5 Essential Tips for Auto Insurance in Vietnam

Get 5 essential tips for auto insurance in Vietnam. Understand local requirements and find reliable coverage for your vehicle.

5 Essential Tips for Auto Insurance in Vietnam

Hey there, fellow drivers! Navigating the roads of Vietnam can be an adventure, to say the least. From the bustling streets of Ho Chi Minh City to the scenic coastal routes, having the right auto insurance isn't just a good idea—it's often a legal requirement and a smart move for your peace of mind. Whether you're a local, an expat, or just visiting for an extended period and planning to drive, understanding the ins and outs of Vietnamese auto insurance is crucial. This guide is designed to give you five essential tips to help you secure reliable coverage, understand local requirements, and even save a few dong along the way. Let's dive in!

Tip 1 Understanding Mandatory Auto Insurance Requirements in Vietnam

First things first, let's talk about what you absolutely must have. In Vietnam, it's mandatory for all vehicle owners to have Civil Liability Insurance for Motor Vehicles (Bảo hiểm trách nhiệm dân sự của chủ xe cơ giới). This isn't optional; it's the law. This type of insurance primarily covers third-party damages, meaning if you're involved in an accident and you're at fault, it will cover the costs for injuries or property damage to the other party. It does not cover damages to your own vehicle or your own medical expenses. Think of it as the bare minimum safety net.

What does mandatory civil liability insurance cover?

- Bodily Injury or Death: This covers compensation for injuries or fatalities to third parties involved in an accident caused by your vehicle. The current maximum compensation limit for bodily injury or death is VND 150 million per person per accident.

- Property Damage: This covers compensation for damage to third-party property. The current maximum compensation limit for property damage is VND 50 million per accident.

Where to get it and what to look for:

You can purchase this mandatory insurance from almost any insurance provider in Vietnam. It's usually quite affordable. When you buy it, you'll receive a physical certificate, which you absolutely need to keep in your vehicle at all times. Traffic police often check for this, and not having it can lead to fines. Make sure the certificate clearly states the coverage period and your vehicle details. Some popular providers include:

- Bao Viet Insurance: One of the largest and most reputable insurers in Vietnam. They offer a straightforward process for mandatory insurance.

- PTI (Post and Telecommunication Insurance): Another widely recognized provider, often found at post offices or through their extensive agent network.

- PVI Insurance: A strong player in the market, offering competitive rates and good customer service.

While the mandatory insurance is crucial, it's just the starting point. For comprehensive protection, you'll definitely want to consider additional coverage, which brings us to our next tip.

Tip 2 Exploring Voluntary Auto Insurance Options for Comprehensive Coverage in Vietnam

Okay, so you've got the mandatory civil liability insurance sorted. Great! But let's be real, that only covers the other guy. What about your car? What about your medical bills if you get hurt? This is where voluntary auto insurance comes into play, and trust me, it's where you'll find true peace of mind on Vietnam's roads.

Types of voluntary coverage to consider:

- Physical Damage Insurance (Bảo hiểm vật chất xe): This is probably the most important voluntary add-on. It covers damage to your own vehicle due to accidents, collisions, fire, theft, natural disasters (like floods or typhoons, which are not uncommon in Vietnam!), and other specified perils. If you've invested a good amount in your car, this is non-negotiable.

- Personal Accident Insurance for Occupants (Bảo hiểm tai nạn lái phụ xe và người ngồi trên xe): This covers medical expenses and compensation for injury or death for the driver and passengers in your vehicle, regardless of who is at fault. Given the nature of traffic in Vietnam, this is a highly recommended addition.

- Theft Insurance (Bảo hiểm mất cắp): While often included in comprehensive physical damage policies, some insurers offer it as a standalone or enhanced option. Given the risk of motorcycle and car theft in certain areas, this can be a valuable layer of protection.

- Roadside Assistance (Cứu hộ giao thông): Many comprehensive policies now include or offer this as an add-on. Imagine breaking down in a remote area; having roadside assistance can be a lifesaver.

Comparing voluntary insurance products and providers:

The market for voluntary auto insurance in Vietnam is quite competitive, which is good news for you! Here are some providers and what they typically offer:

1. Bao Viet Insurance (Bảo Việt)

- Product: Bao Viet Car Insurance (Bảo hiểm ô tô Bảo Việt)

- Coverage Highlights: Offers comprehensive physical damage, personal accident for occupants, theft, and often includes roadside assistance. They have a strong network for claims processing.

- Target User: Drivers looking for a well-established, reliable insurer with extensive coverage options and a good reputation for handling claims.

- Typical Price Range: Varies widely based on vehicle value, age, and chosen coverage, but generally competitive for comprehensive plans. Expect anywhere from 1.5% to 3% of your car's value annually for a full comprehensive package.

