Comparing Umbrella Policies for Enhanced Auto Insurance Protection

Explore comparing umbrella policies for enhanced auto insurance protection. Get extra liability coverage beyond your standard car insurance.

Comparing Umbrella Policies for Enhanced Auto Insurance Protection

Why Your Standard Auto Insurance Might Not Be Enough Understanding Liability Gaps

Hey there! Let's talk about something super important that many folks overlook when it comes to their auto insurance: liability gaps. You might think your standard car insurance policy has you covered for everything, right? Well, not always. While your basic policy is fantastic for everyday bumps and scrapes, and even more serious accidents, there's a limit to how much it will pay out if you're found at fault for a major incident. Imagine a scenario where you cause a multi-car pile-up, or worse, an accident that results in severe injuries or even fatalities. The medical bills, lost wages, and property damage can quickly skyrocket into the millions. Your standard auto insurance policy, even with high limits like $250,000 or $500,000 per person/per accident, might not be enough to cover all those costs. When that happens, guess who's on the hook for the difference? You are. And that's where your personal assets – your savings, your home, your future earnings – could be at risk. This is what we call a liability gap, and it's a pretty scary thought, isn't it? It's not about being a bad driver; accidents happen to even the most careful among us. It's about being prepared for the worst-case scenario and protecting everything you've worked so hard for.

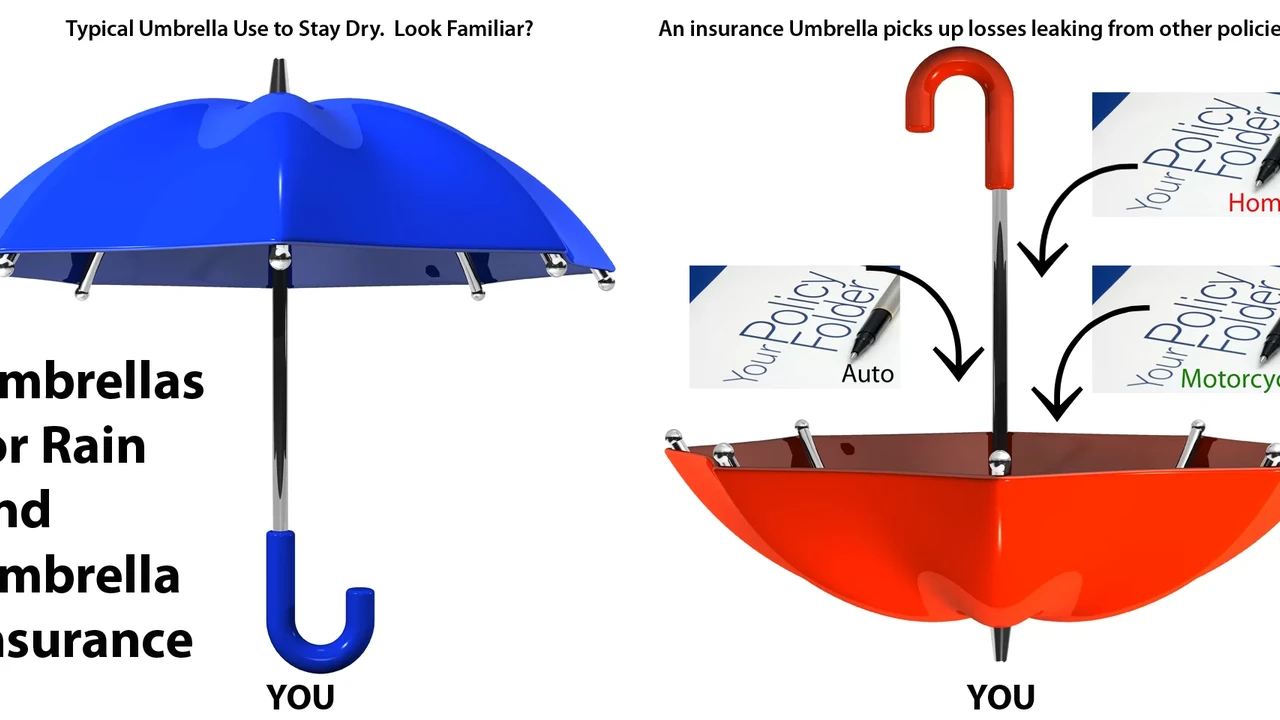

What Exactly is an Umbrella Policy and How Does it Boost Your Auto Coverage

So, what's the solution to these potential liability gaps? Enter the umbrella policy! Think of an umbrella policy as an extra layer of liability protection that kicks in when your underlying insurance policies – like your auto insurance and homeowners insurance – have reached their limits. It literally sits 'over' your other policies, providing additional coverage. It's not just for auto accidents, by the way; it also covers things like libel, slander, false arrest, and even landlord liability if you own rental properties. But for our discussion today, let's focus on how it supercharges your auto coverage. If you're involved in a serious car accident and your auto insurance policy pays out its maximum, your umbrella policy steps in to cover the remaining costs, up to its own limit. These policies typically offer coverage in increments of $1 million, and you can often get up to $5 million or even more, depending on your needs and the insurer. This means that instead of your personal assets being on the line, your umbrella policy provides that crucial financial safety net. It's about peace of mind, knowing that a single, unfortunate event won't derail your financial future.

