3 Essential Considerations for International Auto Insurance

Get 3 essential considerations for international auto insurance. Understand coverage needs when driving abroad or importing a vehicle.

3 Essential Considerations for International Auto Insurance

Hey there, fellow globetrotter and car enthusiast! So, you're thinking about taking your wheels on an international adventure, or maybe you're moving abroad and need to sort out your car insurance. That's awesome! But let's be real, navigating international auto insurance can feel like trying to solve a Rubik's Cube blindfolded. It's not as simple as just extending your current policy. There are a ton of nuances, local laws, and different types of coverage you need to wrap your head around. Don't sweat it, though! We're here to break down the three most essential considerations for international auto insurance, making sure you're covered, compliant, and cruising with peace of mind.

Understanding Local Laws and Requirements for International Driving

First things first, before you even think about hitting the road in a foreign land, you absolutely, positively need to understand the local laws and insurance requirements. This isn't just a suggestion; it's a non-negotiable. Every country has its own set of rules, and what's perfectly legal in your home country might land you in hot water elsewhere. For instance, some countries operate under a 'fault' system, meaning the at-fault driver's insurance pays for damages, while others use a 'no-fault' system, where each driver's insurance covers their own damages regardless of who caused the accident. Knowing this distinction is crucial for how claims are handled.

Mandatory Minimum Coverage for Foreign Vehicles

Most countries will have a mandatory minimum level of third-party liability insurance. This covers damages you might cause to other people or their property. It's the bare minimum, and while it keeps you legal, it often won't cover damages to your own vehicle or your medical expenses. For example, in many European Union countries, a Green Card (International Motor Insurance Card) is recognized, proving you have the minimum required third-party liability insurance. However, this often only covers the legal minimum, which might be significantly lower than what you're used to or what you'd prefer. In Southeast Asian countries like Thailand or Vietnam, you'll typically need to purchase local third-party liability insurance upon entry or through a local provider, as your home country's policy is unlikely to be recognized.

Driving Permits and Licenses for International Travel

Beyond insurance, you'll also need to consider your driving permit. An International Driving Permit (IDP) is often required or highly recommended. This isn't a license itself but a translation of your domestic license into multiple languages, recognized in over 150 countries. You can usually get one from your local automobile association (like AAA in the US or the AA in the UK). Without an IDP, some countries might not even let you rent a car, let alone drive your own. Always check the specific requirements for each country you plan to visit or reside in.

Evaluating Your Current Policy and International Coverage Options

So, you've got your domestic auto insurance. The big question is: does it offer any international coverage? The short answer is, usually not much, if any. Most standard auto insurance policies are designed for domestic use only. However, there are exceptions and specific add-ons you might be able to get.

Checking for Existing International Auto Insurance Riders

Some premium policies or specific insurers might offer limited international coverage, often for short trips to neighboring countries (e.g., a US policy might extend to Canada or Mexico, but usually with specific limitations and requiring a Mexico insurance policy for the latter). It's rare for a standard policy to cover you across continents. Always call your current insurer and ask them directly about their international coverage options. Be very specific about where you're going, for how long, and whether you'll be driving your own car or a rental.

Temporary International Auto Insurance for Short Trips

If you're just going for a short vacation and plan to rent a car, your credit card might offer some rental car insurance benefits. However, these are often secondary (meaning they kick in after your primary insurance) and might not cover liability. Many rental car companies also offer their own insurance, which can be convenient but often pricey. For longer trips or if you're driving your own vehicle, you'll likely need to purchase a separate, temporary international auto insurance policy. These can be bought from specialized international insurance providers or sometimes from local insurers in your destination country. For example, if you're driving through multiple European countries, you might look into a policy that covers the entire Schengen Area.

