Comparing Auto Insurance Claims for Theft vs Vandalism

Explore comparing auto insurance for classic and collector cars. Find specialized coverage that protects the unique value of your vintage vehicle.

Comparing Auto Insurance for Classic and Collector Cars

Explore comparing auto insurance for classic and collector cars. Find specialized coverage that protects the unique value of your vintage vehicle.Hey there, fellow car enthusiasts! If you're lucky enough to own a classic or collector car, you already know it's not just a vehicle; it's a piece of history, a work of art, and often, a significant investment. But here's the thing: insuring these beauties isn't like insuring your daily driver. Standard auto insurance policies just don't cut it when it comes to protecting the unique value and specific needs of a vintage ride. That's where specialized classic car insurance comes in. It's designed to understand and cover what makes your car special, from its agreed-upon value to its limited usage.

In this deep dive, we're going to break down everything you need to know about classic and collector car insurance. We'll compare different providers, look at the types of coverage they offer, discuss how they determine value, and even touch on some real-world scenarios. Our goal is to help you navigate this niche market, ensuring your prized possession is protected with the right policy at the right price. So, buckle up, and let's get started!

Understanding Classic Car Insurance What Makes it Different

First off, let's clarify what sets classic car insurance apart from your run-of-the-mill auto policy. The biggest difference usually boils down to how the car's value is determined and the assumptions made about its usage. Standard policies typically use 'actual cash value' (ACV), which means they factor in depreciation. For a classic car, depreciation is often a dirty word; these vehicles tend to appreciate or hold their value, especially if they're well-maintained and rare. That's why classic car insurance often uses an 'agreed value' or 'stated value' policy.

Agreed Value vs Stated Value Protecting Your Investment

With an agreed value policy, you and the insurance company agree on the car's value when you purchase the policy. If your car is a total loss, you get that agreed-upon amount, no questions asked (assuming you've been honest about its condition and modifications). This is generally the gold standard for classic car owners because it removes any guesswork or disputes about depreciation. You know exactly what you'll get.

A stated value policy is a bit different. While you state a value, the insurer reserves the right to pay out the stated value OR the actual cash value, whichever is less, at the time of a loss. This can be a risky proposition for a classic car owner, as the ACV might be significantly lower than what you believe your car is worth, especially if market values fluctuate. Always aim for an agreed value policy if possible.

Usage Limitations and Storage Requirements for Classic Car Insurance

Another key differentiator is usage. Classic car policies are typically designed for vehicles that are not daily drivers. They assume limited mileage – often 2,500 to 5,000 miles per year – and specific usage, like car shows, club events, or occasional pleasure drives. If you're planning to commute in your classic, a specialized policy might not be for you, or you'll need to discuss it thoroughly with your insurer.

Storage is also a big deal. Insurers often require your classic car to be stored in a secure, enclosed, and locked facility, like a private garage. This reduces the risk of theft or damage, which in turn helps keep your premiums lower. If your car is parked on the street or in an open carport, you might struggle to find coverage or face much higher rates.

Key Coverage Options for Classic and Collector Cars Beyond Standard Auto Insurance

Beyond the basic liability and physical damage coverage, classic car insurance offers specialized options tailored to the unique needs of these vehicles. Let's explore some of the most important ones:

Roadside Assistance and Flatbed Towing for Vintage Vehicles

Imagine your classic breaking down on the side of the road. You wouldn't want it hoisted onto a standard tow truck, potentially damaging its delicate frame or paintwork. Specialized classic car policies often include roadside assistance with flatbed towing. This ensures your car is transported safely and securely, minimizing the risk of further damage.

Spare Parts Coverage Protecting Your Investment in Restoration

Restoring a classic car often involves collecting rare and expensive spare parts. Some classic car policies offer spare parts coverage, which protects these parts even when they're not installed in the vehicle. This is a huge benefit for anyone undertaking a restoration project or simply hoarding valuable components.

Restoration Coverage and In Transit Protection for Project Cars

If you're in the middle of a restoration, restoration coverage can be invaluable. It covers your car during the restoration process, often increasing the agreed value as the project progresses and more value is added. Similarly, if you're transporting your car to a show, a mechanic, or a new home, in-transit protection ensures it's covered against damage during transport.

