Comparing No Fault vs At Fault Auto Insurance Systems

Explore comparing no fault vs at fault auto insurance systems. Understand how these systems impact your claims and liability.

Comparing No Fault vs At Fault Auto Insurance Systems

Understanding the Basics of Auto Insurance Systems

Hey there! Ever wondered what happens after a car accident, especially when it comes to who pays for what? It can get pretty confusing, right? Well, a big part of that confusion often comes down to whether you live in a 'no-fault' or 'at-fault' state or region. These aren't just fancy terms; they fundamentally change how your insurance claim is handled, who you deal with, and even how quickly you might get back on the road. Let's dive deep into these two main types of auto insurance systems, break down their differences, and help you understand which one might apply to you and what it means for your wallet and peace of mind.

At its core, auto insurance is designed to protect you financially in case of an accident. But the path to that protection varies significantly. In an 'at-fault' system, the person who caused the accident is responsible for the damages and injuries. This means their insurance company pays out to the other parties involved. Simple enough, right? But then there's 'no-fault,' which flips the script a bit. In a no-fault system, your own insurance company typically pays for your medical expenses and lost wages, regardless of who caused the accident. Property damage usually still falls under the at-fault driver's responsibility, but the personal injury aspect is where no-fault really shines (or complicates things, depending on your perspective!).

Knowing which system your area uses is super important because it dictates your legal rights, how you file claims, and even the types of coverage you're required to carry. For instance, if you're in a no-fault state, you'll likely have to carry Personal Injury Protection (PIP) coverage, which isn't always mandatory in at-fault states. We'll explore all these nuances, look at some real-world examples, and even touch on hybrid systems that try to get the best of both worlds. So, buckle up, because we're about to demystify auto insurance systems!

At Fault Auto Insurance Systems How Liability Works

Let's kick things off with the 'at-fault' system, also known as a 'tort' system. This is probably what most people instinctively think of when they imagine an accident scenario. In an at-fault system, the central question after an accident is: 'Who is to blame?' Once that's established, the at-fault driver's insurance company is generally responsible for paying for the damages and injuries of the other parties involved. This includes things like medical bills, lost wages, pain and suffering, and repairs to the other vehicles.

Determining Fault in At Fault States

So, how is fault determined? This can be a complex process. It often involves police reports, witness statements, photographic evidence, and sometimes even accident reconstruction specialists. Insurance adjusters from both sides will investigate the incident to figure out who was negligent. It's not always black and white, and sometimes fault can be shared, leading to what's called 'comparative negligence' or 'contributory negligence,' depending on the state's specific laws. For example, in a comparative negligence state, if you're found to be 20% at fault for an accident, you might only be able to recover 80% of your damages from the other driver's insurance.

Coverage Requirements in At Fault Systems

In at-fault states, the primary mandatory coverage is usually liability insurance. This coverage is split into two main parts: Bodily Injury Liability (BIL) and Property Damage Liability (PDL). BIL covers the medical expenses, lost wages, and pain and suffering of others if you cause an accident. PDL covers the cost of repairing or replacing other people's property (like their car or a fence) if you're at fault. While not always mandatory, many drivers in at-fault states also opt for collision coverage (to pay for their own car's damage, regardless of fault) and comprehensive coverage (for non-collision incidents like theft or natural disasters).

Pros and Cons of At Fault Systems

Pros:

- Fairness (in theory): The person who caused the accident pays, which many people see as just.

- Full compensation: If you're not at fault, you can potentially recover all your damages, including pain and suffering, from the at-fault driver's insurer.

- Lower premiums (sometimes): Because your own insurer isn't automatically paying for your medical bills, liability-only policies can sometimes be cheaper.

Cons:

- Slower claims process: Determining fault can take a long time, delaying payouts for repairs and medical treatment.

- Legal battles: Disputes over fault often lead to lawsuits, which can be costly and stressful.

- Uninsured motorists: If the at-fault driver is uninsured or underinsured, you might struggle to get compensation unless you have specific coverage like Uninsured/Underinsured Motorist (UM/UIM).

No Fault Auto Insurance Systems Your Own Insurer Pays

Now, let's shift gears to 'no-fault' systems. These systems were introduced in some states to reduce the number of lawsuits and speed up the claims process, especially for minor accidents. The core idea here is that after an accident, each driver's own insurance company pays for their policyholder's medical expenses and lost wages, regardless of who caused the accident. This means you don't have to wait for fault to be determined before getting treatment for your injuries.

