5 Advanced Strategies to Maximize Auto Insurance Savings

Discover 5 advanced strategies to maximize auto insurance savings. Go beyond basic discounts to significantly reduce your premiums.

Discover 5 advanced strategies to maximize auto insurance savings. Go beyond basic discounts to significantly reduce your premiums.

5 Advanced Strategies to Maximize Auto Insurance Savings

Hey there, savvy driver! You're probably already familiar with the basic ways to save on auto insurance: bundling policies, maintaining a clean driving record, and shopping around for quotes. But what if I told you there are even more sophisticated tactics you can employ to slash those premiums? We're talking about going beyond the obvious and diving deep into the world of advanced auto insurance savings. This isn't just about finding a few extra bucks; it's about strategically optimizing your policy to ensure you're getting the absolute best value without compromising on essential coverage. Let's explore five powerful strategies that can put significant money back in your pocket.

Strategy 1 Optimize Your Deductibles and Coverage Limits for Maximum Savings

One of the most impactful ways to control your auto insurance costs is by strategically adjusting your deductibles and coverage limits. This isn't a one-size-fits-all approach; it requires a careful assessment of your financial situation, risk tolerance, and the value of your vehicle. Let's break it down.

Understanding Deductibles Auto Insurance Deductible Optimization

Your deductible is the amount you pay out of pocket before your insurance kicks in for a covered claim. Generally, a higher deductible leads to a lower premium. But how high is too high? And when does it make sense to raise it?

- When to Consider a Higher Deductible: If you have a healthy emergency fund (at least $1,000-$2,500 readily available) and a good driving record with few claims, increasing your deductible can be a smart move. For instance, moving from a $500 deductible to a $1,000 deductible could save you 10-20% on your comprehensive and collision premiums. If you're driving an older car with a low market value, a very high deductible (e.g., $2,000 or $2,500) might even make sense, as the cost of repairs could quickly approach the car's value.

- When to Stick with a Lower Deductible: If your emergency fund is limited, or if you're prone to minor accidents, a lower deductible (e.g., $250 or $500) might offer better peace of mind, even if it means slightly higher premiums. The last thing you want is to be unable to afford your deductible after an accident.

Product Spotlight: Deductible Options from Major Insurers

Most major insurers like Geico, Progressive, State Farm, and Allstate offer a range of deductible options, typically from $250 to $2,500. Some even offer a 'disappearing deductible' or 'vanishing deductible' feature, where your deductible decreases over time for every year you remain claim-free. For example, Allstate's Deductible Rewards program can reduce your collision deductible by $100 for every year of safe driving, up to $500.

Adjusting Coverage Limits Auto Insurance Coverage Limit Review

Your coverage limits determine the maximum amount your insurer will pay for a claim. While you never want to be underinsured, you also don't want to pay for coverage you don't truly need.

- Liability Coverage: This is crucial. Most experts recommend carrying at least $100,000 per person / $300,000 per accident for bodily injury liability and $50,000 for property damage liability (often written as 100/300/50). If you have significant assets, consider even higher limits or an umbrella policy (more on that later!). However, if you're currently carrying extremely high limits (e.g., 500/500/100) and don't have substantial assets to protect, you might be able to slightly reduce these to a still-robust level without significant risk, leading to minor savings.

- Collision and Comprehensive Coverage: These cover damage to your own vehicle. If your car is older and its market value is less than, say, $3,000-$5,000, the cost of collision and comprehensive coverage might outweigh the potential payout. In such cases, dropping these coverages could save you a significant amount. Always compare the annual premium for these coverages against your car's actual cash value.

- Medical Payments/Personal Injury Protection (PIP): The necessity of these varies by state. If you have excellent health insurance, you might be able to opt for lower limits on these coverages, as your health insurance would be primary for medical expenses.

Scenario Comparison: Deductible and Coverage Adjustment

Let's say you have a 2015 Honda Civic worth $8,000. Your current policy has a $500 deductible for comprehensive/collision and 100/300/50 liability. You have a $5,000 emergency fund.

- Option A (Current): $500 deductible, 100/300/50 liability. Annual premium: $1,200.

- Option B (Optimized): Increase deductible to $1,000 (saving ~15% on comp/coll portion, say $100/year). Keep liability at 100/300/50. Annual premium: $1,100.