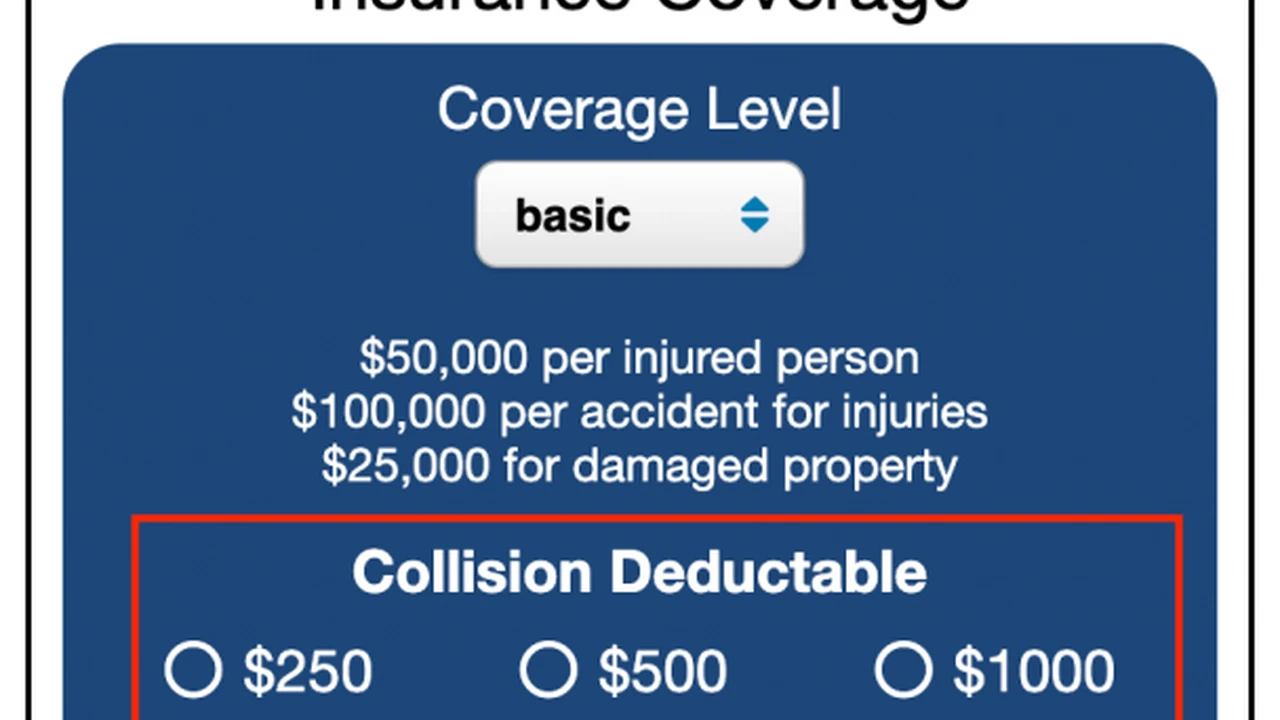

Deductibles and Premiums Balancing Cost and Coverage for Collector Cars

Just like standard insurance, you'll have deductibles. However, given the agreed value nature of many policies, the deductible might be a fixed amount or a percentage of the agreed value. Premiums for classic cars can often be surprisingly affordable, especially if you meet the usage and storage requirements. This is because insurers view them as lower risk due to limited driving and careful ownership.

Top Classic Car Insurance Providers A Comparative Review

Now, let's get to the nitty-gritty: who are the best providers for classic and collector car insurance? While many standard insurers might offer some form of classic car coverage, dedicated specialists often provide the most comprehensive and tailored policies. Here are a few of the top players:

Hagerty Classic Car Insurance The Industry Leader for Vintage Vehicles

Hagerty is arguably the biggest name in classic car insurance, and for good reason. They are enthusiasts themselves, deeply embedded in the classic car community. They offer agreed value coverage as standard, flexible usage plans, and a host of specialized benefits. They also provide valuation services, which can be incredibly helpful in determining your car's agreed value.

- Key Features: Agreed value coverage, flexible mileage plans, roadside assistance with flatbed towing, spare parts coverage, restoration coverage, overseas shipping coverage.

- Target Audience: Serious collectors, restorers, and enthusiasts who want comprehensive, specialized coverage.