Personal Injury Protection PIP Coverage

The cornerstone of a no-fault system is Personal Injury Protection (PIP) coverage. If you're in a no-fault state, you'll typically be required to carry PIP. This coverage pays for your medical expenses, lost wages, and sometimes even essential services (like childcare or household help) if you're injured in an accident, up to a certain limit. It covers you, your passengers, and sometimes even pedestrians or cyclists hit by your car. The beauty of PIP is that it kicks in quickly, allowing you to get medical attention without delay, regardless of who was at fault.

Thresholds for Lawsuits in No Fault States

While no-fault systems aim to reduce lawsuits, they don't eliminate them entirely. Most no-fault states have 'thresholds' that must be met before you can sue the at-fault driver for additional damages, such as pain and suffering. These thresholds can be either monetary (e.g., your medical bills exceed $5,000) or verbal (e.g., you sustained a 'serious injury' like permanent disfigurement or a broken bone). If your injuries don't meet these thresholds, you're generally limited to what your PIP coverage provides.

Pros and Cons of No Fault Systems

Pros:

- Faster medical treatment: You get immediate access to medical care without waiting for fault determination.

- Reduced litigation: Fewer lawsuits mean less stress and potentially lower legal costs for minor accidents.

- Guaranteed coverage for injuries: Your own policy covers your injuries, even if the other driver is uninsured.

Cons:

- Limited recovery for pain and suffering: Unless you meet a specific threshold, you can't sue for non-economic damages.

- Higher premiums (sometimes): Because your insurer is paying for your medical bills regardless of fault, PIP coverage can increase your overall premium.

- Property damage still at-fault: No-fault typically only applies to bodily injuries; property damage claims still follow at-fault rules.

Hybrid Auto Insurance Systems The Best of Both Worlds

To complicate things just a little more (but in a good way!), some states have adopted 'hybrid' systems. These systems try to combine elements of both at-fault and no-fault to offer a balance of benefits. For example, some states might require PIP coverage but still allow you to sue for pain and suffering without meeting a high threshold. Others might offer PIP as an optional add-on, allowing drivers to choose whether they want the no-fault benefits for their injuries.

Add On No Fault States

In 'add-on' no-fault states, drivers can purchase PIP coverage, but it doesn't restrict their right to sue the at-fault driver for damages, including pain and suffering, regardless of the severity of their injuries. This gives drivers the benefit of immediate medical payments through PIP while still preserving their full legal rights to pursue a tort claim against the at-fault party. It's a bit like having your cake and eating it too, offering more flexibility but potentially higher premiums if you opt for the additional coverage.

Choice No Fault States

Then there are 'choice' no-fault states. These states give drivers the option to choose between a no-fault policy (which includes PIP and limits their right to sue) and a traditional at-fault policy (which doesn't include PIP but allows them to sue freely). This allows individuals to tailor their insurance coverage to their personal preferences and risk tolerance. If you're someone who values quick medical payments and wants to avoid potential lawsuits, a no-fault option might appeal to you. If you prefer to retain your full legal rights to sue for all damages, an at-fault option would be your choice. It's all about personal preference and understanding the trade-offs.

Comparing Specific State Systems USA Examples

Let's look at some real-world examples in the USA to illustrate how these systems play out. It's important to remember that insurance laws can change, so always verify the current regulations in your specific state.

At Fault States Examples

Most states in the US operate under an at-fault system. For instance, states like California, Texas, and Illinois are classic at-fault states. In these states, if you're involved in an accident, the insurance companies will investigate to determine who was at fault. The at-fault driver's liability insurance will then pay for the other party's damages and injuries. If you're the one who caused the accident, your own collision coverage would pay for your vehicle's repairs (if you have it), and your liability coverage would handle the other party's costs. If you're not at fault, you'd typically file a claim with the other driver's insurance company. This often means a longer waiting period for compensation, especially if fault is disputed, and a higher likelihood of legal action for significant injuries.

No Fault States Examples

A handful of states are pure no-fault states, or have very strong no-fault components. Florida, Michigan (though Michigan has recently reformed its no-fault laws, it still retains significant no-fault elements), and New York are prime examples. In these states, if you're in an accident, your own PIP coverage will pay for your medical bills and lost wages, regardless of who caused the accident. This is great for getting immediate medical attention. However, to sue the at-fault driver for pain and suffering, you'd typically need to meet a 'serious injury' threshold. For example, in Florida, you must have sustained a permanent injury, significant and permanent scarring or disfigurement, or death to step outside the no-fault system and sue for non-economic damages. Michigan's reforms have introduced more choices for PIP coverage levels, but the core no-fault principle for medical benefits remains strong.

