The Ultimate Guide to High Deductible Auto Insurance Plans

Access the ultimate guide to high deductible auto insurance plans. Learn if this strategy is right for you to lower your monthly premiums.

The Ultimate Guide to High Deductible Auto Insurance Plans

Hey there, savvy driver! Are you looking for smart ways to cut down on your monthly auto insurance bills without sacrificing essential protection? You've probably heard whispers about 'high deductible auto insurance plans' but might be wondering what they actually entail and if they're the right fit for your wallet and peace of mind. Well, you've come to the right place! This comprehensive guide is designed to demystify high deductible plans, break down their pros and cons, and help you decide if this strategy can truly save you money in the long run. We'll dive deep into how deductibles work, explore various scenarios where high deductibles shine (or don't), and even look at some real-world examples and product comparisons to give you a clearer picture. So, buckle up, because we're about to take a deep dive into the world of high deductible auto insurance!

Understanding Auto Insurance Deductibles What They Are and How They Work

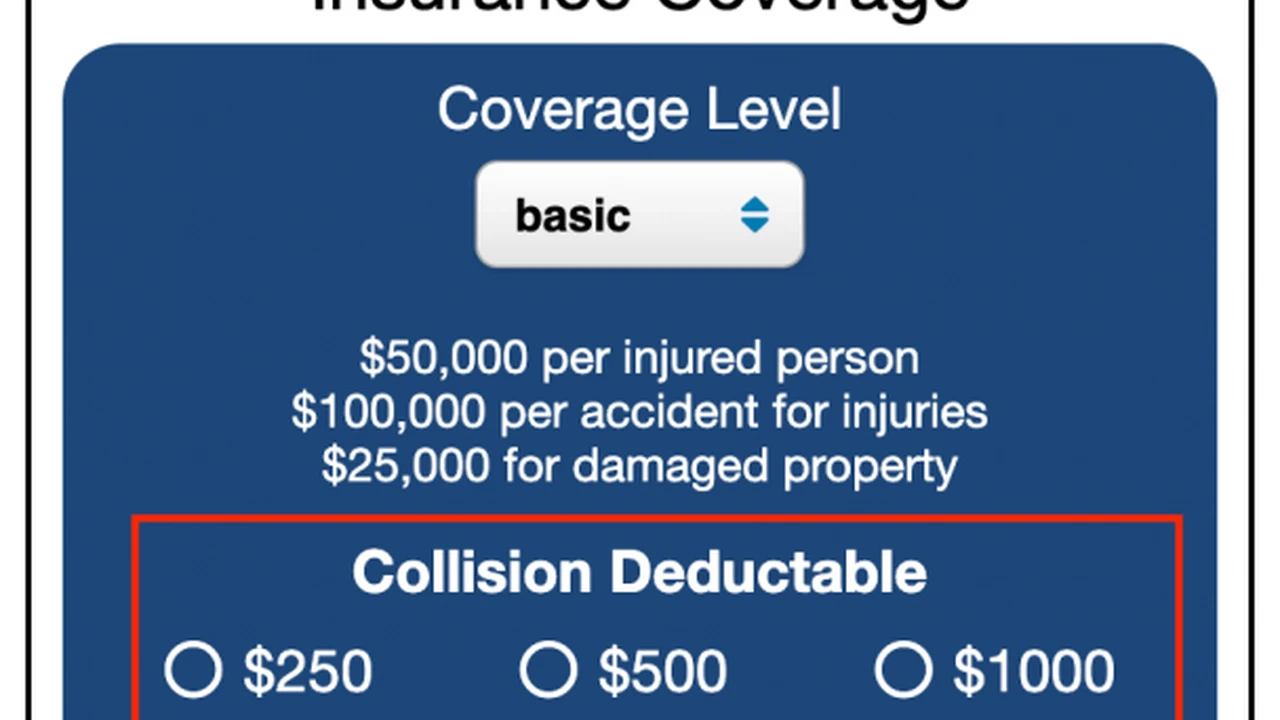

Before we jump into the 'high' part, let's make sure we're all on the same page about what a deductible actually is. In simple terms, an auto insurance deductible is the amount of money you agree to pay out of your own pocket before your insurance company starts paying for a covered claim. Think of it as your share of the repair bill. For example, if you have a $1,000 deductible and your car sustains $3,000 worth of damage in a covered accident, you'd pay the first $1,000, and your insurance company would cover the remaining $2,000. It's a fundamental component of most collision and comprehensive insurance policies.

Deductibles typically apply per incident. So, if you have two separate accidents in a year, you'd likely pay your deductible twice. It's important to note that deductibles usually do not apply to liability coverage. If you're at fault in an accident and your insurance pays for damages to another person's vehicle or their medical bills, you typically won't pay a deductible for that portion of the claim. Your deductible comes into play when you're claiming for damages to your own vehicle under your collision or comprehensive coverage.

