Comparing Auto Insurance Claims for Glass Damage

Explore comparing auto insurance for autonomous and semi autonomous vehicles. Understand emerging coverage needs for self-driving technology.

Comparing Auto Insurance for Autonomous and Semi Autonomous Vehicles

The Rise of Autonomous and Semi Autonomous Vehicles Understanding the Landscape

Hey there! Let's chat about something super exciting and a bit mind-bending: self-driving cars. We're not talking about sci-fi movies anymore; autonomous and semi-autonomous vehicles are already on our roads, and they're changing the way we think about driving. But here's the big question: how does insurance keep up with all this new tech? It's a whole new ballgame, and understanding the nuances is key, especially as more of these vehicles hit the market.

First off, what exactly are we talking about? When we say 'autonomous' or 'self-driving,' we're generally referring to vehicles that can perform driving tasks without human intervention. The Society of Automotive Engineers (SAE) has a handy classification system, from Level 0 (no automation) all the way to Level 5 (full automation, no human needed). Most cars on the road today with advanced features fall into Level 1 or Level 2, which are considered 'semi-autonomous.' Think adaptive cruise control, lane-keeping assist, and automatic emergency braking. These systems help the driver but still require human oversight. Level 3 and above are where things get really interesting, as the car can handle most driving tasks under certain conditions, and the driver might not need to pay constant attention.

The promise of these vehicles is huge: fewer accidents, less traffic, and more free time during commutes. But with great innovation comes new challenges, especially for the insurance industry. Who's at fault if a self-driving car gets into an accident? Is it the driver, the car manufacturer, the software developer, or even the sensor supplier? These are the kinds of questions that insurance companies, regulators, and consumers are grappling with right now.

Current State of Auto Insurance for Advanced Driver Assistance Systems ADAS

Right now, most of the 'self-driving' cars you see are equipped with Advanced Driver Assistance Systems, or ADAS. These are the Level 1 and Level 2 features we just talked about. For these vehicles, the insurance landscape hasn't changed dramatically. Why? Because even with ADAS, the human driver is still considered primarily responsible for the vehicle's operation. If your car has lane-keeping assist and you drift out of your lane and cause an accident, the blame still falls on you, the driver.

However, ADAS features do have an impact on insurance premiums, often in a good way! Many insurers offer discounts for vehicles equipped with safety features like automatic emergency braking, blind-spot monitoring, and adaptive headlights. These systems are proven to reduce the likelihood and severity of accidents, which means fewer claims for insurers. So, if you're buying a new car with these features, definitely ask your insurance provider about potential discounts. It's a win-win: you're safer, and you save some cash.

But here's a twist: while ADAS can reduce certain types of accidents, they can also make repairs more expensive. A simple fender bender in a car with advanced sensors and cameras embedded in the bumper can cost significantly more to fix than in a traditional car. This increased repair cost can, in some cases, offset the savings from accident reduction, leading to higher comprehensive or collision premiums. It's a delicate balance that insurers are constantly evaluating.

Emerging Coverage Needs for Level 3 and Beyond Autonomous Vehicles

Now, let's dive into the really futuristic stuff: Level 3, 4, and 5 autonomous vehicles. This is where the traditional insurance model starts to bend and potentially break. At Level 3, the vehicle can drive itself under specific conditions, but the human driver must be ready to take over if prompted. This 'handover problem' is a huge headache for liability. If the car asks the driver to take control, and the driver doesn't respond in time, who's at fault?

As we move to Level 4 (high automation, car handles most driving in defined areas) and Level 5 (full automation, no human needed), the responsibility shifts significantly from the driver to the technology. This means product liability insurance for manufacturers and software developers will become much more prominent. Imagine a scenario where a Level 5 autonomous taxi gets into an accident with no human occupant. The traditional 'driver at fault' model simply doesn't apply.

Some experts predict a future where personal auto insurance as we know it might largely disappear for fully autonomous vehicles, replaced by fleet insurance for robotaxi companies or product liability insurance for manufacturers. However, this transition will be gradual and complex. During the interim, we might see hybrid insurance models, where policies cover both human-driven and autonomous modes, with different liability frameworks for each.