Hybrid States Examples

Then we have the hybrid states, offering a blend. Pennsylvania is a great example of a 'choice' no-fault state. Drivers there can choose between a 'full tort' option (which allows them to sue for all damages, including pain and suffering, regardless of injury severity) or a 'limited tort' option (which restricts their right to sue for pain and suffering unless they meet a serious injury threshold, similar to pure no-fault states). The limited tort option usually comes with lower premiums. Another example is Kentucky, which is also a choice no-fault state, allowing drivers to accept or reject their no-fault rights. If they reject, they retain their full tort rights. These hybrid systems aim to give consumers more control over their coverage and potential legal recourse.

Impact on Claims Process and Settlements

The type of auto insurance system in your area has a massive impact on how your claim is processed and what kind of settlement you can expect. It's not just about who pays; it's about the entire journey from accident to resolution.

Claims in At Fault Systems

In an at-fault system, the claims process can often be a bit of a waiting game. After an accident, you (or your insurer) will need to gather evidence to prove the other driver was at fault. This can involve police reports, witness statements, photos, and even expert analysis. Once fault is established, you'll typically file a claim with the at-fault driver's insurance company. They will then assess your damages, including medical bills, lost wages, and vehicle repairs. Negotiations can be lengthy, especially if there are significant injuries or disputes over the extent of damages. If an agreement can't be reached, a lawsuit might be filed, which can drag out the process for months or even years. The upside is that if you're not at fault, you can potentially recover all your damages, including compensation for pain and suffering, which can be substantial in serious injury cases.

Claims in No Fault Systems

No-fault systems generally aim for a quicker resolution, at least for personal injuries. When an accident occurs, you immediately file a claim with your own insurance company for your medical expenses and lost wages under your PIP coverage. This means you can start receiving treatment without delay, which is a huge benefit. Your insurer pays these benefits regardless of who caused the accident. For property damage, however, you'd still typically file a claim with the at-fault driver's insurer (or use your own collision coverage). The main limitation in no-fault states is the restriction on suing for pain and suffering unless your injuries meet a specific threshold. This means that for minor to moderate injuries, your recovery is limited to your PIP benefits, and you can't seek additional compensation for non-economic damages.

Settlement Differences

The types of settlements also differ. In at-fault states, a settlement can include economic damages (medical bills, lost wages, property damage) and non-economic damages (pain and suffering, emotional distress). The value of non-economic damages can be highly subjective and often a point of contention. In no-fault states, settlements for personal injuries are primarily limited to economic damages covered by PIP, unless the injury meets the state's threshold for a tort claim. This means that while you get faster access to funds for immediate needs, the overall potential for a large settlement, especially for pain and suffering, is often reduced unless your injuries are severe enough to bypass the no-fault threshold.

Required Coverages and Policy Implications

The type of auto insurance system in your state directly influences the types of coverage you're legally required to carry and, consequently, the structure of your policy and your premiums.

Mandatory Coverages in At Fault States

In at-fault states, the cornerstone of mandatory coverage is Liability Insurance. This typically includes:

- Bodily Injury Liability (BIL): This pays for medical expenses, lost wages, and pain and suffering for others if you cause an accident. States usually have minimum limits, often expressed as two numbers, e.g., 25/50, meaning $25,000 per person and $50,000 per accident.

- Property Damage Liability (PDL): This covers damage to other people's property (like their car, a fence, or a building) if you're at fault. This is usually expressed as a third number, e.g., 25, meaning $25,000 per accident.

While not always mandatory, many drivers in at-fault states also purchase:

- Uninsured/Underinsured Motorist (UM/UIM) Coverage: This protects you if you're hit by a driver who doesn't have insurance or doesn't have enough insurance to cover your damages. This is highly recommended, as relying solely on the at-fault driver's insurance can be risky.

- Collision Coverage: This pays for damage to your own vehicle if you hit another car or object, regardless of who is at fault.

- Comprehensive Coverage: This covers damage to your vehicle from non-collision events like theft, vandalism, fire, or natural disasters.