The amount of your deductible is a choice you make when you purchase your policy. Common deductible amounts range from $250, $500, $1,000, $1,500, to even $2,500 or more. The general rule of thumb is: the higher your deductible, the lower your monthly or annual premium. This is because by agreeing to pay more out-of-pocket in the event of a claim, you're taking on more of the risk, and your insurance company rewards you with a lower premium.

The Appeal of High Deductible Auto Insurance Plans Lowering Your Premiums

So, why are so many people considering high deductible plans? The primary, and most attractive, reason is the significant savings on premiums. For many drivers, especially those with good driving records, older vehicles, or those who simply want to keep their monthly expenses down, a high deductible can be a game-changer. Let's break down the math a bit.

Imagine two drivers, both with similar cars and driving histories. Driver A chooses a $500 deductible for their collision and comprehensive coverage, while Driver B opts for a $2,000 deductible. Driver B's monthly premium could be substantially lower – sometimes by 15%, 20%, or even more, depending on the insurer and other factors. Over a year, those savings can really add up, potentially putting hundreds of dollars back into your pocket.

This strategy is particularly appealing if you're a safe driver who rarely files claims. If you go years without an accident or a need to use your comprehensive coverage, you're essentially paying less for insurance you're not using frequently. It's a calculated risk, where you bet on your ability to avoid incidents, or at least minor ones, and save money in the process.

When High Deductibles Make Sense Ideal Scenarios for Savings

High deductible plans aren't for everyone, but they can be an excellent choice for certain drivers and situations. Let's explore some scenarios where this strategy truly shines:

Drivers with Excellent Driving Records and Low Claim Frequency

If you've been driving for years without a single accident or even a minor fender bender, you're a prime candidate for a high deductible. Your history suggests you're less likely to need to file a claim, making the risk of a higher out-of-pocket expense less probable. Why pay a higher premium every month for something you rarely use?

Older Vehicles with Lower Market Value

For cars that are several years old and have depreciated significantly, a high deductible can be very practical. If your car is only worth, say, $5,000, and you have a $1,000 or $1,500 deductible, the insurance payout after a claim might not be substantially more than your deductible, especially after factoring in the hassle. In some cases, if the repair cost is close to or less than your deductible, you might even choose to pay for minor repairs yourself without involving insurance, thus avoiding potential premium increases. For very old cars, some people even drop collision and comprehensive coverage entirely, but a high deductible can be a good middle ground.

Strong Emergency Fund and Financial Stability

This is perhaps the most crucial factor. A high deductible plan only works if you can comfortably afford to pay that deductible amount out of pocket if an accident occurs. If you have a robust emergency fund that can easily cover a $1,000, $1,500, or even $2,500 deductible without causing financial strain, then a high deductible is a viable option. If paying that amount would put you in a difficult financial position, then a lower deductible might be a safer bet, even if it means higher premiums.

Drivers Who Can Self-Insure for Minor Damages

Some drivers prefer to handle minor dings and scratches themselves rather than filing a claim and potentially seeing their premiums rise. With a high deductible, you're essentially self-insuring for those smaller incidents. If a repair costs $800 and your deductible is $1,000, you'd pay for it yourself anyway. This mindset aligns well with a high deductible strategy.

When High Deductibles Might Not Be the Best Choice Potential Drawbacks and Risks

While the allure of lower premiums is strong, high deductible plans aren't a universal solution. There are situations where they might not be the best fit, and it's important to be aware of the potential downsides:

Limited Emergency Savings or Tight Budget

As mentioned, if you don't have readily available funds to cover your deductible in an emergency, a high deductible plan could leave you in a tough spot after an accident. Imagine your car is totaled, and you need to pay $2,000 before your insurance kicks in, but you only have $500 in savings. That's a recipe for financial stress and potentially being without a vehicle.

Newer or High-Value Vehicles

If you drive a brand-new car or a luxury vehicle, the repair costs for even minor damage can be incredibly high. In such cases, a lower deductible might offer more peace of mind, as the difference between your deductible and the total repair bill will be substantial, making the insurance payout more impactful. For example, if your new car needs $10,000 in repairs, paying a $500 deductible feels much better than paying a $2,000 deductible.

Frequent Accidents or High-Risk Driving

If you have a history of frequent accidents or live in an area with a high incidence of theft or vandalism, you might find yourself paying your high deductible multiple times. In such scenarios, the premium savings might be offset by the repeated out-of-pocket expenses, making a lower deductible more cost-effective in the long run.

Peace of Mind and Risk Aversion

For some people, the peace of mind that comes with a lower deductible is worth the higher premium. They prefer knowing that in the event of an accident, their out-of-pocket expense will be minimal, even if it means paying a bit more each month. If you're risk-averse, a high deductible might cause more anxiety than it saves you money.