- Option C (Aggressive Optimization for Older Car): If your Civic was only worth $3,000, you might consider dropping comprehensive/collision entirely (saving ~40% of total premium, say $480/year). Annual premium: $720.

Always get quotes for different deductible and coverage limit combinations to see the exact impact on your premium. Use online quote tools from providers like Progressive's Name Your Price tool or Geico's Coverage Calculator to experiment with these adjustments.

Strategy 2 Leverage Telematics and Usage Based Insurance UBI Programs for Personalized Rates

Telematics, often referred to as Usage-Based Insurance (UBI), is a game-changer for safe drivers. These programs use technology (a device plugged into your car's OBD-II port or a smartphone app) to monitor your driving habits, such as mileage, speed, braking, acceleration, and even the time of day you drive. In return, insurers offer personalized premiums based on your actual driving behavior, often resulting in significant discounts.

How Telematics Works Auto Insurance Telematics Explained

The concept is simple: the safer you drive, the more you save. Insurers collect data on your driving and use it to assess your risk profile. If you demonstrate responsible driving habits, you're rewarded with lower rates. This is particularly beneficial for drivers who:

- Drive fewer miles than average.

- Avoid hard braking and rapid acceleration.

- Don't drive frequently during late-night hours.

Popular Telematics Programs and Their Features:

- Progressive Snapshot: This is one of the most well-known UBI programs. You can use a plug-in device or their mobile app. Drivers can save an average of $150 per year, with some saving up to $1,000. It monitors mileage, hard braking, and time of day.

- Geico DriveEasy: Geico's app-based program tracks driving habits like hard braking, aggressive acceleration, cornering, phone usage, and time of day. It offers personalized rates and feedback on your driving.

- State Farm Drive Safe & Save: This program uses either the Car Connection device or the State Farm mobile app. It tracks mileage, acceleration, braking, and cornering. Discounts can be up to 30%.

- Allstate Drivewise: Available via their mobile app, Drivewise rewards safe driving with cash back and policy discounts. It monitors speed, braking, and time of day.

- Liberty Mutual RightTrack: This program uses a plug-in device or a mobile app to monitor driving behavior for 90 days, after which you receive a personalized discount that applies for the life of your policy. Initial sign-up discounts are also common.

Choosing the Right Telematics Program Usage Based Insurance Comparison

When considering a UBI program, here's what to look for:

- Potential Savings: What's the average discount? Is there an initial sign-up discount?

- Monitoring Method: Do you prefer a plug-in device or a smartphone app? Consider battery drain for app-based programs.

- Data Points Tracked: Some programs are more intrusive than others. Understand what data is being collected.

- Impact on Rates: While most programs promise savings for good drivers, some (like Progressive Snapshot) can potentially increase your rates if your driving habits are deemed risky. Always clarify this with your insurer.

- Privacy Concerns: Understand the insurer's data privacy policy.

Real-World Application: Sarah, a remote worker, drives only about 5,000 miles a year and has a very smooth driving style. By enrolling in Progressive Snapshot, she received an initial discount of 10% and, after the monitoring period, her premium was reduced by an additional 18%, saving her over $200 annually. John, on the other hand, has a long commute with frequent rush hour driving and occasional hard braking. He tried Geico DriveEasy but found his discount was minimal, so he opted out after the trial period.

It's worth trying a UBI program, especially if you believe you're a safe driver. The trial period often comes with an immediate discount, and you can usually opt out if the final discount isn't substantial or if you're uncomfortable with the monitoring.

Strategy 3 Explore Specialized Policies and Niche Insurers for Unique Needs

While major insurers offer broad coverage, sometimes your specific situation calls for a more tailored approach. Niche insurers and specialized policies can often provide better rates or more appropriate coverage for unique vehicles or driving profiles.

Classic Car Insurance Specialized Auto Insurance

If you own a classic, antique, or collector car, insuring it with a standard auto policy is a mistake. Standard policies typically insure vehicles based on their depreciated actual cash value, which doesn't reflect the true market value of a classic car. Specialized classic car insurance policies offer:

- Agreed Value Coverage: You and the insurer agree on the car's value upfront, and that's the amount you'll receive if it's totaled, regardless of depreciation.

