5 Ways to Optimize Your Auto Insurance Coverage Annually

Discover 5 ways to optimize your auto insurance coverage annually. Review your policy regularly to ensure you have the right protection at the best price.

5 Ways to Optimize Your Auto Insurance Coverage Annually

Hey there, savvy driver! Let's talk about something super important but often overlooked: your auto insurance. It's not a 'set it and forget it' kind of deal. Life changes, your car changes, and guess what? The insurance market changes too. That's why taking a good, hard look at your policy every single year is one of the smartest financial moves you can make. We're not just talking about saving a few bucks; we're talking about making sure you're properly protected without overpaying for things you don't need. So, buckle up, because we're diving into five fantastic ways to optimize your auto insurance coverage annually.

1. Reassess Your Coverage Needs Annually Your Driving Habits and Vehicle Value

Think about it: is your life today the same as it was a year ago? Probably not! Maybe you've moved closer to work, started working from home, or your kids finally got their licenses. All these things impact how much you drive and what kind of risks you face on the road. Your car's value also changes, and that's a big one for insurance.

Understanding Your Current Driving Habits and Mileage

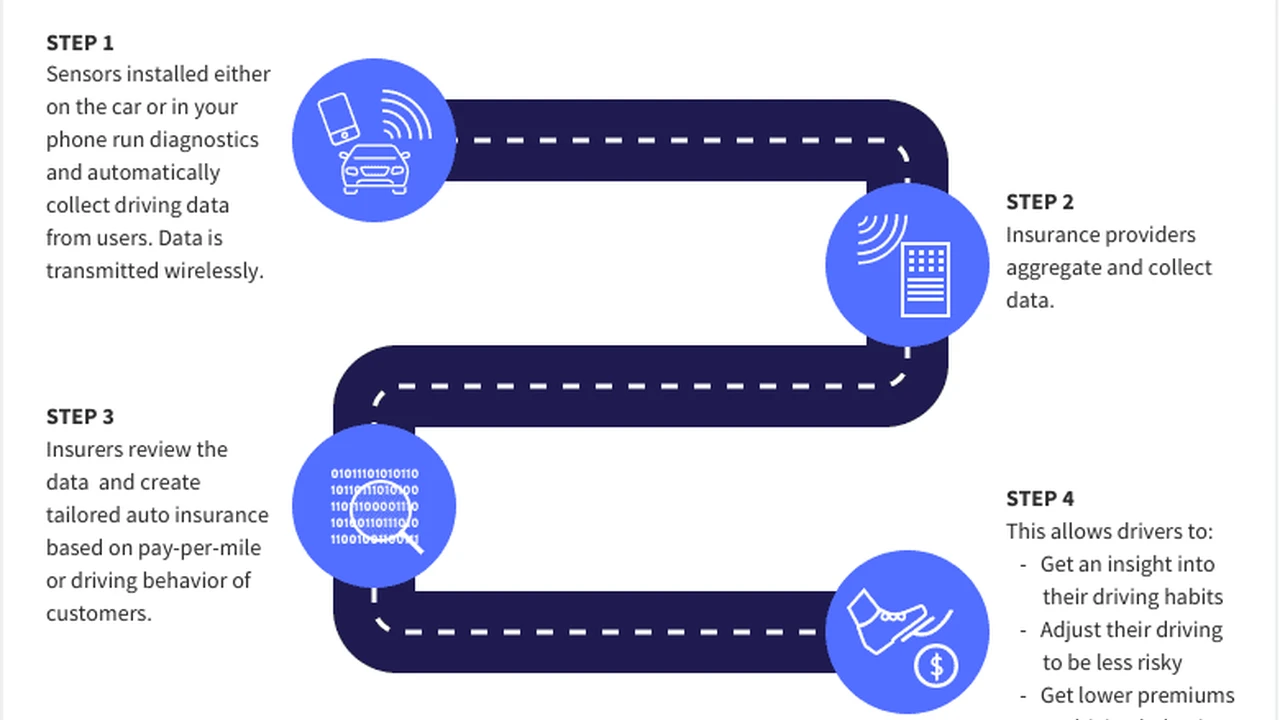

Did you know that how much you drive can significantly affect your premiums? If you've gone from a long daily commute to working remotely, your annual mileage has likely plummeted. Many insurers offer discounts for low-mileage drivers. Some even have 'pay-per-mile' or 'usage-based' insurance programs that track your actual driving. If you're driving less, you're less likely to be in an accident, and your insurer should reflect that in your rates. Be honest with your insurer about your mileage; it could lead to substantial savings.

Evaluating Your Vehicle's Current Market Value and Depreciation

Cars depreciate, and they do it fast! A car that was worth $30,000 two years ago might only be worth $18,000 today. Why pay for collision and comprehensive coverage based on its original value when its current market value is much lower? If your car is older or has significantly depreciated, you might consider increasing your deductibles or even dropping collision and comprehensive coverage altogether, especially if the cost of these coverages approaches or exceeds the car's actual cash value. This is a common strategy for older vehicles where the repair cost might be more than the car is worth. Always check the Kelley Blue Book or Edmunds for an accurate valuation.

Adjusting Deductibles for Collision and Comprehensive Coverage