Mandatory Coverages in No Fault States

In no-fault states, in addition to liability coverage (which is still required to cover damages you cause to others' property and injuries if you exceed the no-fault threshold), you'll also be required to carry Personal Injury Protection (PIP). PIP is the defining feature of no-fault systems and covers:

- Medical Expenses: For you and your passengers, regardless of fault.

- Lost Wages: If you're unable to work due to accident-related injuries.

- Essential Services: Sometimes covers costs for services you can't perform due to injury, like childcare or household chores.

- Funeral Expenses: In the tragic event of a fatality.

PIP limits vary by state, and some states, like Michigan, have recently introduced options for different levels of PIP coverage, allowing drivers to choose lower limits for potentially lower premiums. Even in no-fault states, collision, comprehensive, and UM/UIM coverage are often recommended or required by lenders if you have a car loan.

Policy Implications and Premiums

The type of system can influence your premiums. In theory, no-fault systems, by reducing litigation, might lead to lower overall costs for insurers, which could translate to lower premiums. However, the mandatory PIP coverage can also make policies more expensive, especially if you opt for higher limits. At-fault systems might have lower base liability premiums, but the risk of being sued for large sums (including pain and suffering) means many drivers opt for higher liability limits and additional coverages like UM/UIM, which can increase costs. Ultimately, many factors influence premiums, including your driving record, vehicle type, location, and chosen deductibles, but the underlying insurance system plays a foundational role in the cost structure.

Choosing the Right Coverage for Your Situation

Regardless of whether you're in an at-fault or no-fault state, choosing the right auto insurance coverage is crucial. It's not just about meeting legal minimums; it's about protecting your financial well-being.

Assessing Your Risk Profile

Before you even look at specific policies, take a moment to assess your own risk profile. Do you drive a lot? Do you have a long commute? Do you live in an area with high accident rates or vehicle theft? Do you have significant assets you need to protect from potential lawsuits? Are you comfortable with a higher deductible to lower your monthly premium, or do you prefer lower out-of-pocket costs in case of an accident? Your answers to these questions will help guide your coverage choices.

Beyond the Minimums

While state minimums are a starting point, they are often woefully inadequate to cover the true costs of a serious accident. Imagine causing an accident that results in severe injuries to multiple people. If your bodily injury liability limit is only $25,000 per person and $50,000 per accident, and the medical bills for two injured parties total $150,000, you could be personally responsible for the remaining $100,000. That's a huge financial risk! Most experts recommend carrying much higher liability limits, often $100,000/$300,000 for bodily injury and $50,000 or $100,000 for property damage, especially if you have significant assets to protect.

Key Coverages to Consider

- Higher Liability Limits: As discussed, this is paramount for protecting your assets.

- Uninsured/Underinsured Motorist (UM/UIM): This is incredibly important, especially in at-fault states, as it protects you if the other driver can't pay.

- Collision and Comprehensive: If your car is relatively new or valuable, these coverages are essential to protect your investment. If your car is older and not worth much, you might consider dropping them to save on premiums, but be prepared to pay for repairs out of pocket.

- Personal Injury Protection (PIP) or Medical Payments (MedPay): Even in at-fault states, MedPay can provide quick access to funds for medical bills for you and your passengers, regardless of fault. In no-fault states, PIP is mandatory and crucial.

- Gap Insurance: If you have a new car and a loan, gap insurance covers the difference between what you owe on the car and its actual cash value if it's totaled.

- Roadside Assistance and Rental Car Reimbursement: These are often inexpensive add-ons that can save you a lot of hassle and money in an emergency.

Reviewing Your Policy Regularly

Your insurance needs change over time. Buying a new car, getting married, having children, moving to a new area, or even just your car getting older can all impact what coverage is best for you. It's a good idea to review your policy at least once a year with your insurance agent to ensure you have adequate coverage and are taking advantage of all available discounts.

Real World Scenarios and Product Recommendations

Let's put this into perspective with some real-world scenarios and then look at how different insurance products and providers might fit in. Remember, specific product availability and pricing will vary greatly by location, your driving history, and the insurer.

Scenario 1 Minor Fender Bender in an At Fault State

Situation: You're driving in California (an at-fault state) and lightly rear-end another car at a stop sign. Minor damage to both vehicles, no apparent injuries.

How it plays out: You are clearly at fault. You exchange information, take photos, and file a claim with your insurance company. Your property damage liability coverage will pay for the repairs to the other car. If you have collision coverage, it will pay for the repairs to your car (after your deductible). The other driver might try to claim minor whiplash, which your bodily injury liability would cover. The process might be relatively quick if damages are low and no injuries are claimed.

