Understanding the Impact of ADAS on Auto Insurance Premiums

Learn about the impact of ADAS on auto insurance premiums. Discover how advanced driver assistance systems can affect your rates and safety.

Learn about the impact of ADAS on auto insurance premiums. Discover how advanced driver assistance systems can affect your rates and safety.

Understanding the Impact of ADAS on Auto Insurance Premiums

Hey there, savvy driver! Ever wondered how all those fancy tech features in your car – you know, the ones that beep at you when you're drifting or slam on the brakes when you're not paying attention – actually affect your wallet when it comes to auto insurance? Well, you're in the right place! We're diving deep into the world of ADAS, or Advanced Driver Assistance Systems, and exploring their fascinating, sometimes confusing, impact on your auto insurance premiums. It's not as straightforward as you might think, but understanding it can definitely help you save some cash and drive a whole lot safer.

ADAS isn't just a buzzword; it's a revolution in automotive safety. These systems are designed to prevent accidents, mitigate their severity, and generally make driving a less stressful experience. From adaptive cruise control to lane-keeping assist, these technologies are becoming standard in many new vehicles, and for good reason. They're literally saving lives and preventing countless fender benders. But what does that mean for your insurance company, and more importantly, for your monthly premium?

Let's break it down. On one hand, fewer accidents should mean lower payouts for insurers, which theoretically should translate to lower premiums for you. Sounds logical, right? But then there's the flip side: these systems are incredibly complex and expensive to repair. A simple bumper ding on a car with advanced sensors can turn into a multi-thousand-dollar repair bill. So, it's a bit of a tug-of-war between reduced accident frequency and increased repair costs. We'll explore both sides of this coin and give you the lowdown on what to expect.

What Exactly is ADAS and Why Does it Matter for Your Car Insurance?

Alright, let's get our heads around what ADAS actually entails. It's a broad term covering a whole suite of technologies designed to assist the driver. Think of them as your co-pilot, constantly monitoring the road and your surroundings, ready to step in when things get a bit hairy. These systems use various sensors, cameras, radar, and lidar to gather information and then process it to provide warnings or even take control of certain vehicle functions.

Why does this matter for your car insurance? Simple: insurance companies are all about risk assessment. The safer your car is, and the less likely it is to be involved in an accident, the lower your perceived risk. ADAS aims to significantly reduce that risk. However, the complexity of these systems introduces new variables into the insurance equation. It's a balancing act between the benefits of accident prevention and the costs associated with their sophisticated technology.

Key ADAS Features and Their Safety Benefits for Drivers

Let's look at some of the most common ADAS features you'll find in modern cars and how they contribute to safety:

- Automatic Emergency Braking (AEB): This is a big one! AEB systems use sensors to detect an impending collision with a vehicle or pedestrian and can automatically apply the brakes if the driver doesn't react in time. Think of how many rear-end collisions this could prevent!

- Lane Keeping Assist (LKA) and Lane Departure Warning (LDW): LKA actively helps steer your car back into its lane if you start to drift, while LDW simply warns you. These are fantastic for preventing accidents caused by driver fatigue or distraction.

- Blind Spot Monitoring (BSM): Ever almost changed lanes into a car you didn't see? BSM uses sensors to detect vehicles in your blind spots and warns you with a light or sound. Super helpful for highway driving.

- Adaptive Cruise Control (ACC): This isn't just about comfort; it's a safety feature too. ACC maintains a set speed but also adjusts it to keep a safe following distance from the car in front. Less chance of tailgating accidents!

- Rear Cross Traffic Alert (RCTA): Backing out of a busy parking spot can be a nightmare. RCTA warns you if there's traffic approaching from either side, preventing those annoying parking lot bumps.

- Forward Collision Warning (FCW): This system alerts you if it detects a potential frontal collision, giving you precious extra seconds to react.

- Parking Assist Systems: While not directly preventing high-speed collisions, these systems help prevent scrapes and bumps during parking maneuvers, which can still lead to insurance claims.