Long-Term International Auto Insurance for Relocation

If you're relocating to another country and importing your vehicle, or buying a car there, you'll almost certainly need to purchase a local insurance policy. This is where things get a bit more complex. You'll need to research local insurance companies, compare quotes, and understand their policy structures. Factors like your driving history, the type of vehicle, and even your residency status can affect your premiums. For instance, in Australia, you'd look for providers like NRMA, AAMI, or Budget Direct. In the UK, companies like Admiral, Direct Line, or Aviva are popular. In Southeast Asia, you'd be looking at local giants like AXA or local specialized insurers in countries like Singapore (e.g., NTUC Income, FWD) or Malaysia (e.g., Etiqa, Allianz Malaysia).

Comparing Specialized International Auto Insurance Providers and Products

When your domestic policy just won't cut it, it's time to look at specialized international auto insurance providers. These companies understand the complexities of cross-border driving and offer policies tailored to various scenarios. It's not just about finding any policy; it's about finding the right policy that offers comprehensive coverage, good customer service, and a smooth claims process, especially when you're far from home.

Key Features to Look for in International Auto Insurance Products

When comparing policies, don't just focus on the price. Look for:

- Comprehensive Coverage: Beyond basic liability, does it cover damage to your own vehicle (collision and comprehensive)? What about theft, fire, and vandalism?

- Medical Payments/Personal Injury Protection: Does it cover your medical expenses and those of your passengers, regardless of fault?

- Roadside Assistance: This can be a lifesaver in an unfamiliar country. Does the policy include towing, flat tire service, or emergency fuel delivery?

- Legal Assistance: In case of an accident, having legal support can be invaluable.

- Repatriation/Travel Assistance: If your car is totaled or you're injured, does the policy help with getting you and your vehicle back home?

- Customer Service and Claims Process: Is their customer service available 24/7? Do they have English-speaking representatives? What's their claims process like, especially for international claims?

Recommended International Auto Insurance Products and Providers

Here are a few examples of providers and types of products you might encounter, along with their typical use cases and general price ranges (which can vary wildly based on location, vehicle, and driver profile):

1. Clements Worldwide

Product Type: Expat Auto Insurance, International Car Insurance for Owned Vehicles

Use Case: Ideal for expats, diplomats, and international professionals who are moving abroad and taking their own vehicle, or purchasing one in their new country of residence. They offer policies that can cover vehicles in over 170 countries, often with US-style coverage levels.

Key Features: Worldwide coverage, flexible policy terms, often includes comprehensive and collision, liability, and sometimes even personal effects coverage. They understand the unique needs of expats.

Comparison: Unlike local insurers that might only cover one country, Clements offers a global solution, simplifying insurance for those with international lifestyles. They are known for their expertise in complex international insurance scenarios.

Estimated Price Range: Highly variable, but expect premiums to be higher than a standard domestic policy due to the specialized nature and broad coverage. Could range from $1,500 to $5,000+ annually, depending on the vehicle, location, and coverage limits.

2. Allianz Travel Insurance (with Car Rental Collision Coverage)

Product Type: Travel Insurance Add-on for Rental Cars

Use Case: Perfect for short-term international travelers who are renting a car for their vacation or business trip. This is typically an add-on to a comprehensive travel insurance policy.

Key Features: Covers collision damage to your rental car, often primary coverage (meaning it pays out before your personal auto insurance). Can be much cheaper than buying insurance directly from the rental company.

Comparison: While not full auto insurance, it's a cost-effective alternative to rental company CDW (Collision Damage Waiver) for those who don't own a car abroad. It usually doesn't cover third-party liability, so you'd still need to ensure the rental company provides that or purchase it separately.

Estimated Price Range: Often an additional $9-$15 per day on top of a travel insurance policy, or a flat fee for the duration of the trip, significantly less than rental company options which can be $20-$40+ per day.

3. Local Insurers in Southeast Asia (e.g., AXA, Etiqa, NTUC Income)

Product Type: Standard Local Auto Insurance Policies

Use Case: Essential for anyone residing in a Southeast Asian country (e.g., Singapore, Malaysia, Thailand, Indonesia, Philippines) and owning a vehicle there. Also necessary for long-term visitors importing a car.

Key Features: Adheres to local regulations, offers various levels of coverage from basic third-party to comprehensive. Often includes local roadside assistance and claims handling.