Your deductible is the amount you pay out of pocket before your insurance kicks in. A higher deductible usually means a lower premium. If you have a healthy emergency fund and can comfortably cover a $1,000 or $2,500 deductible, increasing it from, say, $500 could save you hundreds of dollars a year. Just make sure you're comfortable with the higher out-of-pocket expense if you do need to file a claim. It's a balancing act between monthly savings and potential future costs.

2. Shop Around and Compare Quotes Annually Best Auto Insurance Deals

This is probably the single most effective way to optimize your auto insurance. Loyalty is great, but it doesn't always pay off in the insurance world. Insurers frequently change their pricing models, offer new discounts, and compete fiercely for new customers. What was the best deal last year might not be this year.

Why Comparing Auto Insurance Quotes is Crucial Every Year

Think of it like shopping for groceries. You wouldn't buy the same brand of cereal every week if another store had it for half the price, right? Insurance is no different. Your current insurer might slowly creep up your rates without you noticing, or a competitor might have a fantastic new offer. By getting quotes from at least three to five different companies annually, you ensure you're always getting a competitive rate. Don't just look at the big names; sometimes smaller, regional insurers offer surprisingly good deals.

Top Online Platforms for Comparing Auto Insurance Rates

Gone are the days of calling multiple agents. Now, you can get a bunch of quotes in minutes! Here are some of the best platforms:

- Gabi: This platform is fantastic because it compares your current policy with over 40 top insurance companies to find you the best rate. You just upload your current policy, and Gabi does the rest. It's super easy and often finds significant savings.

- The Zebra: Known for its comprehensive comparison tools, The Zebra allows you to compare quotes from over 100 providers in real-time. It's great for getting a broad overview of the market.

- NerdWallet: While not a direct quote comparison tool, NerdWallet offers excellent guides and links to various insurers, helping you understand your options and then directing you to get quotes.

- Policygenius: This platform offers a more personalized approach, connecting you with licensed agents who can help you compare policies and understand complex coverage options across multiple carriers.

- Bankrate: Similar to The Zebra, Bankrate provides a quick way to compare quotes from numerous providers, often highlighting potential savings.

Key Factors to Compare Beyond Price Coverage and Customer Service

While price is important, it shouldn't be your only consideration. A super cheap policy that leaves you underinsured or with terrible customer service isn't a good deal in the long run. Always compare:

- Coverage Limits: Make sure the liability limits, uninsured/underinsured motorist coverage, and other coverages are adequate for your needs. Don't just go for the state minimums if you have significant assets to protect.