- Lower Premiums: Classic cars are typically driven less and maintained meticulously, leading to lower risk and thus lower premiums.

- Specialized Repair Options: Coverage for original parts and specialized repair shops.

- Roadside Assistance for Classics: Designed for older vehicles.

Recommended Classic Car Insurers:

- Hagerty: Widely considered the leader in classic car insurance. They offer agreed value, flexible usage, and roadside assistance specifically for classics. A 1969 Ford Mustang valued at $30,000 might cost around $400-$600 annually with Hagerty, significantly less than a standard policy.

- Grundy Worldwide: Another top-tier classic car insurer offering agreed value, low annual mileage limits, and coverage for cars under restoration.

- American Collectors Insurance: Provides similar benefits, often with options for higher mileage limits if you drive your classic more frequently.

High-Risk Driver Insurance Options for Challenging Driving Records

If you have a history of DUIs, multiple accidents, or numerous tickets, you're considered a high-risk driver, and standard insurers might charge exorbitant rates or even deny coverage. However, specialized insurers cater to this market.

- Non-Standard Insurers: Companies like The General, Titan Insurance (a Nationwide company), and Dairyland Auto specialize in high-risk policies. While premiums will be higher than for standard drivers, these insurers can provide necessary coverage, including SR-22 filings if required.

- Assigned Risk Pool: In some states, if you can't find coverage through the voluntary market, you might be placed in an 'assigned risk pool' or 'residual market.' This is a last resort, and premiums are typically very high, but it ensures you meet state minimum requirements.

Tip: Even as a high-risk driver, shop around. Rates can vary wildly between non-standard insurers. Focus on maintaining a clean record going forward; after a few years, you may qualify for standard rates again.

Usage-Based Insurance for Low-Mileage Drivers Low Mileage Auto Insurance

While covered in Strategy 2, it's worth reiterating that UBI programs are particularly beneficial for low-mileage drivers. If you work from home, use public transport, or have a short commute, your annual mileage is likely below the national average (around 13,500 miles). Many insurers offer specific low-mileage discounts or programs that heavily weigh mileage in their calculations.

Consider Pay-Per-Mile Insurance:

- Metromile: This insurer specializes in pay-per-mile insurance. You pay a low base rate plus a few cents for each mile you drive. This can lead to massive savings for very low-mileage drivers. For example, if your base rate is $30/month and you drive 500 miles at $0.06/mile, your total bill is $60. If you drive 200 miles, it's $42. They also offer a smart driving app with features like street sweeping alerts and car health diagnostics. Metromile is currently available in AZ, CA, IL, NJ, OR, PA, VA, and WA.

- Root Insurance: While not strictly pay-per-mile, Root uses a comprehensive telematics approach to price policies. They claim to offer significant savings to good drivers, often rejecting high-risk drivers. Their app monitors driving for a few weeks before offering a personalized quote.

Scenario: Low-Mileage Driver Savings

Maria drives only 3,000 miles a year. With a traditional insurer, her premium is $1,000. With Metromile, her base rate is $29/month and she pays $0.05/mile. Her annual cost would be $29 * 12 + 3000 * $0.05 = $348 + $150 = $498. That's a saving of over $500!

Strategy 4 Implement Advanced Defensive Driving and Safety Features for Discounts

Many insurers reward proactive measures that reduce the likelihood of accidents or theft. Investing in advanced defensive driving courses and equipping your vehicle with modern safety features can unlock significant discounts.

Defensive Driving Courses Auto Insurance Defensive Driving Discounts

Completing an approved defensive driving course can not only make you a safer driver but also earn you a discount on your auto insurance. These courses typically cover topics like hazard perception, accident avoidance, and safe driving practices. The discount usually lasts for a few years (e.g., 3-5 years) and can range from 5% to 15%.

- Who Benefits Most: Younger drivers, senior drivers (many states mandate discounts for seniors completing these courses), and drivers looking to offset a minor infraction on their record.

- Where to Find Courses: Look for courses approved by your state's DMV or reputable organizations like the National Safety Council (NSC) or AAA. Many are now available online, making them convenient.

Example: A 20-year-old driver in Texas completes an approved defensive driving course. Their annual premium of $2,500 could see a 10% discount, saving them $250 per year for the next three years.