New types of coverage might also emerge. For instance, 'cyber liability' could become crucial, covering risks associated with hacking or software malfunctions. 'Data breach' coverage might also be relevant, given the vast amounts of data autonomous vehicles collect. It's a rapidly evolving space, and insurers are working hard to develop new products that address these unique risks.

Key Differences in Insurance Approaches for Autonomous vs Semi Autonomous Cars

Let's break down the core differences in how insurance companies are looking at these two categories:

- Semi-Autonomous (ADAS-equipped cars): For these vehicles (Levels 1 and 2), the focus remains largely on the human driver. Your personal auto insurance policy is still the primary coverage. Discounts are often available for safety features, but repair costs can be higher due to complex sensors. The liability is almost always with the human behind the wheel.

- Autonomous (Level 3+ vehicles): This is where things get murky. For Level 3, there's a shared responsibility model, which is challenging for insurers. For Level 4 and 5, the liability is expected to shift significantly towards the manufacturer or fleet operator. This could mean a move from individual policies to product liability or commercial fleet policies. New types of coverage, like cyber insurance, will become essential.

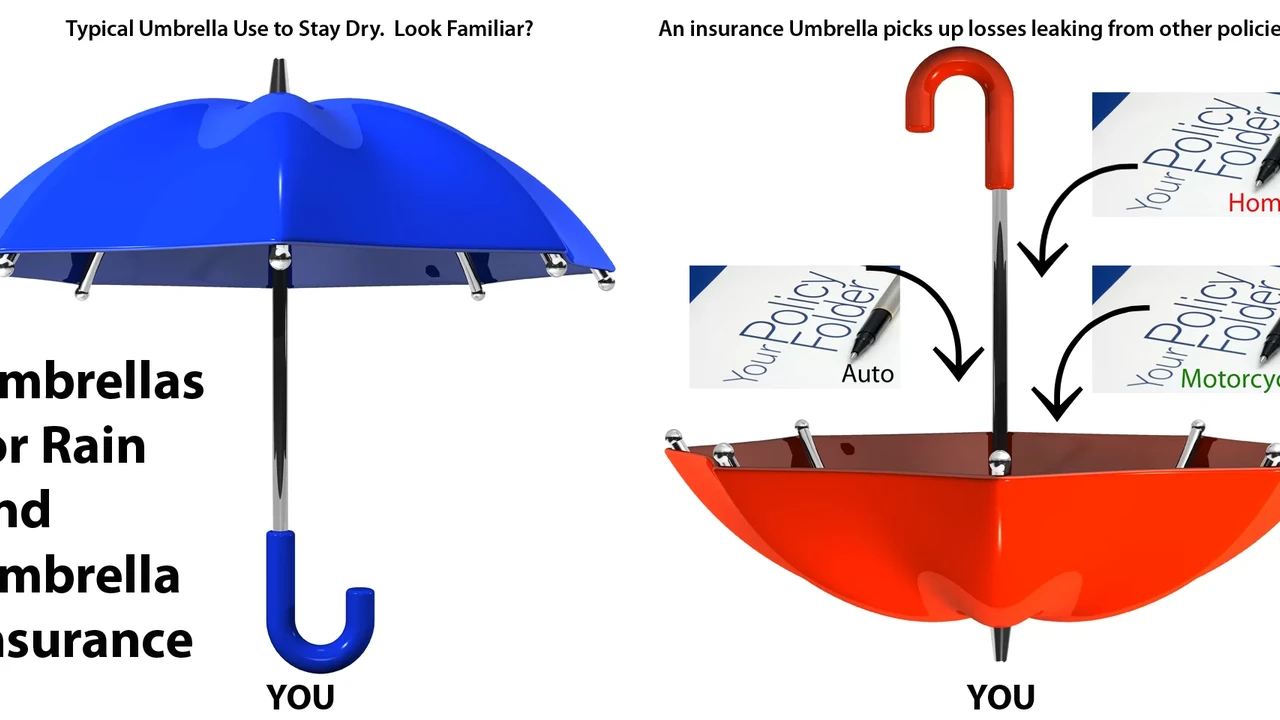

Think of it this way: with a semi-autonomous car, you're still the pilot, even if the co-pilot (ADAS) is helping. With a fully autonomous car, the car itself is the pilot, and you're just a passenger. This fundamental shift in who's 'driving' is what drives the difference in insurance approaches.