These features are designed to make you a safer driver, and in theory, that should make you a more attractive customer to insurance companies. But as we'll see, it's not always that simple.

The Good News How ADAS Can Lower Your Auto Insurance Premiums

Okay, let's start with the positives! There's definitely a strong argument to be made that ADAS should lead to lower insurance premiums. Here's why:

Reduced Accident Frequency and Severity for Insurance Savings

This is the most obvious benefit. If ADAS systems are doing their job, they're preventing accidents from happening in the first place, or at least reducing their severity. Fewer accidents mean fewer claims for insurance companies to pay out. Studies by organizations like the Insurance Institute for Highway Safety (IIHS) have consistently shown the effectiveness of these systems:

- AEB: IIHS research indicates that AEB can reduce front-to-rear crashes by 50% and injuries in those crashes by 56%. That's a massive impact!

- FCW: Even just the warning system can reduce front-to-rear crashes by 27%.

- LKA/LDW: These systems have been shown to reduce single-vehicle, sideswipe, and head-on crashes by 11%.

- BSM: Reduces lane-change crashes by 14%.

When insurance companies see these kinds of statistics, it directly impacts their risk models. A car equipped with these features is statistically less likely to be involved in certain types of accidents, which should, in turn, lead to lower premiums for the policyholder. Many insurers are already offering discounts for vehicles equipped with specific ADAS features, especially AEB and FCW, as these have the most direct impact on preventing costly collisions.

Specific ADAS Discounts and How to Qualify for Lower Rates

Many insurance providers are now actively offering discounts for vehicles equipped with ADAS. It's not always a blanket discount for 'ADAS' but rather for specific features. Here's what to look for and how to qualify:

- Automatic Emergency Braking (AEB) Discount: This is probably the most common and significant discount. If your car has AEB, make sure your insurer knows about it.

- Forward Collision Warning (FCW) Discount: Often paired with AEB, or sometimes offered as a standalone discount.

- Lane Departure Warning (LDW) / Lane Keeping Assist (LKA) Discount: Another popular one, especially as these systems become more prevalent.

- Blind Spot Monitoring (BSM) Discount: Some insurers recognize the value of this in preventing sideswipe accidents.

- Advanced Safety Feature Package Discount: Many car manufacturers offer ADAS features as part of a larger safety package. Some insurers will give a discount for the entire package.

How to Qualify:

- Know Your Car's Features: Check your car's owner's manual or the manufacturer's website to confirm which ADAS features your vehicle has. Don't just assume!

- Inform Your Insurer: When getting a quote or renewing your policy, explicitly tell your insurance agent about your car's ADAS features. They might not automatically know.

- Shop Around: Not all insurers offer the same discounts, or the same percentage off. Get quotes from several providers and compare their ADAS discounts.

- Ask for Specifics: If an insurer says they offer 'safety feature discounts,' ask them to specify which ADAS features qualify and how much you can save.

For example, State Farm often offers discounts for vehicles with active safety features like AEB and FCW. GEICO also has a 'Safety Feature Discount' that can apply to cars with ADAS. Progressive and Allstate are known to offer similar savings. It really pays to ask!

The Not-So-Good News Increased Repair Costs and Their Impact on Premiums

Now for the other side of the coin. While ADAS is fantastic for preventing accidents, when an accident does happen, repairs can get seriously expensive. And those increased repair costs can, in turn, push up your insurance premiums.

Why ADAS Repairs are More Expensive for Car Owners

Imagine a simple fender bender from a decade ago. A new bumper, maybe some paint, and you're good to go. Now, imagine that same fender bender on a car equipped with ADAS. That bumper might house radar sensors for adaptive cruise control, ultrasonic sensors for parking assist, and cameras for lane keeping. Even a minor impact can damage these sophisticated components, and they're not cheap to replace or recalibrate.