- Deductibles: As discussed, higher deductibles mean lower premiums, but ensure you can afford them.

- Discounts: Check what discounts each insurer offers. Some might have unique ones your current provider doesn't.

- Customer Service and Claims Handling: This is HUGE. Read reviews on sites like J.D. Power, Consumer Reports, and the Better Business Bureau. A smooth claims process can make a world of difference after an accident. Look for insurers with high ratings for customer satisfaction and efficient claims processing.

- Financial Strength: Check ratings from A.M. Best or Standard & Poor's. You want an insurer that's financially stable enough to pay out claims.

3. Maximize Available Discounts Annually Hidden Savings in Auto Insurance

Discounts are your best friends when it comes to saving money on auto insurance. Many people leave money on the table simply because they don't know what discounts are available or don't ask for them. Make it a point to review all potential discounts every year.

Common Auto Insurance Discounts You Might Be Missing

Let's break down some of the most common and often overlooked discounts:

- Multi-Policy Discount (Bundling): This is a big one. If you have your home, renters, life, or even motorcycle insurance with the same company, you can often get a significant discount on all policies.

- Multi-Car Discount: Insuring more than one vehicle with the same company usually earns you a discount.

- Good Driver Discount: If you have a clean driving record (no accidents or tickets) for a certain period (e.g., 3-5 years), you're likely eligible.

- Defensive Driving Course Discount: Completing an approved defensive driving course can often get you a discount, especially if you're a younger driver or have points on your license.

- Good Student Discount: For young drivers (typically under 25) who maintain a certain GPA (e.g., B average or 3.0), this can be a lifesaver for expensive teen insurance.

- Vehicle Safety Features Discount: Cars with anti-lock brakes, airbags, anti-theft devices, daytime running lights, and electronic stability control often qualify for discounts.

- Low Mileage Discount: As mentioned, if you drive less than a certain number of miles per year, you could save.

- Payment Discounts: Paying your premium in full, setting up automatic payments, or opting for paperless billing can all earn you small but cumulative discounts.

- Occupational Discounts: Some insurers offer discounts for certain professions, like teachers, engineers, military personnel, or first responders.

- Affinity Group Discounts: Being part of certain organizations, alumni associations, or credit unions can sometimes qualify you for special rates.

Leveraging Telematics and Usage Based Insurance Programs

This is a growing area for discounts. Telematics programs use a device (or an app on your phone) to track your driving habits, such as mileage, speed, braking, and time of day you drive. If you're a safe driver, these programs can lead to significant savings.

- Progressive Snapshot: One of the pioneers, Snapshot tracks your driving for a period and then adjusts your premium based on your habits. Safe drivers can save a lot.

- State Farm Drive Safe & Save: Uses your smartphone or an in-car device to monitor driving.

- Allstate Drivewise: Offers cash rewards and policy discounts for safe driving.

- GEICO DriveEasy: An app-based program that monitors driving behavior to help you save.

Comparison: While all these programs aim to reward safe driving, their tracking methods and the exact metrics they prioritize can differ. Some might focus more on hard braking, others on speeding. It's worth checking which program aligns best with your driving style. The potential savings can be substantial, often 10-30% or more, but you need to be comfortable with your driving data being collected.

Asking Your Agent About New or Unadvertised Discounts

Don't be shy! Your insurance agent is a valuable resource. When you call for your annual review, specifically ask, 'Are there any new discounts I might qualify for?' or 'Are there any discounts I'm not currently getting that I should be?' Sometimes, discounts aren't widely advertised, or your eligibility might have changed. A good agent will proactively look for ways to save you money.

4. Review and Update Your Policy Details Annually Life Changes and Auto Insurance

Your life isn't static, and neither should your insurance policy be. Major life events can have a big impact on your insurance needs and rates. An annual review is the perfect time to update everything.

Reporting Major Life Changes Marriage New Job Moving

- Marriage: Getting married can often lead to lower rates, especially if your spouse has a good driving record. Insurers see married couples as more stable and less risky.