Specific Products and Coverage Options for Self Driving Technology

While the fully autonomous insurance market is still in its infancy, some insurers are already rolling out specific products or endorsements to address the unique aspects of advanced vehicle technology. Here are a few examples and what they might cover:

Tesla Insurance

Product: Tesla Insurance

Description: Tesla, being at the forefront of autonomous driving features with its Autopilot and Full Self-Driving (FSD) capabilities, has taken the unique step of offering its own insurance product in several US states. This insurance is designed specifically for Tesla vehicles and leverages real-time driving data collected from the car itself. It uses a 'Safety Score' based on factors like forward collision warnings, hard braking, aggressive turning, and unsafe following distance to calculate premiums. The idea is that safer Tesla drivers pay less.

Use Case: Owners of Tesla vehicles (Model S, 3, X, Y) who want insurance directly integrated with their car's technology and potentially lower premiums based on their driving behavior. It's particularly relevant for those who actively use Autopilot and FSD features, as the system is designed to understand how these features interact with human driving.

Comparison: Unlike traditional insurers who might offer a flat discount for ADAS features, Tesla Insurance dynamically adjusts premiums based on actual driving data. This means your premium can change monthly based on your Safety Score. Traditional insurers might not fully account for the nuances of Tesla's advanced systems in their pricing models.

Pricing: Varies significantly based on the driver's Safety Score, location, vehicle model, and coverage choices. Tesla claims it can be 20% to 40% lower, and in some cases up to 60% lower, than traditional insurance. However, a low Safety Score can lead to higher premiums.

LexisNexis Telematics Solutions for Insurers

Product: LexisNexis Telematics Exchange, LexisNexis Drive Metrics

Description: While not a direct insurance product for consumers, LexisNexis provides data and analytics solutions to many insurance companies. They collect vast amounts of driving data (with consumer consent) from various sources, including OEM telematics (like what Tesla uses), aftermarket devices, and smartphone apps. This data helps insurers better understand driving behavior and the impact of ADAS features.

Use Case: Insurers use these solutions to develop usage-based insurance (UBI) programs and refine their pricing for vehicles with ADAS. For consumers, this means that if your car has built-in telematics or you opt into a UBI program, your insurer might use data from LexisNexis (or similar providers) to assess your risk and offer discounts. It helps bridge the gap between vehicle technology and insurance pricing.

Comparison: This is more of a backend solution that powers many UBI programs offered by traditional insurers. It allows a wider range of insurers to offer data-driven pricing similar to Tesla Insurance, but often with less direct control over the data display for the consumer.

Pricing: Not applicable directly to consumers, as it's a service for insurers. For consumers, participating in UBI programs powered by such data can lead to discounts of 10-30% or more, depending on driving behavior.

Waymo and Cruise Commercial Fleet Insurance

Product: Specialized Commercial Fleet Policies

Description: Companies like Waymo (Google's self-driving car project) and Cruise (GM's autonomous vehicle unit) operate fully autonomous robotaxi services in select cities. Their insurance needs are entirely different. They don't rely on individual driver policies. Instead, they purchase highly specialized commercial fleet insurance policies that cover product liability, general liability, and potentially cyber liability for their autonomous vehicles.

Use Case: These policies are for the operators of Level 4 and Level 5 autonomous vehicle fleets. If you're a passenger in a Waymo or Cruise vehicle and it gets into an accident, you're covered under their commercial policy, not your personal auto insurance. This is the future model for fully autonomous transportation services.

Comparison: This is a complete departure from personal auto insurance. It's a business-to-business insurance model where the 'driver' is the AI and the 'vehicle' is part of a commercial operation. The liability shifts entirely to the company operating the autonomous fleet.