- Expensive Components: The sensors, cameras, and radar units themselves are high-tech and costly. A single radar sensor can cost hundreds, if not thousands, of dollars.

- Specialized Labor: Repairing and, more importantly, recalibrating ADAS systems requires specialized tools and highly trained technicians. Not every body shop is equipped for this, and those that are charge a premium for their expertise.

- Recalibration: After a repair, many ADAS components need to be precisely recalibrated. For example, a front-facing camera for AEB needs to be perfectly aligned to accurately detect objects. This recalibration process is time-consuming and adds significantly to the repair bill.

- Hidden Damage: Sometimes, the damage to ADAS components isn't immediately visible. A slight misalignment can cause a system to malfunction, leading to further diagnostic costs.

This means that even a low-speed collision that would have been a minor repair on an older car can become a major, expensive claim on a car with ADAS. Insurance companies factor these potential repair costs into their premium calculations. So, while you might get a discount for having ADAS, the base cost of insuring your vehicle might be higher due to the increased repair expenses.

How Repair Costs Influence Your Auto Insurance Rates

Insurance companies operate on a simple principle: they collect premiums to cover potential payouts. If the cost of those payouts increases, so do the premiums. When ADAS-equipped cars are involved in accidents, the average cost per claim goes up significantly. This trend is already being observed across the industry.

For instance, a study by AAA found that repairing a vehicle with ADAS features after a minor front-end collision can cost twice as much as repairing a similar vehicle without the technology. This isn't just about replacing a sensor; it's about the labor, the recalibration, and the specialized parts. This increased cost per claim can offset some of the savings from reduced accident frequency, leading to a more complex premium structure.

In some cases, particularly for comprehensive and collision coverage, the cost of insuring a car with extensive ADAS might be higher than a comparable car without it, even with safety discounts applied. Insurers are still gathering data and refining their models, but the trend of higher repair costs for ADAS-equipped vehicles is undeniable.

Comparing ADAS Features and Their Insurance Implications for Different Car Models

Not all ADAS systems are created equal, and their impact on insurance can vary significantly depending on the car manufacturer and model. Some systems are more robust, more integrated, and potentially more expensive to repair than others.

Top Car Models with Effective ADAS and Potential Insurance Benefits

Certain manufacturers have been at the forefront of ADAS development, and their systems are often highly rated by safety organizations. Cars with these well-regarded systems might see more favorable insurance treatment.

- Subaru (EyeSight): Subaru's EyeSight system is consistently praised for its effectiveness. It includes AEB, ACC, LKA, and FCW. Vehicles like the Subaru Forester and Outback with EyeSight often qualify for significant safety discounts due to the system's proven track record in preventing accidents.

- Toyota (Toyota Safety Sense): Toyota's suite, including AEB, LKA, and ACC, is standard on many of their newer models like the Toyota Camry and RAV4. Its widespread adoption means insurers have a lot of data on its effectiveness.

- Honda (Honda Sensing): Similar to Toyota, Honda Sensing is standard on many models such as the Honda Civic and CR-V. It offers AEB, LKA, and ACC, contributing to strong safety ratings.

- Volvo (City Safety): Volvo has long been a leader in safety, and their City Safety system (which includes AEB) is highly effective. Models like the Volvo XC60 and S60 are often seen as very safe bets by insurers.

- Mazda (i-Activsense): Mazda's suite, found in vehicles like the Mazda CX-5, includes AEB, BSM, and LKA, contributing to good safety scores.

When considering these models, it's worth noting that while their ADAS features are excellent for safety, the repair costs for these sophisticated systems can still be a factor. However, the proven reduction in accident frequency often outweighs the increased repair cost in the eyes of many insurers, leading to net savings for drivers.