- Unique Selling Point: Extensive branch network across Vietnam, making in-person support and claims easier for many.

2. PTI (Post and Telecommunication Insurance)

- Product: PTI Car Insurance (Bảo hiểm ô tô PTI)

- Coverage Highlights: Known for flexible packages, including physical damage, personal accident, and various add-ons like flood damage or specific theft coverage. They often have promotions.

- Target User: Drivers who appreciate convenience and potentially more customizable packages. Good for those who prefer online purchasing or have access to post office branches.

- Typical Price Range: Similar to Bao Viet, competitive pricing, often with online discounts.

- Unique Selling Point: Strong online presence and integration with postal services, making it accessible.

3. PVI Insurance

- Product: PVI Car Insurance (Bảo hiểm ô tô PVI)

- Coverage Highlights: Offers robust comprehensive coverage, often with higher limits for certain perils. They are known for their corporate clients but also serve individuals well.

- Target User: Drivers looking for solid, reliable coverage, especially those with newer or higher-value vehicles who want strong protection.

- Typical Price Range: Generally competitive, sometimes slightly higher for premium coverage, but often justified by broader terms.

- Unique Selling Point: Strong financial backing and a reputation for professional claims handling.

4. Liberty Insurance Vietnam

- Product: Liberty AutoCare

- Coverage Highlights: An international player, Liberty offers comprehensive plans with features like new car replacement, rental car reimbursement, and higher liability limits. Their policies are often more aligned with international standards.

- Target User: Expats or locals who prefer an international insurer, potentially seeking higher coverage limits and more Western-style policy features.

- Typical Price Range: Often on the higher end compared to local insurers, but offers premium benefits.

- Unique Selling Point: International standards of service and potentially more English-speaking support.

When choosing, always get multiple quotes. Don't just look at the price; compare the exact coverage details, deductibles, exclusions, and the insurer's reputation for claims processing. A cheaper policy might have higher deductibles or more exclusions, which could cost you more in the long run.

Tip 3 Understanding Deductibles and Exclusions in Vietnamese Auto Insurance

Alright, let's talk about the fine print – deductibles and exclusions. These are super important because they directly impact how much you pay out of pocket when you make a claim. Ignoring them can lead to some nasty surprises, so let's get them straight.

Deductibles (Mức miễn thường):

A deductible is the amount of money you have to pay yourself before your insurance company starts paying for a claim. For example, if your car suffers VND 20 million in damage and your deductible is VND 5 million, you'll pay VND 5 million, and your insurer will cover the remaining VND 15 million. In Vietnam, deductibles can vary significantly.

- Standard Deductibles: Most policies will have a standard deductible, often around VND 500,000 to VND 2,000,000 for physical damage claims.

- Voluntary Deductibles: Some insurers allow you to choose a higher deductible in exchange for a lower premium. This can be a good strategy if you're a very careful driver and want to save on your annual cost, but be prepared to pay more if an accident does occur.

- Theft Deductibles: Theft claims often have a higher deductible, sometimes a percentage of the car's value.

Exclusions (Các trường hợp loại trừ bảo hiểm):

Exclusions are specific situations or types of damage that your insurance policy will not cover. It's vital to read these carefully in your policy document. Common exclusions in Vietnamese auto insurance include:

- Driving Under Influence (DUI): If you're driving under the influence of alcohol or drugs and get into an accident, your claim will almost certainly be denied.

- Driving Without a Valid License: If you don't have a valid Vietnamese driving license (or an international driving permit recognized in Vietnam), your policy won't cover you.

- Intentional Damage: If you intentionally cause damage to your vehicle or another's, it's not covered.

- Illegal Activities: Using your vehicle for illegal purposes.

- Wear and Tear: Normal wear and tear, mechanical breakdowns, or electrical failures not caused by an accident.

- Racing or Speed Tests: Damage incurred during racing or speed tests.

- War or Terrorism: Damages caused by war, civil unrest, or acts of terrorism are typically excluded.

- Specific Natural Disasters (sometimes): While comprehensive policies usually cover natural disasters, some might have specific exclusions or higher deductibles for certain events like floods if your car was parked in a known flood zone against advice. Always check the fine print regarding natural disaster coverage.

- Unreported Accidents: Failing to report an accident to the police and your insurer within the stipulated timeframe can lead to claim denial.

Why this matters for your auto insurance strategy:

Understanding these points helps you make informed decisions. If you choose a very low premium with a high deductible, make sure you have enough savings to cover that deductible if you need to make a claim. Always ask your insurance agent to clearly explain the deductibles and all exclusions before you sign on the dotted line. Don't be afraid to ask questions, especially if English isn't their first language or yours. Get it clarified!