- Pricing: Generally competitive, especially for those who meet their underwriting criteria (secure storage, limited usage, good driving record). Premiums can vary widely based on the car's value and location.

- Example Scenario: You own a meticulously restored 1965 Ford Mustang valued at $75,000. Hagerty would offer an agreed value policy for $75,000, ensuring you get that amount if it's totaled. They'd also cover your spare engine block stored in the garage.

Grundy Worldwide Collector Car Insurance Comprehensive Protection for High Value Classics

Grundy Worldwide is another highly respected name, often favored by owners of higher-value classics and collections. They also offer agreed value policies and are known for their 'no mileage limitation' option, which can be a huge plus for those who want to drive their classics more frequently, though this often comes with a higher premium. They also have a strong focus on collections and estate planning for classic cars.

- Key Features: Agreed value coverage, no mileage limitation option (with certain policies), coverage for collections, estate planning services, liability coverage for car shows.

- Target Audience: Owners of high-value classics, large collections, and those who desire more flexible mileage options.

- Pricing: Can be slightly higher than Hagerty for comparable coverage, especially with the no mileage option, but offers excellent value for high-end vehicles and collections.

- Example Scenario: You have a collection of five classic Porsches, with a total value exceeding $500,000. Grundy could provide a single policy covering the entire collection, with the flexibility to drive them more often than typical classic car policies allow.

American Modern Insurance Group Specialized Coverage for Unique Vehicles

American Modern offers a broader range of specialty insurance, including classic cars, custom builds, and even exotic vehicles. They provide agreed value coverage and are often a good option for those with slightly less conventional classics or modified vehicles that might not fit neatly into other insurers' categories. They are known for their flexibility and ability to underwrite unique situations.

- Key Features: Agreed value coverage, coverage for custom and modified classics, flexible underwriting for unique vehicles, various deductible options.

- Target Audience: Owners of custom classics, hot rods, restomods, and those who need a more flexible approach to underwriting.

- Pricing: Competitive, often a good choice for modified vehicles where other insurers might hesitate or charge more.

- Example Scenario: You own a highly customized 1970 Chevrolet Chevelle with a modern engine swap and custom interior. American Modern would be more likely to provide agreed value coverage for its unique modifications, which might be difficult with other providers.

J.C. Taylor Classic Car Insurance A Longstanding Tradition in Collector Car Protection

J.C. Taylor has been around for a very long time, specializing in classic car insurance since 1961. They are known for their straightforward agreed value policies and strong customer service. They often have competitive rates for more traditional classics and are a solid choice for owners who appreciate a long-standing, reliable insurer.

- Key Features: Agreed value coverage, competitive rates for traditional classics, strong customer service, coverage for various types of collector vehicles.

- Target Audience: Owners of traditional classic cars, hot rods, and antique vehicles looking for reliable, no-frills agreed value coverage.

- Pricing: Often very competitive, especially for vehicles that fit their traditional classic car profile.

- Example Scenario: You have a well-maintained 1957 Chevrolet Bel Air that you take to local car shows. J.C. Taylor would offer a competitive agreed value policy, understanding the historical significance and value of such a vehicle.

State Farm and GEICO Classic Car Programs Exploring Mainstream Options

While the specialists are often preferred, some mainstream insurers like State Farm and GEICO do offer classic car programs, often in partnership with a specialty insurer or through their own dedicated departments. These can sometimes be convenient if you already have other policies with them, potentially offering multi-policy discounts. However, it's crucial to scrutinize their terms to ensure you're getting true agreed value coverage and not a stated value policy disguised as something more comprehensive.

- Key Features: Potential for multi-policy discounts, convenience of bundling with existing insurance.

- Target Audience: Existing customers of these insurers who want to keep all their policies under one roof, or those with less valuable classics.

- Pricing: Varies, but always compare their 'classic' offerings very carefully against the specialists.

- Example Scenario: You have your home and daily driver insured with State Farm. You acquire a 1978 Pontiac Trans Am that you plan to drive occasionally. State Farm might offer a classic car policy, but you'd need to confirm it's agreed value and that the usage limitations align with your plans.