Key Benefits of Adding an Umbrella Policy to Your Auto Insurance Portfolio

Alright, let's dive into the awesome benefits of having an umbrella policy. It's not just about covering huge accident costs; there's more to it! First off, and probably the most obvious, is the extended liability protection. As we discussed, it provides millions in additional coverage beyond your standard auto and home policies. This is a massive shield against lawsuits and judgments that could otherwise wipe out your savings. Secondly, it offers broader coverage than standard policies. While your auto policy covers car-related incidents, an umbrella policy can also cover things like personal injury claims (libel, slander), false imprisonment, and even liability if someone is injured on your property, even if it's not your primary residence. This comprehensive protection is a huge plus. Thirdly, it's surprisingly affordable for the amount of coverage you get. When you compare the cost of a $1 million umbrella policy (often just a few hundred dollars a year) to the potential financial devastation of a major lawsuit, it's an incredible value. Fourth, it provides peace of mind. Knowing that you're protected against catastrophic financial loss allows you to live your life with less worry. You can drive, host parties, and generally exist without constantly fretting about a potential lawsuit. Finally, it's particularly beneficial for individuals with significant assets. If you own a home, have substantial savings, or a high income, you're a bigger target for lawsuits. An umbrella policy is almost a non-negotiable for asset protection in these cases. It's like having a financial bodyguard for your wealth.

Who Needs an Umbrella Policy Most Identifying High Risk Drivers and Asset Holders

So, is an umbrella policy for everyone? While it's a great idea for many, some folks definitely need it more than others. Let's break down who should seriously consider adding this extra layer of protection. First up, individuals with significant assets. If you own a home, have substantial savings, investments, or a high net worth, you're a prime target for lawsuits. An umbrella policy protects these assets from being seized to satisfy a judgment. Next, high-income earners. Even if your current assets aren't massive, your future earning potential is a valuable asset that can be targeted in a lawsuit. An umbrella policy helps protect that future income. Then there are drivers who spend a lot of time on the road. The more you drive, the higher your exposure to potential accidents. This includes commuters, road-trippers, and anyone who uses their car frequently. Also, parents of teen drivers. Let's be honest, new drivers, especially teenagers, are statistically more prone to accidents. An umbrella policy can provide crucial protection if your teen causes a serious accident. Furthermore, individuals who own certain types of property. If you have a swimming pool, a trampoline, or even a dog, these can increase your liability risk. An umbrella policy extends beyond auto to cover these home-related liabilities. Finally, anyone who engages in activities that increase their risk. This could include volunteering, coaching youth sports, or even serving on a non-profit board, where you could potentially be held liable for actions. Basically, if you have something to lose, an umbrella policy is a smart move to protect it.

Comparing Top Umbrella Policy Providers in the USA Key Features and Pricing

Alright, let's get down to brass tacks and look at some of the top umbrella policy providers in the USA. Keep in mind that pricing can vary wildly based on your location, driving record, underlying policy limits, and the amount of coverage you choose. It's always best to get personalized quotes, but this will give you a good starting point.

GEICO Umbrella Insurance Review and Features

GEICO is a household name for auto insurance, and they also offer competitive umbrella policies. Their policies typically start at $1 million in coverage and can go up to $5 million. A big plus with GEICO is their ease of bundling. If you already have your auto and home insurance with them, adding an umbrella policy is usually a seamless process and can often lead to additional multi-policy discounts. They are known for their strong customer service and straightforward claims process. Pricing for a $1 million policy can range from approximately $150 to $300 per year, but this is a rough estimate. You'll generally need to have your underlying auto liability limits at $250,000/$500,000 and homeowners liability at $300,000 to qualify. GEICO is a solid choice for those looking for a reliable insurer with a good online presence and competitive rates.

Progressive Umbrella Insurance Review and Features

Progressive is another major player that offers robust umbrella coverage. Similar to GEICO, they offer coverage starting at $1 million and going up to $5 million or more. Progressive is often praised for its flexible policy options and willingness to work with a variety of underlying carriers. This means you might be able to get an umbrella policy from Progressive even if your auto or home insurance is with a different company, though bundling with Progressive usually offers the best rates. They also have a strong focus on digital tools and mobile app functionality, making it easy to manage your policy. Expect a $1 million policy to cost in the range of $200 to $400 annually. Progressive is a good fit for those who appreciate flexibility and a strong online experience.