Product Recommendation: For this scenario, strong Property Damage Liability and Bodily Injury Liability are key. Also, Collision Coverage is important for your own vehicle. Companies like GEICO, Progressive, and State Farm are popular in California and offer robust liability and physical damage coverages. They also have good online tools for claims reporting, which can speed up the process for minor incidents.

Scenario 2 Serious Accident in a No Fault State

Situation: You're driving in Florida (a no-fault state) and are T-boned by another driver who ran a red light. Your car is totaled, and you have significant injuries requiring hospitalization and time off work.

How it plays out: Regardless of the other driver being at fault, your own Personal Injury Protection (PIP) coverage will immediately kick in to cover your medical bills and lost wages, up to your policy limits. This is crucial for getting prompt medical care. For your totaled car, you'd use your own Collision Coverage (if you have it) or file a claim against the at-fault driver's property damage liability. If your injuries meet Florida's 'serious injury' threshold (e.g., permanent injury), you could then sue the at-fault driver for additional damages, including pain and suffering, using their bodily injury liability coverage.

Product Recommendation: In Florida, robust PIP coverage is non-negotiable. Also, high limits for Bodily Injury Liability (to protect you if you cause an accident and exceed the no-fault threshold) and Collision Coverage are vital. Companies like Allstate, Farmers, and Liberty Mutual are strong contenders in Florida, offering comprehensive PIP options and good claims service for serious accidents. Consider adding Gap Insurance if your car is new and financed, as it would cover the difference between your car's value and your loan balance if it's totaled.

Scenario 3 Uninsured Driver in an At Fault State

Situation: You're in Texas (an at-fault state) and are hit by an uninsured driver. Your car has moderate damage, and you have minor injuries.

How it plays out: This is where Uninsured Motorist (UM) coverage becomes your best friend. Since the other driver has no insurance, your UM coverage (specifically Uninsured Motorist Bodily Injury and Uninsured Motorist Property Damage) would pay for your medical bills, lost wages, and repairs to your car, up to your policy limits. Without UM coverage, you'd be left paying out of pocket or trying to sue the uninsured driver directly, which is often a difficult and fruitless endeavor.

Product Recommendation: In states with high rates of uninsured drivers, strong Uninsured/Underinsured Motorist (UM/UIM) coverage is paramount. Companies like Nationwide, Travelers, and USAA (for military families) are known for offering excellent UM/UIM options and reliable claims handling. Always opt for UM/UIM limits that match your bodily injury liability limits to ensure comprehensive protection.

Scenario 4 Hybrid System Choice in Pennsylvania

Situation: You live in Pennsylvania (a choice no-fault state) and are deciding between 'full tort' and 'limited tort' options.

How it plays out:

- Full Tort: You pay a slightly higher premium, but if you're injured in an accident caused by another driver, you retain your full right to sue them for all damages, including pain and suffering, regardless of the severity of your injuries.

- Limited Tort: You pay a lower premium, but your right to sue for pain and suffering is restricted unless you sustain a 'serious injury' (as defined by Pennsylvania law). You still get immediate medical benefits through your PIP coverage.

Product Recommendation: This choice depends on your risk tolerance and budget. If you prioritize lower premiums and are comfortable with the limitations on suing for pain and suffering for minor injuries, Limited Tort might be for you. If you want to preserve all your legal rights, even for minor injuries, Full Tort is the way to go. Companies like Erie Insurance, Amica, and Geico are popular in Pennsylvania and can walk you through the nuances of these choices, helping you decide what's best for your situation. They offer competitive rates for both options.

The Future of Auto Insurance Systems

The landscape of auto insurance is constantly evolving, and the debate between at-fault and no-fault systems is far from over. Several factors are influencing how these systems might change in the future.

Technological Advancements and Autonomous Vehicles

The rise of Advanced Driver-Assistance Systems (ADAS) and the eventual widespread adoption of autonomous vehicles will undoubtedly shake up traditional notions of fault. If a self-driving car causes an accident, who is at fault? The vehicle owner? The manufacturer? The software provider? This question could push more states towards a no-fault-like system, where the focus shifts from individual driver fault to product liability or a broader compensation fund. Insurers are already grappling with how to rate and cover these new technologies, and it's likely to lead to significant legislative changes in the coming decades.