Tip 4 Navigating the Claims Process for Auto Insurance in Vietnam

So, you've had an unfortunate incident. Now what? Knowing how to navigate the claims process efficiently can save you a lot of headaches and ensure you get the compensation you're entitled to. The process in Vietnam has some specific steps you should follow.

Immediate steps after an accident:

- Ensure Safety: First and foremost, check for injuries. If anyone is hurt, call for medical assistance immediately (115 for ambulance).

- Secure the Scene: If possible and safe, move your vehicle to the side of the road to prevent further accidents. Turn on your hazard lights.

- Do NOT Admit Fault: Even if you think you're at fault, do not admit it at the scene. Let the authorities and insurance adjusters determine liability.

- Collect Information:

- Exchange contact and insurance information with all parties involved.

- Take photos and videos of the accident scene from multiple angles, including vehicle damage, road conditions, traffic signs, and any visible injuries.

- Note down the license plate numbers of all vehicles involved.

- Get contact information from any witnesses.

- Contact the Police: For any significant accident, especially those involving injuries or substantial property damage, you must contact the local traffic police (113). They will create an accident report, which is crucial for your insurance claim.

- Notify Your Insurer: Contact your insurance company as soon as possible, ideally within 24 hours. Most insurers have a hotline for reporting accidents. They will guide you on the next steps.

The claims submission and assessment process:

- Submit Required Documents: Your insurer will ask for a set of documents, which typically include:

- Your insurance policy certificate.

- Your driver's license and vehicle registration (cavet).

- The police accident report (if applicable).

- Photos and videos from the scene.

- Claim form provided by the insurer.

- Repair estimates from authorized garages (your insurer might have preferred partners).

- Vehicle Inspection: An insurance adjuster will inspect your damaged vehicle to assess the extent of the damage and verify the claim details. This might happen at the accident scene or at a designated garage.

- Repair Approval: Once the assessment is complete and the claim is approved, the insurer will authorize repairs at an approved garage. You might have the option to choose your own garage, but it's often smoother to go with their recommendations.

- Settlement: After repairs are completed and verified, the insurer will pay the garage directly (minus your deductible), or reimburse you if you paid upfront. For total loss or personal injury claims, the settlement process might be more complex and involve negotiations.

Tips for a smooth claims process:

- Be Prompt: Report the accident and submit documents quickly. Delays can complicate your claim.

- Be Thorough: Provide as much detail and evidence as possible.

- Communicate Clearly: Maintain clear communication with your insurer and keep records of all correspondence.

- Understand Your Policy: Re-read your policy to understand what's covered and your responsibilities.

- Don't Settle Too Quickly: For serious injuries, ensure you've completed all medical treatments before agreeing to a final settlement.

While the process can seem daunting, being prepared and knowing these steps will make it much more manageable. Remember, your insurance company is there to help, but you also need to advocate for yourself.