Vehicle Safety Features Auto Insurance Safety Feature Discounts

Modern vehicles are packed with advanced safety features, and insurers recognize that these technologies reduce the risk of accidents and injuries. Make sure your insurer knows about all the safety features in your car.

- Anti-Lock Braking System (ABS): Standard on most modern cars, but if you have an older vehicle with ABS, ensure it's noted.

- Electronic Stability Control (ESC): Helps drivers maintain control during extreme steering maneuvers.

- Advanced Driver-Assistance Systems (ADAS): This is where the big discounts are emerging. Features like:

- Forward Collision Warning (FCW) / Automatic Emergency Braking (AEB): Can prevent or mitigate frontal crashes.

- Lane Departure Warning (LDW) / Lane Keeping Assist (LKA): Helps prevent unintentional lane changes.

- Blind Spot Monitoring (BSM): Alerts drivers to vehicles in their blind spots.

- Adaptive Cruise Control (ACC): Maintains a safe distance from the car ahead.

- Anti-Theft Devices: Alarms, immobilizers, GPS tracking systems (e.g., LoJack, OnStar).

Insurers Offering ADAS Discounts:

- Liberty Mutual: Offers discounts for features like adaptive cruise control, lane departure warning, and forward collision warning.

- Farmers Insurance: Provides discounts for anti-lock brakes, anti-theft systems, and passive restraint systems.

- Travelers: Offers discounts for cars with features like forward collision warning, lane departure warning, and automatic emergency braking.

- State Farm: Has discounts for passive restraint systems (airbags, automatic seatbelts) and anti-theft devices.

Cost vs. Savings: While you might not buy a new car just for the insurance discount, if you're already in the market, prioritizing models with comprehensive ADAS packages can lead to long-term savings. For anti-theft, a basic alarm system might cost $100-$300 to install, but could save you 5-15% on your comprehensive premium, potentially paying for itself in a few years.

Strategy 5 Leverage Financial Planning and Credit Score for Better Rates

Your financial health, particularly your credit score, plays a surprisingly significant role in your auto insurance premiums in many states. Insurers use credit-based insurance scores as a predictor of future claims. A higher score often translates to lower premiums.

Improving Your Credit Score Auto Insurance Credit Score Impact

While not directly related to driving, improving your credit score can be one of the most effective long-term strategies for reducing insurance costs. Here's how:

- Pay Bills on Time: Payment history is the biggest factor in your credit score.

- Reduce Debt: Especially revolving debt like credit card balances. Keep credit utilization low.

- Avoid Opening Too Many New Credit Accounts: Each new application can temporarily ding your score.

- Check Your Credit Report Regularly: Dispute any errors that could be dragging your score down.

- Maintain a Long Credit History: The longer your positive credit history, the better.

Impact: The difference in premiums between a driver with excellent credit and one with poor credit can be hundreds, even thousands, of dollars annually. For example, a driver with poor credit might pay 70-100% more for the same coverage than a driver with excellent credit.

States Where Credit Score is Not Used: California, Hawaii, Massachusetts, and Michigan prohibit or severely restrict the use of credit scores in determining auto insurance rates. If you live in these states, this strategy won't apply to you.