Factors Influencing Classic Car Insurance Premiums Getting the Best Rates

Several factors play a role in determining your classic car insurance premiums. Understanding these can help you get the best possible rates:

Vehicle Value and Rarity How Agreed Value Impacts Cost

The agreed value of your vehicle is, naturally, a primary factor. A higher agreed value means a higher premium, as the insurer's potential payout is greater. The rarity and desirability of your car can also influence rates, as these factors affect repair costs and the likelihood of theft.

Storage Conditions and Security Measures Protecting Your Investment

As mentioned, secure storage is key. A car stored in a locked, private garage will almost always have lower premiums than one parked in a public garage or on the street. Some insurers might even offer discounts for additional security measures like alarm systems or surveillance.

Driving Record and Claims History Your Personal Risk Profile

Your personal driving record and claims history still matter, even for a classic car. A clean driving record with no accidents or violations will generally qualify you for better rates. Insurers see responsible drivers as lower risk, regardless of the vehicle type.

Annual Mileage and Usage Patterns How Often You Drive Your Classic

The less you drive your classic, the lower your premium is likely to be. Most classic car policies have strict mileage limitations. If you exceed these, you could void your coverage or face higher rates. Be honest about your intended usage to ensure your policy remains valid.

Location and Climate Where Your Classic Car Resides

Where you live can also impact your rates. Areas with higher theft rates, more frequent natural disasters (like hurricanes or floods), or higher population density might see higher premiums. Climate can also be a factor if your car is exposed to harsh weather conditions.

Real World Scenarios and Practical Advice for Classic Car Owners

Let's look at some practical advice and common scenarios you might encounter as a classic car owner:

Buying a New Classic Car Insuring Your Latest Acquisition

When you buy a new classic, get insurance quotes BEFORE you finalize the purchase. This ensures you understand the costs and can get immediate coverage. Have a professional appraisal done to establish an accurate agreed value, especially if it's a private sale.

Restoring a Classic Car Adjusting Coverage as Value Increases

If you're restoring a car, make sure your policy includes restoration coverage and allows for periodic adjustments to the agreed value as you invest more time and money into the project. Keep meticulous records of all parts and labor.

Selling a Classic Car Transferring or Canceling Your Policy

Once you sell your classic, promptly notify your insurer to cancel or transfer the policy. If you're buying another classic, you might be able to transfer your existing policy or get a new one with the same provider, potentially streamlining the process.

Appraisals and Valuations Ensuring Accurate Agreed Value

Regularly get your classic car appraised, especially if its market value is appreciating or if you've made significant improvements. This ensures your agreed value policy remains accurate and you're fully protected. Many classic car insurers can recommend reputable appraisers.

What to Do After an Accident with Your Classic Car Navigating Claims

If the unthinkable happens and your classic is involved in an accident, immediately contact your classic car insurer. They often have specialized claims adjusters who understand the unique repair processes and parts sourcing for vintage vehicles. Document everything with photos and detailed notes.

Beyond Insurance Protecting Your Classic Car Investment

While insurance is crucial, there are other steps you can take to protect your classic car investment:

Regular Maintenance and Professional Care Preserving Your Classic

Consistent maintenance by mechanics familiar with classic cars is vital. This not only preserves its condition and value but can also prevent breakdowns that might lead to accidents or costly repairs.

Secure Storage and Anti Theft Measures Deterring Criminals

Invest in a secure garage, and consider additional anti-theft devices like GPS trackers, kill switches, or advanced alarm systems. The harder you make it for thieves, the safer your car will be.

Joining Classic Car Clubs and Communities Networking and Resources

Being part of classic car clubs and communities offers a wealth of knowledge, resources, and support. You can get advice on maintenance, restoration, and even insurance from experienced owners.

Documentation and Records Keeping Track of Your Car's History

Keep meticulous records of your car's history, including purchase documents, restoration receipts, maintenance logs, and any awards or accolades. This documentation can significantly enhance its value and aid in insurance claims or appraisals.

Alright, so we've covered a lot of ground here, from the fundamental differences in classic car insurance to specific providers and practical tips. The main takeaway is this: your classic car deserves more than a standard auto policy. It needs specialized coverage that recognizes its unique value, usage, and the passion you've poured into it. By choosing an agreed value policy from a reputable classic car insurer, you're not just buying insurance; you're investing in peace of mind, knowing that your cherished vehicle is protected by people who understand its true worth. So go ahead, enjoy those drives, show off your beauty, and rest easy knowing you've got the right coverage in place!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)