State Farm Umbrella Insurance Review and Features

State Farm, with its extensive network of local agents, provides a more personalized approach to umbrella insurance. Their policies also typically start at $1 million. A key advantage of State Farm is the personal touch of a local agent who can help you understand your specific needs and tailor the coverage. This can be particularly beneficial if you have complex assets or unique liability concerns. They are known for their financial stability and reliable claims handling. Pricing for a $1 million policy might be slightly higher than some online-only insurers, potentially in the range of $250 to $500 per year, but the value of personalized advice can be significant. State Farm is ideal for those who prefer working with a dedicated agent and value a long-standing, reputable insurer.

Allstate Umbrella Insurance Review and Features

Allstate offers comprehensive umbrella policies designed to protect your assets. They provide coverage starting at $1 million and can be scaled up. Allstate emphasizes customizable coverage, allowing you to fine-tune your policy to match your specific risk profile. They also offer various discounts, especially if you bundle your auto and home insurance with them. Allstate has a strong reputation for customer satisfaction and claims service. A $1 million policy could cost around $200 to $450 per year. Allstate is a strong contender for those looking for a well-rounded policy from a trusted brand with good bundling opportunities.

Chubb Umbrella Insurance Review and Features for High Net Worth Individuals

For high-net-worth individuals, Chubb is often considered the gold standard for umbrella policies. While they also offer coverage starting at $1 million, their policies are designed for those with significant assets and complex needs, often extending to $10 million or more. Chubb's policies are known for their broad coverage and superior claims service, often going above and beyond what standard insurers offer. They provide specialized coverage for things like domestic staff liability, worldwide coverage, and even coverage for board memberships. The pricing for Chubb policies will be higher, reflecting the enhanced coverage and service, potentially starting from $500 to $1,000+ per year for a $1 million policy, and significantly more for higher limits. Chubb is the go-to choice for affluent individuals who require the highest level of protection and white-glove service.

Understanding Underlying Coverage Requirements for Umbrella Policies

Before you can even think about getting an umbrella policy, there's a crucial step: you need to have sufficient underlying liability coverage on your auto and homeowners insurance policies. Umbrella policies don't just kick in from dollar one; they act as excess coverage. This means your primary policies need to meet certain minimum liability limits before the umbrella policy takes over. Most insurers will require you to have auto liability limits of at least $250,000 per person and $500,000 per accident (often written as 250/500). For property damage, they usually require at least $100,000. On the homeowners side, you'll typically need at least $300,000 to $500,000 in personal liability coverage. Why these high limits? Because the umbrella policy is designed to cover catastrophic losses that exceed these amounts. If your underlying limits are too low, you'd have a 'gap' between what your primary policy covers and when your umbrella policy starts, leaving you exposed. So, before you shop for an umbrella, make sure your existing policies are up to snuff. If they're not, you'll need to increase those limits first, which will slightly increase the cost of your primary policies, but it's a necessary step to qualify for and fully benefit from an umbrella policy.

How to Bundle and Save Maximizing Discounts with Multi Policy Options

One of the smartest ways to get an umbrella policy without breaking the bank is to bundle it with your existing insurance policies. Most major insurers offer significant discounts when you purchase multiple policies from them – think auto, home, and umbrella. This is often referred to as a multi-policy discount, and it can lead to substantial savings. For example, if you have your auto and home insurance with State Farm, adding an umbrella policy from State Farm will likely be cheaper than getting an umbrella policy from a different carrier. Insurers love customers who bring all their business to one place because it increases customer loyalty and reduces their administrative costs. So, they pass some of those savings on to you. When you're shopping for an umbrella policy, always ask about bundling options. Even if you currently have separate insurers for your auto and home, it might be worth getting quotes from a single provider for all three policies. The combined savings could be more than you expect, making that extra layer of protection even more affordable. It's a win-win: you get comprehensive coverage, and you save some cash!