Comparison: These are your go-to for compliance with local laws and for navigating the local claims process. They understand the specific risks and road conditions of the region. While they don't offer global coverage, they are the most practical and often only legal option for long-term vehicle ownership in these countries.

Estimated Price Range: Varies greatly by country, vehicle type, and driver profile. In Singapore, comprehensive insurance for a mid-range car could be S$1,000 - S$2,500 annually. In Malaysia, it might be RM 800 - RM 2,000. In Thailand, expect 15,000 - 30,000 THB. These are rough estimates and can be higher or lower.

4. Green Card System (for European Travel)

Product Type: International Motor Insurance Card

Use Case: For drivers from countries within the Green Card system (e.g., EU, UK, some non-EU countries) traveling to other participating countries with their own vehicle. It proves you have the minimum required third-party liability insurance.

Key Features: Facilitates cross-border travel by providing internationally recognized proof of insurance. Simplifies border crossings and ensures legal compliance for basic liability.

Comparison: It's not a standalone insurance policy but a certificate that extends your existing domestic policy's third-party liability coverage to other Green Card countries. It's crucial for ensuring you meet minimum legal requirements, but often doesn't provide comprehensive coverage for your own vehicle.

Estimated Price Range: Often included with your existing policy or a small administrative fee from your insurer. The cost is essentially embedded in your domestic policy premium.

Tips for Getting the Best Deals on International Auto Insurance

To snag the best deals, always:

- Shop Around: Get quotes from multiple providers, both international specialists and local insurers in your destination.