ADAS Repair Cost Comparison for Popular Vehicles

Let's get a bit more granular and look at some hypothetical (but realistic) repair cost comparisons for popular vehicles, highlighting the ADAS impact. Keep in mind these are estimates and actual costs can vary widely based on location, specific damage, and repair shop.

| Vehicle Model | ADAS Features | Hypothetical Minor Front Bumper Damage (No ADAS) | Hypothetical Minor Front Bumper Damage (with ADAS) | Estimated ADAS Repair Cost Increase |

|---|---|---|---|---|

| 2015 Honda Civic (No ADAS) | None | $800 - $1,200 | N/A | N/A |

| 2023 Honda Civic (Honda Sensing) | AEB, FCW, LKA, ACC | N/A | $2,500 - $4,000 (includes sensor replacement & recalibration) | $1,700 - $2,800 |

| 2016 Toyota RAV4 (No ADAS) | None | $900 - $1,300 | N/A | N/A |

| 2023 Toyota RAV4 (Toyota Safety Sense) | AEB, FCW, LKA, ACC, BSM | N/A | $3,000 - $5,000 (includes radar unit, camera, recalibration) | $2,100 - $3,700 |

| 2017 Ford F-150 (Basic) | None | $1,000 - $1,500 | N/A | N/A |

| 2023 Ford F-150 (Co-Pilot360) | AEB, BSM, LKA, RCTA | N/A | $3,500 - $6,000 (includes multiple sensors, wiring, recalibration) | $2,500 - $4,500 |

As you can see, the repair costs for ADAS-equipped vehicles can be substantially higher. This is a critical factor that insurance companies weigh when setting premiums. While the accident prevention benefits are real, the cost of fixing these advanced systems means that the overall insurance picture is more nuanced than simply 'safer car equals cheaper insurance.'

Strategies for Maximizing Your Auto Insurance Savings with ADAS Equipped Vehicles

So, you've got a car with ADAS, or you're thinking of getting one. How can you make sure you're getting the best possible deal on your insurance, balancing the safety benefits with the potential repair costs?

Choosing the Right Insurance Provider for ADAS Discounts

This is probably the most important step. Not all insurance companies are created equal when it comes to ADAS. Some are more aggressive with their discounts, while others are more conservative. Here's what to look for:

- Ask Directly: Don't assume. When getting quotes, specifically ask about discounts for Automatic Emergency Braking, Lane Keeping Assist, Blind Spot Monitoring, and other ADAS features your car has.

- Compare Multiple Quotes: Get quotes from at least 3-5 different insurance providers. You'll be surprised at the variation in how they value ADAS features. Companies like Progressive, GEICO, State Farm, Allstate, and Liberty Mutual are large players and often have established ADAS discount programs. Smaller, regional insurers might also offer competitive rates.

- Look for Insurers with Telematics Programs: Some insurers offer usage-based insurance (UBI) programs (like Progressive's Snapshot or State Farm's Drive Safe & Save). While not directly ADAS discounts, these programs often reward safe driving, and ADAS features can certainly help you maintain a safer driving record, leading to further savings.

- Check for Manufacturer-Specific Programs: Occasionally, car manufacturers partner with insurance companies to offer special rates for their vehicles equipped with advanced safety features. It's worth checking if your car's brand has such a partnership.

Maintaining Your ADAS Systems to Prevent Costly Claims

Just like any other part of your car, ADAS systems need to be maintained. Proper maintenance can prevent malfunctions that could lead to accidents or costly repairs.

- Regular Servicing: Follow your car manufacturer's recommended service schedule. This often includes checks of ADAS sensors and cameras.

- Keep Sensors Clean: Many ADAS sensors are located in the front bumper, windshield, or grille. Keep these areas clean and free of dirt, snow, or ice. A dirty sensor can lead to system malfunctions.

- Windshield Replacement: If your car has a camera mounted on the windshield for ADAS (like for LKA or AEB), ensure that any windshield replacement is done by a certified technician who can properly recalibrate the camera. An improperly calibrated camera can render the system ineffective or even dangerous.

- Avoid Aftermarket Modifications: Be cautious with aftermarket modifications, especially to your car's exterior. A new grille or bumper that isn't designed for your car's ADAS can block sensors or interfere with their operation.