Common Misconceptions About Umbrella Policies Debunking the Myths

There are a few myths floating around about umbrella policies that we need to clear up. Let's bust some of these misconceptions! Myth #1: Umbrella policies are only for the super-rich. Nope! While they are essential for high-net-worth individuals, anyone with assets to protect (like a home, savings, or even future earnings) can benefit. The cost is often much lower than people imagine. Myth #2: My auto and home insurance cover everything, so I don't need an umbrella. As we've discussed, standard policies have limits. A major accident or lawsuit can easily exceed those limits, leaving your personal assets vulnerable. An umbrella policy fills that gap. Myth #3: Umbrella policies are complicated and hard to get. Not at all! If you meet the underlying coverage requirements, getting an umbrella policy is usually a straightforward process, especially if you bundle with your current insurer. Myth #4: It only covers car accidents. False! While it significantly boosts your auto liability, it also covers a wide range of other personal liabilities, including those related to your home, rental properties, and even personal injury claims like libel or slander. Myth #5: It's too expensive. For the amount of protection it offers (often millions of dollars), an umbrella policy is incredibly cost-effective. A $1 million policy can often be had for just a few hundred dollars a year. Don't let these myths prevent you from getting the crucial protection you need!

Real World Scenarios Where an Umbrella Policy Saved the Day

Let's look at some real-world examples (hypothetical, of course, but based on common occurrences) where an umbrella policy truly made a difference. Imagine Sarah, a careful driver, who unfortunately hydroplaned on a rainy highway, causing a chain reaction accident involving three other vehicles. One driver sustained severe spinal injuries, leading to massive medical bills and lost income. Sarah's auto insurance policy had a $500,000 liability limit, which was quickly exhausted. The total damages and settlement reached $1.5 million. Without an umbrella policy, Sarah would have been personally responsible for the remaining $1 million, potentially losing her home and life savings. However, because she had a $2 million umbrella policy, it kicked in to cover the additional $1 million, protecting her financial future. Another scenario: Mark hosted a backyard barbecue, and a guest, after having a few drinks, slipped on a wet patio and suffered a serious head injury. The guest sued Mark for negligence. Mark's homeowners insurance had a $300,000 liability limit, but the lawsuit settlement was for $750,000. Mark's $1 million umbrella policy covered the $450,000 difference, saving him from financial ruin. These stories highlight that it's not just about driving; an umbrella policy is a comprehensive shield against various unforeseen liabilities that can arise in everyday life. It's about being prepared for those 'what if' moments that can have devastating financial consequences.

Choosing the Right Coverage Amount for Your Umbrella Policy Assessing Your Risk

Deciding how much umbrella coverage you need can feel a bit like guesswork, but there are some smart ways to assess your risk and choose the right amount. Generally, umbrella policies start at $1 million, and you can often go up to $5 million or even $10 million. Here's how to think about it: First, consider your total net worth. This includes the equity in your home, your savings, investments, and other valuable assets. A good rule of thumb is to have at least enough umbrella coverage to protect your total net worth. If you have $2 million in assets, a $2 million umbrella policy is a sensible starting point. Second, think about your future earning potential. If you're a high-income earner with many years left in your career, a lawsuit could target your future wages. This is an asset that needs protection, so you might want higher limits. Third, evaluate your lifestyle and risk factors. Do you have a swimming pool? A trampoline? A dog that might bite? Do you frequently host parties? Do you have a teen driver? Each of these increases your liability exposure. The more risk factors you have, the more coverage you should consider. Fourth, look at the cost difference between different coverage levels. Often, increasing your umbrella coverage from $1 million to $2 million doesn't double the premium; it might only increase it by a relatively small amount, making higher limits a great value. Finally, consult with an insurance professional. A good agent can help you analyze your specific situation, assets, and risks to recommend an appropriate coverage amount. Don't just guess; make an informed decision to ensure you're adequately protected.

The Future of Personal Liability Insurance Adapting to New Risks

The world is constantly changing, and so are the risks we face. Personal liability insurance, including umbrella policies, is always adapting to keep up. What does the future hold? We're seeing a rise in new types of liability. For example, with the increasing popularity of smart home devices and IoT (Internet of Things), there could be new liability concerns related to data breaches or device malfunctions that cause harm. Imagine a smart lock failing and leading to a break-in, or a smart appliance causing a fire. Insurers are already starting to think about how to cover these emerging risks. Another area is cyber liability. While traditional umbrella policies focus on physical harm or property damage, the digital world presents new challenges. Could an umbrella policy eventually offer broader protection against personal cyber attacks or identity theft that leads to significant financial loss? It's a possibility. Furthermore, as more people engage in the gig economy, driving for rideshare or delivery services, the lines between personal and commercial liability can blur. While specific commercial policies exist, umbrella policies might evolve to offer more seamless transitions or broader coverage for these hybrid activities. Finally, with the increasing litigiousness of society, the need for higher liability limits will likely continue to grow. Insurers will continue to innovate, offering more tailored and comprehensive umbrella policies to protect individuals from an ever-expanding array of potential financial threats. Staying informed and regularly reviewing your coverage with an agent will be key to ensuring you're always adequately protected in this evolving landscape.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)