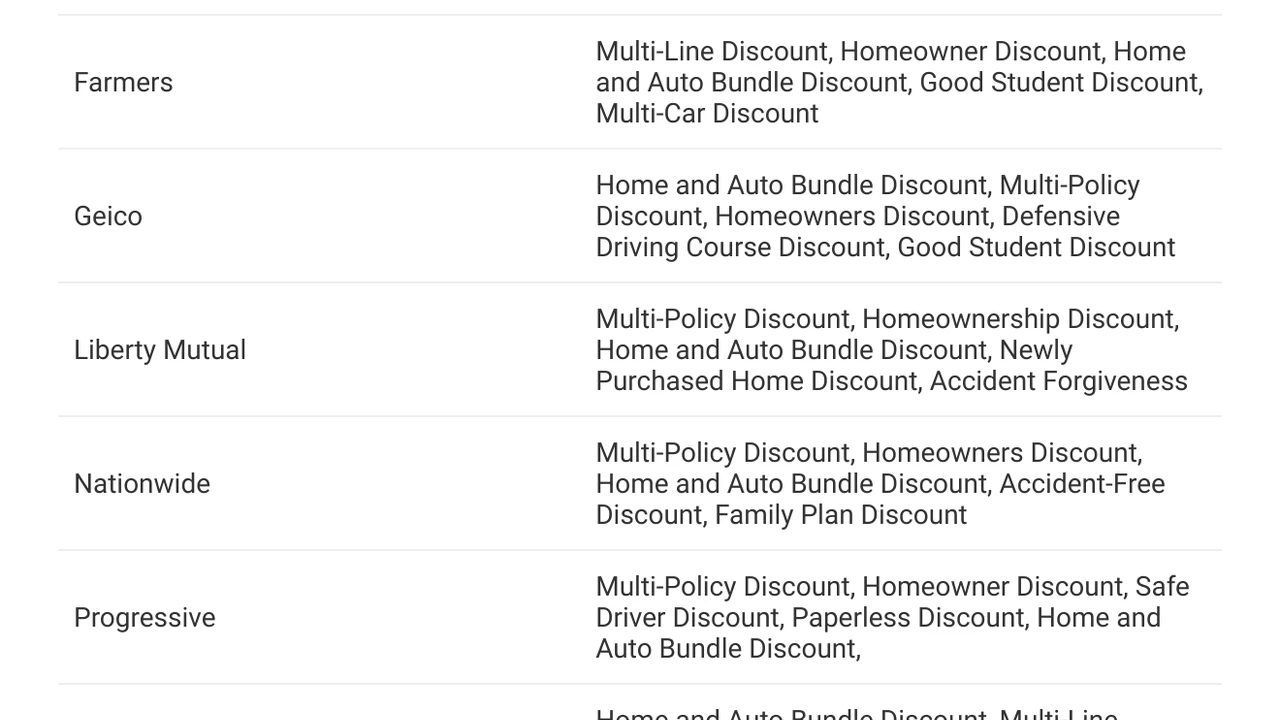

- Bundle Policies: If you're getting other types of insurance (travel, health, home), see if you can bundle your auto insurance for a discount.

- Maintain a Clean Driving Record: Your driving history, even from your home country, can impact rates abroad.

- Consider a Higher Deductible: If you're comfortable with more out-of-pocket risk, a higher deductible can lower your premiums.

- Ask About Discounts: Don't be shy! Inquire about discounts for good drivers, anti-theft devices, low mileage, or specific professions.

- Read the Fine Print: Seriously, understand what's covered, what's excluded, and the claims process. Pay attention to geographical limits and currency conversions for payouts.

Navigating Claims and Emergency Situations Abroad with International Auto Insurance

Okay, so you've got your insurance sorted. But what happens if the unthinkable occurs? An accident, a breakdown, or even theft can be incredibly stressful, especially in a foreign country. Knowing how to navigate claims and emergencies is just as important as having the right policy.

Immediate Steps After an International Auto Accident

If you're involved in an accident abroad, the immediate steps are similar to what you'd do at home, but with an added layer of complexity:

- Ensure Safety: Move to a safe location if possible, turn on hazard lights, and set up warning triangles.

- Check for Injuries: Prioritize the well-being of everyone involved. Call emergency services (know the local emergency number – e.g., 112 in Europe, 999 in Singapore/Malaysia, 191 in Thailand).

- Contact Local Police: Even for minor incidents, a police report is often crucial for insurance claims.

- Exchange Information: Get details from all parties involved: names, contact info, vehicle registration, insurance details. Take photos of everything – vehicle damage, road conditions, relevant signage.

- Do NOT Admit Fault: This is critical. Let the authorities and insurance companies determine fault.

- Contact Your Insurer: As soon as it's safe, contact your international auto insurance provider. They will guide you through the local claims process and provide assistance. Have your policy number handy.

Understanding the International Claims Process

The claims process can vary significantly depending on the country and your policy. Your international insurer should have a dedicated claims department that can assist you. They might have local partners or adjusters who speak the local language and understand the legal framework. Be prepared to provide all documentation: police reports, photos, witness statements, and any medical reports if there are injuries.

Roadside Assistance and Emergency Support for International Drivers

This is where a good international policy truly shines. If your policy includes roadside assistance, you'll have a lifeline in case of a breakdown. This can include:

- Towing Services: Getting your vehicle to a repair shop.

- Flat Tire Changes: If you don't have a spare or the tools.

- Battery Jump-Starts: For those unexpected dead batteries.

- Emergency Fuel Delivery: When you misjudge the distance to the next gas station.

- Lockout Services: If you accidentally lock your keys in the car.

Always keep your insurer's emergency contact number readily available, perhaps programmed into your phone and written down in your glove compartment. Some policies even offer concierge services to help with language barriers or finding local resources.

Dealing with Language Barriers and Local Bureaucracy

One of the biggest challenges when dealing with an accident or claim abroad is the language barrier and unfamiliar bureaucracy. This is another reason why choosing an insurer with good international support is vital. They can often provide translators or guide you through the necessary paperwork. If you're dealing with local authorities or repair shops directly, consider using translation apps or hiring a local guide if the situation is complex. Patience and persistence are key here!

So, there you have it! International auto insurance might seem like a maze, but by focusing on these three essential considerations – understanding local laws, evaluating your coverage options, and knowing how to handle emergencies – you can confidently navigate the world's roads. Drive safe, explore more, and enjoy the freedom that comes with being properly insured!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)