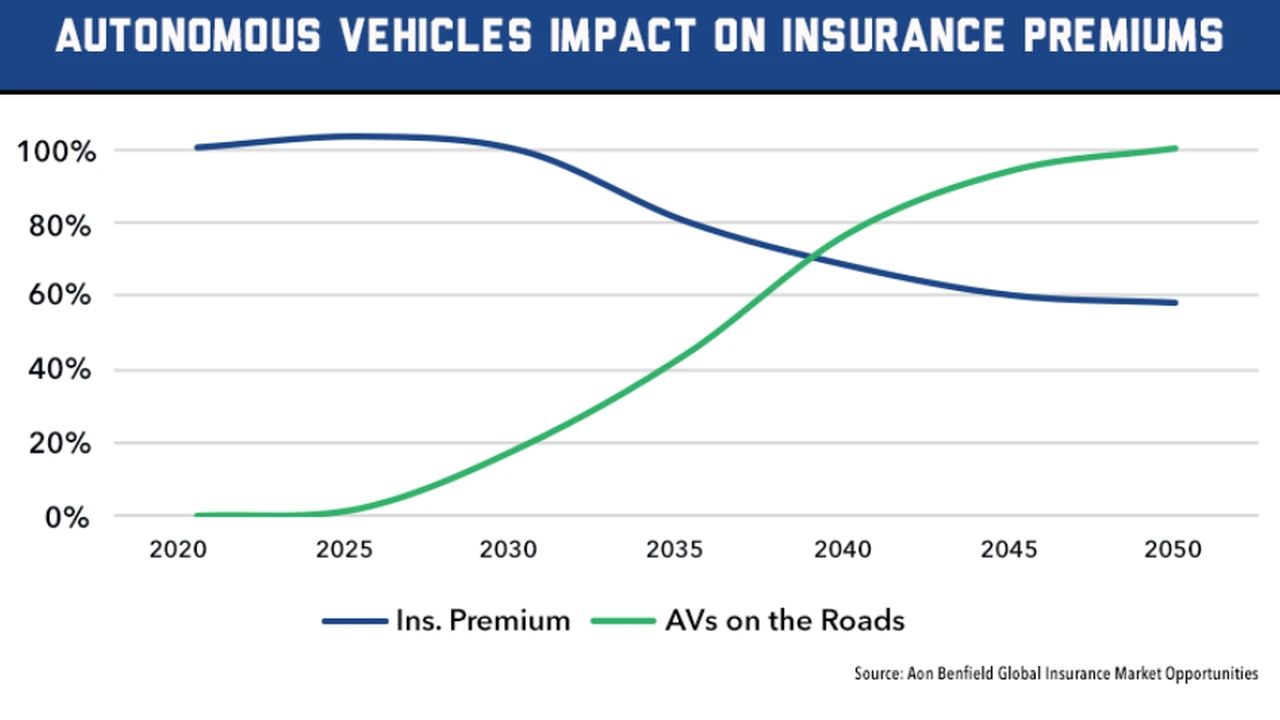

The Future of Auto Insurance for Autonomous Vehicles

The insurance world is on the cusp of a massive transformation because of autonomous vehicles. Here's what we might see down the road:

Shift from Driver-Centric to Product-Centric Insurance

As cars become more autonomous, the focus of insurance will likely shift from insuring the driver to insuring the vehicle's technology and the manufacturer. This could mean:

- Manufacturer-Provided Insurance: Car companies might bundle insurance directly with the vehicle purchase or lease, covering product liability.

- Fleet Insurance Models: For Level 4/5 robotaxis, insurance will be more like commercial fleet insurance, covering the entire fleet rather than individual drivers.

New Risk Factors and Data-Driven Premiums

Insurers will start looking at new risk factors:

- Software Updates: How often is the car's software updated? Are there known bugs?

- Cybersecurity Vulnerabilities: How secure is the vehicle's system from hacking?

- Sensor Maintenance: Are the car's sensors properly maintained and calibrated?

- Data Analytics: Even more sophisticated use of driving data to assess risk, potentially leading to highly personalized premiums.

Regulatory and Legal Challenges

Governments and legal systems are still catching up. Clearer laws on liability for autonomous vehicles are needed to provide certainty for both consumers and insurers. This will be a slow but necessary process.

Practical Advice for Insuring Your Smart Car

So, what should you do right now if you own or plan to buy a car with autonomous or semi-autonomous features?

Always Compare Quotes and Ask Questions

Don't just stick with your current insurer. Shop around and get quotes from multiple providers. When you talk to them, specifically ask about:

- Discounts for your car's specific ADAS features.

- How they handle claims if an autonomous feature was engaged.

- Their network of repair shops for vehicles with complex sensor systems.

Understand Your Vehicle's Capabilities and Limitations

Read your car's manual! Know exactly what your semi-autonomous features can and cannot do. Understand that even with Autopilot or Super Cruise, you are still the primary driver and responsible for monitoring the road.

Consider Higher Coverage Limits

Given the potentially higher repair costs for smart cars, it might be wise to opt for higher comprehensive and collision coverage limits, and potentially higher liability limits, especially if you're driving a Level 2 vehicle where you're still primarily responsible.

Stay Informed About Policy Changes

The insurance landscape for autonomous vehicles is evolving. Keep an eye on news from your insurer and the industry as a whole. What's true today might change next year.

Insuring an autonomous or semi-autonomous vehicle is definitely more complex than insuring a traditional car, but it's also an exciting time. By understanding the technology, asking the right questions, and staying informed, you can make sure you're properly covered as we cruise into the future of driving.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)