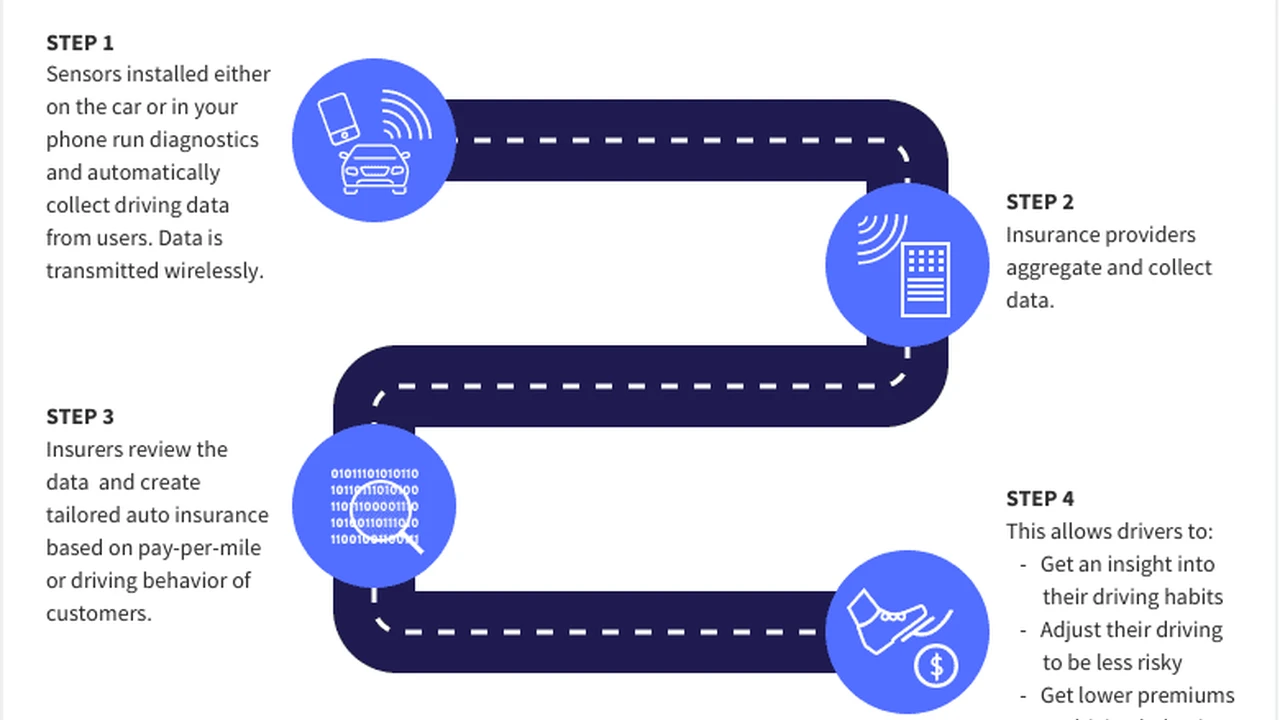

Data and Telematics

Telematics, which involves tracking driving behavior (speed, braking, mileage), is already influencing premiums. As more data becomes available, it could lead to more personalized insurance rates. This might not directly change the at-fault/no-fault structure, but it could make insurance more granular and potentially fairer for safe drivers, regardless of the system. It could also provide more objective data points for determining fault in at-fault states, potentially speeding up claims.

Consumer Demand and Cost Pressures

Consumers are always looking for lower premiums and a simpler claims process. The push for affordability and efficiency could lead more states to explore hybrid models or reforms to existing no-fault systems, like Michigan's recent changes, which aim to give drivers more control over their PIP coverage levels. There's a constant balancing act between providing comprehensive coverage, keeping premiums affordable, and ensuring a fair and efficient claims process.

Global Trends

While our focus has been on the USA, it's worth noting that other countries also grapple with similar issues. Many European countries operate under variations of at-fault systems, while some, like Australia, have moved towards more no-fault-like schemes for personal injury. Learning from international experiences could also influence future reforms in the US and Southeast Asia.

Ultimately, the goal of any auto insurance system is to provide financial protection and facilitate recovery after an accident. As technology advances and societal needs change, these systems will continue to adapt. Staying informed about the system in your area and regularly reviewing your coverage is the best way to ensure you're adequately protected, no matter what the future holds for auto insurance.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)