- Address Warning Lights Promptly: If an ADAS warning light comes on your dashboard, don't ignore it! Get it checked by a qualified mechanic as soon as possible.

Considering Higher Deductibles for ADAS Equipped Vehicles

Given the potentially higher repair costs for ADAS-equipped vehicles, one strategy to lower your premiums is to opt for a higher deductible on your comprehensive and collision coverage. A deductible is the amount you pay out of pocket before your insurance kicks in.

- How it Works: If you choose a $1,000 deductible instead of a $500 deductible, your premium will be lower. In the event of a claim, you'll pay the first $1,000 of the repair bill.

- The Trade-off: This strategy works best if you have a good emergency fund to cover the higher deductible in case of an accident. If you're prone to minor fender benders, a higher deductible might not save you money in the long run.

- Why it's Relevant for ADAS: Since ADAS repairs can be expensive, a higher deductible can significantly reduce your premium. However, be prepared for a larger out-of-pocket expense if you do have a claim involving ADAS components.

It's a balancing act. You want to save on premiums, but you also want to ensure you can afford the deductible if an accident occurs. Evaluate your driving habits and financial situation carefully before making this decision.

The Future of ADAS and Auto Insurance What to Expect

ADAS technology is evolving at a rapid pace, and so too will its relationship with auto insurance. What can we expect in the coming years?

Emerging ADAS Technologies and Their Potential Impact on Premiums

New ADAS features are constantly being developed, and some are already making their way into production vehicles:

- Driver Monitoring Systems: These systems use cameras to monitor driver attention and fatigue. If they can prove to significantly reduce accidents caused by distracted or drowsy driving, they could lead to new discounts.

- Vehicle-to-Everything (V2X) Communication: This technology allows cars to communicate with each other, traffic infrastructure, and even pedestrians. Imagine cars warning each other about hazards around a blind corner! This could be a game-changer for accident prevention.

- Advanced Parking and Maneuvering Systems: As these systems become more sophisticated, they could virtually eliminate low-speed parking lot incidents, leading to fewer minor claims.

- Enhanced Pedestrian and Cyclist Detection: With urban environments becoming more crowded, improved detection systems for vulnerable road users will be crucial for safety and could influence premiums.

As these technologies mature and their effectiveness is proven, insurance companies will adapt their models. We might see more granular discounts based on the specific combination and sophistication of ADAS features in a vehicle.