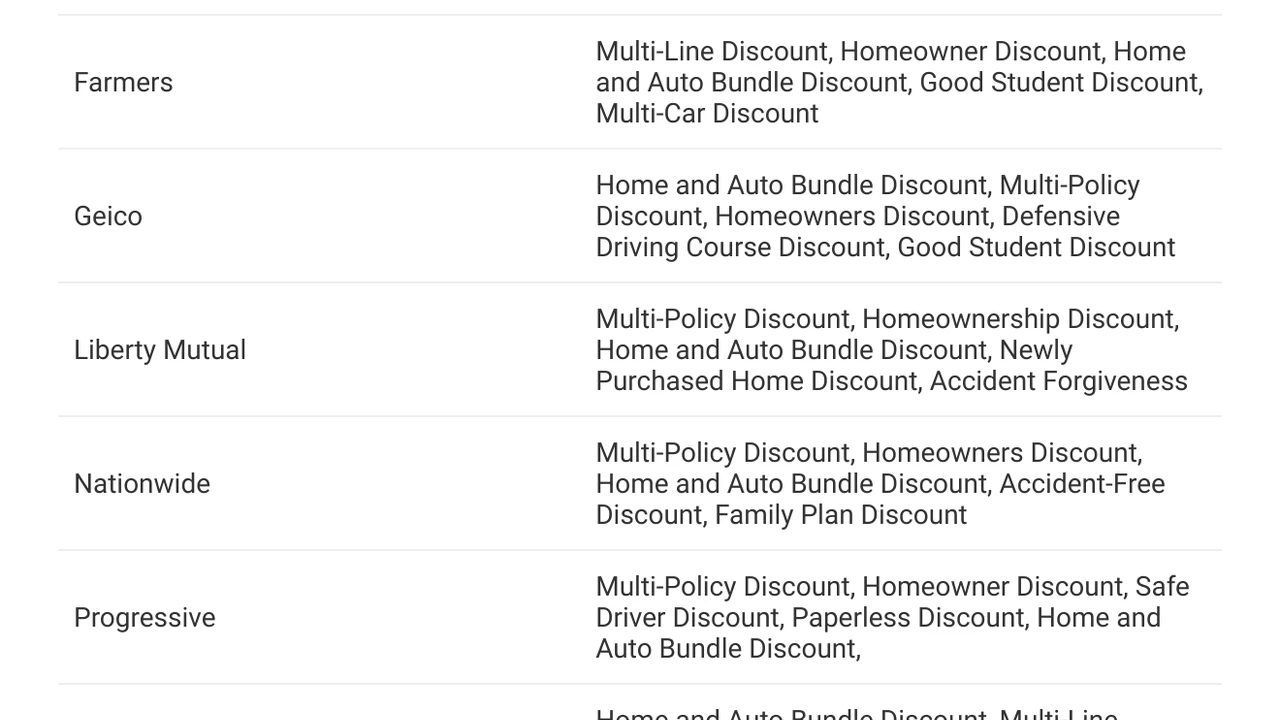

Bundling Beyond Home and Auto Multi Policy Discounts

You probably know about bundling home and auto insurance, but many insurers offer discounts for bundling other types of policies as well. This can include:

- Renters Insurance: If you rent, adding a renters policy to your auto insurance can often unlock a multi-policy discount, and renters insurance itself is usually very affordable (e.g., $15-$20/month).

- Life Insurance: Some insurers, like State Farm and Allstate, offer discounts if you have a life insurance policy with them in addition to auto.

- Motorcycle, Boat, or RV Insurance: If you own other vehicles, insuring them with the same company can lead to further savings.

- Umbrella Policy: While primarily for increased liability protection, an umbrella policy (which sits above your auto and home liability) can sometimes qualify you for additional multi-policy discounts.

Example: Sarah has auto insurance with Geico for $1,200/year. She also pays $200/year for renters insurance with a different provider. By switching her renters insurance to Geico, she might get a 5-10% discount on her auto policy ($60-$120) and potentially a small discount on her renters policy, making the switch worthwhile.

Reviewing Your Policy Annually Auto Insurance Annual Review

This isn't a one-time fix; it's an ongoing process. Your life changes, your car ages, and insurance rates fluctuate. Make it a habit to review your policy at least once a year, ideally before your renewal date.

- Life Changes: Did you get married? Move? Change jobs (affecting your commute)? These can all impact your rates.

- Vehicle Changes: Is your car older now? Has its market value significantly decreased? Re-evaluate your comprehensive and collision coverage.

- Driving Record: If a ticket or accident has fallen off your record, your rates should decrease. Ensure your insurer has updated information.

- New Discounts: Insurers frequently introduce new discounts. Ask your agent if there are any new ones you qualify for.

- Shop Around: Even if you're happy with your current insurer, get quotes from 2-3 other companies annually. This keeps your current insurer competitive and ensures you're not overpaying. Online comparison tools like The Zebra or NerdWallet's comparison tool can make this process quick and easy.

By consistently applying these advanced strategies, you're not just looking for a quick discount; you're actively managing your auto insurance costs like a pro. It takes a little effort, but the long-term savings can be substantial, giving you more money for the things that truly matter.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)