- New Job/Commute Change: As mentioned, if your commute changes significantly (shorter, longer, or eliminated), update your mileage. A new job might also come with a new address, which can impact rates.

- Moving: Your zip code is a huge factor in your insurance rates. Moving even a few miles can change your premium, sometimes dramatically. Always update your address promptly.

- Adding or Removing Drivers: If a child gets their license, they need to be added. If a child goes off to college without a car, or an adult moves out, removing them can save you money.

- New Vehicle Purchase: Obviously, if you get a new car, you need to update your policy. But even if you don't, consider if your current car's usage has changed (e.g., it's now a secondary vehicle).

Updating Your Vehicle Information After Modifications or Upgrades

Did you add a fancy new stereo system? Get custom rims? Install a performance chip? Some modifications can increase your car's value and might require additional coverage. Conversely, if you've removed expensive aftermarket parts, you might be able to reduce your coverage. Always inform your insurer about significant modifications to ensure they're covered and you're not overpaying.

Ensuring Accurate Driver Information and Household Members

Make sure all drivers listed on your policy are accurate. If a child has moved out and is no longer driving your car, remove them. If a new driver has moved in, add them. Inaccurate driver information can lead to claims being denied or you paying for coverage you don't need. Also, if a driver on your policy has improved their driving record (e.g., a ticket has fallen off their record), make sure your insurer knows.

5. Understand Your Policy Documents Annually Key Terms and Coverage Details

This might sound boring, but truly understanding what you're paying for is empowering. Don't just glance at the premium amount; dig into the details.

Decoding Your Declarations Page and Policy Booklet

Your declarations page is the summary of your policy. It lists your coverages, limits, deductibles, and premiums. Your policy booklet is the detailed legal document. While you don't need to read every single word, familiarize yourself with the sections relevant to your coverage. Pay attention to:

- Coverage Types: Liability, collision, comprehensive, uninsured/underinsured motorist, personal injury protection (PIP), medical payments. Know what each covers.

- Limits: The maximum amount your insurer will pay for a claim. Are they sufficient?

- Exclusions: What your policy doesn't cover. This is crucial to avoid surprises.

- Endorsements/Riders: Any additional coverages you've added, like rental car reimbursement or roadside assistance.

Reviewing Your Liability Limits and Asset Protection

This is arguably the most critical part of your policy. Your liability coverage protects your assets if you're at fault in an accident. If your liability limits are too low, and you cause a serious accident, you could be personally responsible for damages exceeding your coverage. If you own a home, have significant savings, or a high income, you should seriously consider higher liability limits (e.g., 250/500/100 or even higher). An umbrella policy (as discussed in other articles) can provide an extra layer of protection above your auto and home insurance limits.

Understanding Optional Coverages Rental Reimbursement Roadside Assistance

Many policies offer optional coverages that can be incredibly useful but also add to your premium. Review these annually:

- Rental Car Reimbursement: If your car is in the shop after a covered accident, this pays for a rental. Do you need it? If you have a second car or can easily get by without one, you might not.

- Roadside Assistance: Covers towing, jump-starts, flat tire changes. Do you already have this through your car manufacturer, a credit card, or an auto club like AAA? If so, you might be double-covered and can drop it from your auto policy.

- Gap Insurance: If you have a new car and owe more than it's worth, gap insurance pays the difference if your car is totaled. If your car is older or you've paid down the loan, you might not need it anymore.

- New Car Replacement: For newer vehicles, this replaces your totaled car with a brand new one of the same make and model, rather than just its depreciated value.

By taking these five steps annually, you're not just optimizing your auto insurance; you're becoming a more informed and financially responsible car owner. It might take an hour or two of your time each year, but the peace of mind and potential savings are absolutely worth it. So, mark your calendar, set a reminder, and make your annual auto insurance review a priority!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)