Pricing: Extremely high and proprietary, reflecting the cutting-edge nature of the technology and the significant liability risks involved in operating fully autonomous vehicles in public. These costs are factored into the service fees for robotaxi rides.

Traditional Insurers Offering ADAS Discounts and Endorsements

Product: Standard Auto Insurance Policies with ADAS Discounts and Potential Future Endorsements

Description: Most major insurers (e.g., Geico, Progressive, State Farm, Allstate, Liberty Mutual, etc.) already offer discounts for vehicles equipped with various ADAS features. These discounts typically apply to collision and comprehensive coverage, as these features reduce the likelihood of damage to your vehicle. As Level 3 vehicles become more common, we might see specific endorsements added to personal policies to address the shared liability aspect.

Use Case: For the vast majority of drivers with semi-autonomous cars, your existing insurer is your go-to. You'll want to inform them about your car's safety features to ensure you're getting all eligible discounts. As technology progresses, keep an eye out for new endorsements that might cover specific autonomous driving scenarios.

Comparison: These are the standard policies you're familiar with, but with an increasing focus on integrating vehicle technology into their pricing models. They are generally slower to adapt to radical shifts than specialized products like Tesla Insurance, but they offer broad coverage and established claims processes.

Pricing: Varies widely based on driver profile, vehicle, location, and chosen coverage. ADAS discounts can range from 5% to 25% on certain coverages, depending on the specific features and insurer.

The Future of Auto Insurance Navigating the Autonomous Revolution

So, what's next for auto insurance as self-driving cars become more prevalent? It's going to be a fascinating journey, full of twists and turns. We're likely to see a gradual evolution rather than a sudden revolution. Here are some predictions and considerations:

Data Driven Premiums and Personalized Insurance

The trend towards usage-based insurance (UBI) and telematics will only accelerate. As vehicles become more connected and generate more data, insurers will have an unprecedented ability to assess risk based on actual driving behavior, not just historical averages. This means more personalized premiums, where safe drivers with ADAS-equipped cars could see significant savings. However, privacy concerns around data collection will also become more prominent.

Shifting Liability and Product Liability

As vehicles become more autonomous, the liability for accidents will increasingly shift from the human driver to the vehicle manufacturer, software developer, or component supplier. This means product liability insurance will become a cornerstone of the autonomous vehicle ecosystem. Insurers will need to develop sophisticated models to determine fault in complex scenarios involving AI decisions and sensor failures.

New Coverage Types and Hybrid Models

We'll likely see the emergence of entirely new types of insurance coverage. Think 'cyber insurance' for vehicles to protect against hacking or software vulnerabilities, or 'downtime insurance' for autonomous fleets that rely on constant operation. Hybrid insurance models, where a single policy covers both human-driven and autonomous modes with different liability rules, could become common during the transition period.

Regulatory Changes and Standardization

Governments and regulatory bodies will play a crucial role in shaping the future of autonomous vehicle insurance. We'll need clear legal frameworks for liability, data privacy, and vehicle certification. International standardization will also be important, as autonomous vehicles cross borders and operate in different legal environments.

Impact on Accident Rates and Repair Costs

The ultimate goal of autonomous vehicles is to drastically reduce accidents. If successful, this could lead to a significant decrease in the overall number of claims, potentially lowering insurance costs for everyone. However, as mentioned earlier, the cost of repairing these high-tech vehicles can be substantially higher. This tension between fewer accidents and more expensive repairs will be a key factor in future premium calculations.

The Role of the Human Driver

Even with advanced automation, the human element won't disappear entirely, at least not for a long time. Drivers will still be responsible for maintenance, software updates, and understanding the limitations of their vehicle's autonomous capabilities. Insurance policies will need to reflect this ongoing human responsibility, even as the car takes on more tasks.

It's an exciting time to be thinking about cars and insurance. The road ahead for autonomous and semi-autonomous vehicles is paved with innovation, but also with complex questions that the insurance industry is just beginning to answer. Staying informed and understanding how these technologies impact your coverage will be more important than ever.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)