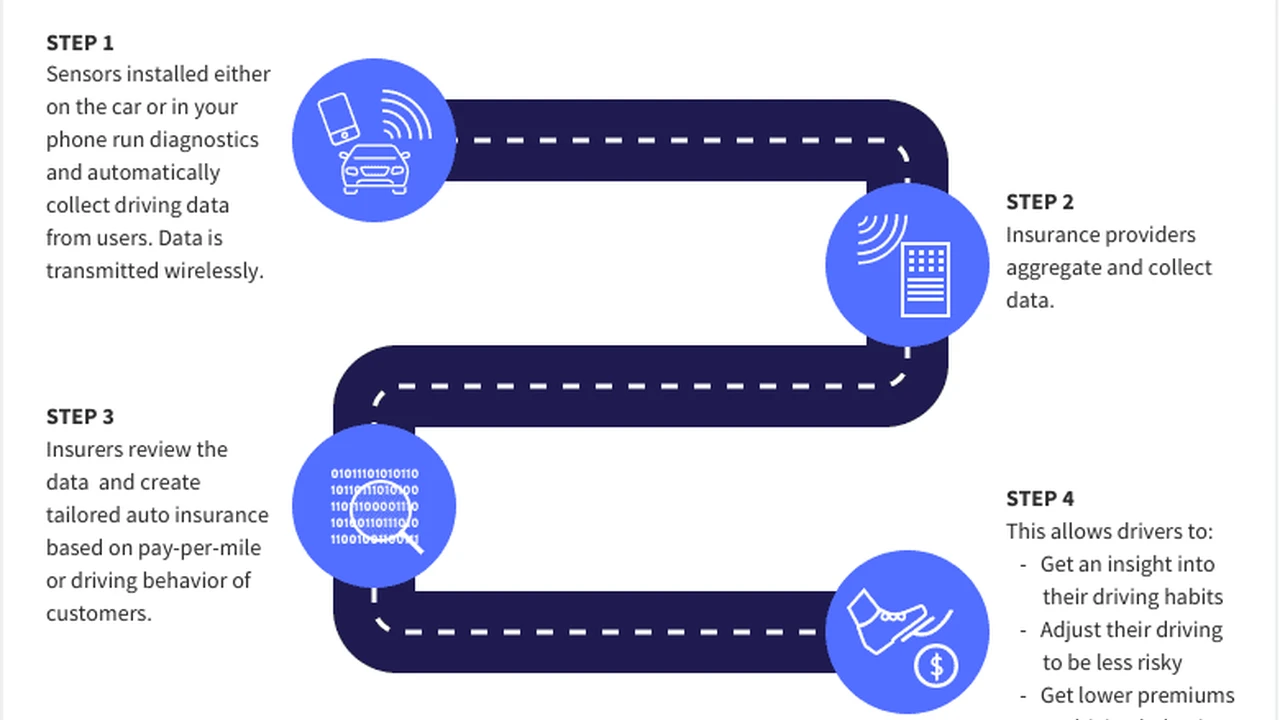

Tip 5 Saving Money on Auto Insurance Premiums in Vietnam

Who doesn't love saving a bit of cash? While auto insurance is a necessary expense, there are definitely ways to reduce your premiums in Vietnam without compromising on essential coverage. Let's explore some smart strategies to keep more money in your pocket.

Smart strategies for lower auto insurance costs:

- Shop Around and Compare Quotes: This is probably the most effective tip. Don't just renew with your current provider without checking what others are offering. Get quotes from at least 3-5 different insurers (Bao Viet, PTI, PVI, Liberty, etc.) every year. Prices and promotions can change, and a new insurer might offer a better deal for the same coverage.

- Increase Your Deductible: As we discussed, a higher deductible means you pay more out of pocket if you make a claim, but it also significantly lowers your annual premium. If you're a safe driver with a good emergency fund, this can be a smart financial move.

- Maintain a Good Driving Record: This is a no-brainer globally, and it applies in Vietnam too. Avoiding accidents and traffic violations will keep your premiums lower in the long run. Some insurers offer 'no-claim bonuses' or discounts for drivers who haven't made a claim for a certain period.

- Ask About Discounts: Always ask your insurer about available discounts. These can include:

- No-Claim Discount (NCD): For drivers who haven't made a claim for a year or more.

- Multi-Policy Discount: If you bundle your car insurance with other policies like home insurance from the same provider.

- Good Driver Discount: For drivers with a clean record over several years.

- Security Device Discount: If your car has advanced security features like alarms or GPS trackers.

- Low Mileage Discount: If you don't drive your car very often.

- Choose Your Vehicle Wisely: The type of car you drive significantly impacts your insurance costs. More expensive, high-performance, or frequently stolen vehicles will naturally have higher premiums. If you're in the market for a new car, consider insurance costs as part of your budget.

- Pay Annually: If you can afford it, paying your premium annually rather than monthly or quarterly can often save you a small percentage, as insurers sometimes charge administrative fees for installment payments.

- Review Your Coverage Annually: Your insurance needs can change. If your car is getting older and its value has depreciated significantly, you might consider reducing your comprehensive coverage to just third-party fire and theft, or increasing your deductible. Don't pay for coverage you no longer need.

- Install Security Features: Adding an alarm system, immobilizer, or GPS tracking device can not only deter theft but also qualify you for discounts from some insurers.

Practical application for Vietnamese drivers:

For example, if you own a common car like a Toyota Vios or a Hyundai Accent, which are popular and parts are readily available, your physical damage insurance might be more affordable than for a luxury import. If you live in a secure compound with guarded parking, you might have a lower risk of theft, which could be reflected in your premium if you discuss it with your insurer.

By actively applying these tips, you can significantly reduce your auto insurance expenses in Vietnam while ensuring you still have the protection you need. It's all about being proactive and informed!

Final Thoughts on Securing Your Ride in Vietnam

So there you have it – five essential tips to help you navigate the world of auto insurance in Vietnam. From understanding the mandatory requirements to exploring comprehensive voluntary options, deciphering deductibles and exclusions, mastering the claims process, and finally, smart strategies to save money, you're now better equipped to make informed decisions.

Driving in Vietnam is an experience, and while it can be exhilarating, it also comes with its own set of risks. Having the right auto insurance isn't just about ticking a legal box; it's about protecting your financial well-being, your vehicle, and most importantly, your peace of mind. Don't rush into a decision. Take your time, compare policies, ask questions, and choose the coverage that best fits your needs and budget. Safe travels on Vietnam's vibrant roads!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)