The Shift Towards Usage Based Insurance and ADAS Integration

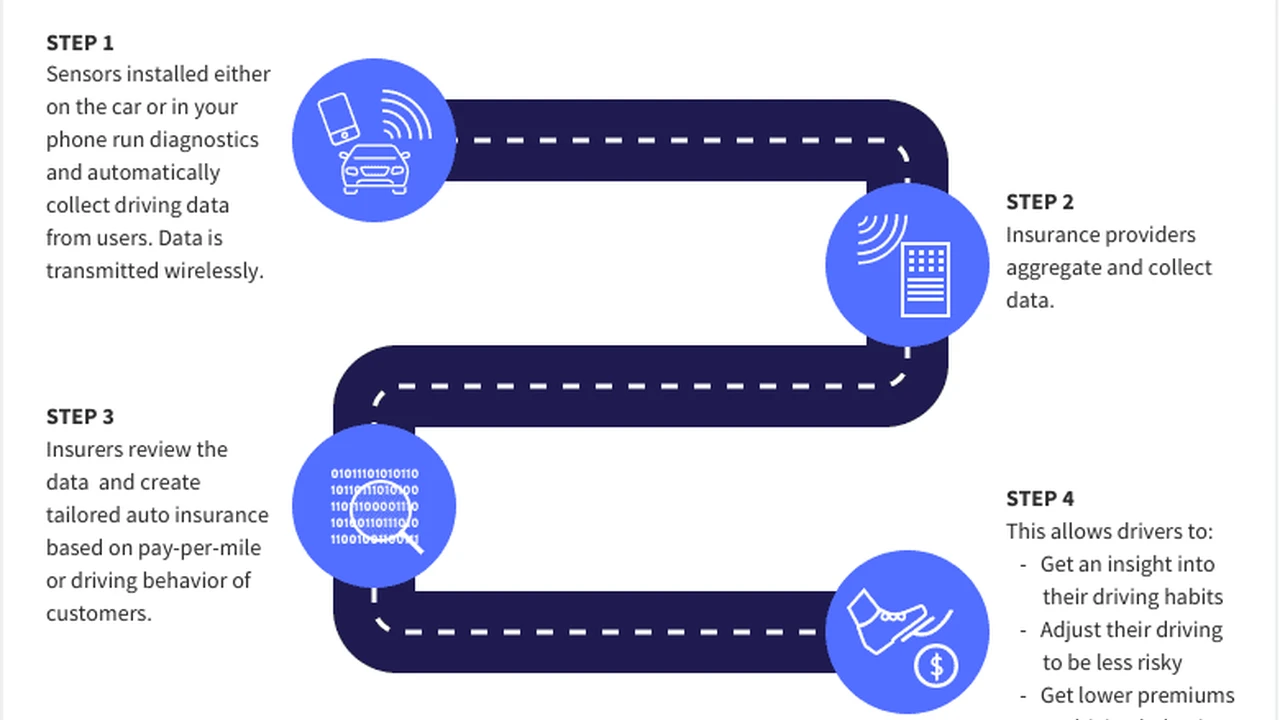

Usage-based insurance (UBI), where your premiums are based on your actual driving behavior, is becoming increasingly popular. ADAS plays a fascinating role here.

- Data Collection: The same sensors and cameras that power ADAS can also collect data on your driving habits – how often you brake hard, accelerate rapidly, or drift out of your lane. This data can be used by UBI programs to personalize your premium.

- Reinforcing Safe Driving: ADAS features like FCW and LKA can help you maintain safer driving habits, which in turn can lead to better scores in UBI programs and lower premiums.

- The 'Black Box' Effect: As cars become more connected and data-rich, the line between ADAS and UBI will blur. Your car itself might become a 'black box' that constantly feeds data to your insurer, potentially leading to highly individualized premiums based on your actual risk profile, influenced by how effectively you use (or are assisted by) your ADAS features.

This integration means that in the future, simply having ADAS might not be enough for a discount; how you drive with those systems could be the deciding factor. It's a move towards more personalized and dynamic insurance pricing.

Autonomous Vehicles and the Ultimate Insurance Paradigm Shift

The ultimate evolution of ADAS is, of course, fully autonomous vehicles. When cars can drive themselves without human intervention, the entire concept of auto insurance will undergo a massive paradigm shift.

- Liability Shift: Who is at fault in an accident involving an autonomous vehicle? The driver? The car manufacturer? The software provider? This question will fundamentally change liability insurance.

- Reduced Accidents: Proponents of autonomous vehicles argue they will drastically reduce accidents, as human error is eliminated. This could lead to a significant decrease in overall insurance claims.

- Product Liability Insurance: Insurance might shift from being primarily driver-centric to more product-liability focused, covering the technology and manufacturers.

- New Insurance Models: We might see subscription-based insurance models tied to vehicle usage, or even insurance bundled directly with the purchase or lease of an autonomous vehicle.

While fully autonomous vehicles are still some way off for widespread adoption, the journey there is paved with increasingly sophisticated ADAS. Understanding how these systems impact your insurance today is just the beginning of navigating the exciting and ever-changing landscape of automotive technology and its financial implications.

So, next time you're looking at a new car, or just reviewing your current policy, remember that those beeps and nudges from your ADAS aren't just about safety; they're also a key player in determining what you pay for your auto insurance. Stay informed, drive safe, and keep those premiums as low as possible!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)