Comparing High Deductible Auto Insurance Products and Providers

When considering a high deductible plan, it's not just about the deductible amount itself, but also about the overall policy, the insurer's reputation, and how they handle claims. Many major insurance providers offer flexible deductible options, allowing you to choose what works best for you. Here's a look at how some popular providers approach high deductible plans and what to consider:

Geico

Geico is well-known for its competitive rates and extensive discount options. They offer a wide range of deductible choices, typically from $250 up to $2,500 or even higher for collision and comprehensive coverage. Geico's online quote system makes it easy to adjust your deductible and instantly see the impact on your premium. They are often a good choice for drivers looking to maximize savings with a high deductible, especially if you qualify for their numerous discounts (e.g., good driver, multi-car, federal employee). Their mobile app and online tools are also very user-friendly for managing policies and claims.

Progressive

Progressive is another major player that embraces flexible deductible options. They are famous for their 'Name Your Price' tool, which allows you to input your desired premium and then see what coverage options fit that budget, including various deductible levels. Progressive also offers a 'Deductible Savings Bank' for some policies, where your deductible decreases by a certain amount for every claim-free policy period. This can be a great incentive for safe drivers opting for a high deductible, as it gradually reduces your out-of-pocket risk over time. They also have strong telematics programs like Snapshot that can further reduce premiums for safe drivers, making a high deductible even more attractive.

State Farm

State Farm, a long-standing and trusted insurer, also provides a variety of deductible options. While they might not always be the cheapest upfront, their strong agent network and reputation for excellent customer service can be a significant draw. If you prefer a more personalized approach and want to discuss the implications of a high deductible with a local agent, State Farm could be a good fit. They also offer various discounts that can help offset premiums, making high deductibles more manageable.

Allstate

Allstate offers customizable policies with various deductible levels. They are known for their 'Drivewise' program, a telematics offering that rewards safe driving with discounts, which can complement a high deductible strategy by further lowering your base premium. Allstate also has a 'Claim-Free Bonus' in some states, which can reduce your deductible over time if you remain claim-free, similar to Progressive's offering. This can make a high deductible less daunting for long-term safe drivers.

Local and Regional Insurers

Don't forget to check out local and regional insurance companies! Sometimes, these smaller providers can offer highly competitive rates and more personalized service, especially if you're in a specific geographic area. They might have unique programs or discounts that larger national carriers don't. Always get quotes from a mix of national and local providers when comparing high deductible options.

Key Considerations When Comparing Providers for High Deductibles

- Premium Savings: How much does increasing your deductible actually save you with each provider? This can vary significantly.

- Financial Stability: Ensure the insurer has a strong financial rating (e.g., A.M. Best) to guarantee they can pay out claims.

- Claim Process: Read reviews about their claims handling. A high deductible means you're paying a significant amount upfront, so you want a smooth and efficient claims experience for the rest.

- Customer Service: How easy is it to reach them? Do they have good online tools?

- Additional Features: Do they offer deductible reduction programs, accident forgiveness, or telematics discounts that can further enhance your high deductible strategy?

Practical Scenarios and Real-World Applications of High Deductibles

Let's look at some practical examples to illustrate how high deductibles play out in different situations:

Scenario 1 The Safe Driver with an Older Car

Meet Sarah. She drives a 2015 Honda Civic, valued at about $8,000. She's been driving for 15 years without a single accident. Her current policy has a $500 deductible, and she pays $120/month. She decides to switch to a $1,500 deductible. Her premium drops to $90/month, saving her $360 per year. Over five years, she saves $1,800. If she has a minor fender bender that costs $1,200 to fix, she pays it out of pocket because it's less than her deductible. If she has a major accident costing $5,000, she pays $1,500, and her insurer pays $3,500. Given her safe driving history, the $1,800 saved over five years easily covers the extra $1,000 she'd pay in a single claim compared to her old deductible. This is a win for Sarah.

Scenario 2 The New Driver with a Tight Budget

John is 19 and just got his first car, a used Toyota Corolla. Insurance for young drivers is notoriously expensive. With a $500 deductible, his premium is $250/month. By increasing his deductible to $2,000, his premium drops to $180/month, saving him $840 per year. John has $2,500 in savings specifically for emergencies. He understands that if he has an accident, he'll need to pay $2,000. He's a careful driver, but the high deductible allows him to afford insurance that would otherwise be out of reach. He's taking a calculated risk, but the immediate savings are crucial for his budget.

Scenario 3 The Driver in a High-Risk Area

Maria lives in a bustling city neighborhood with a high rate of car break-ins and minor parking lot accidents. She drives a newer SUV. She initially considered a $1,500 deductible to save money. However, after experiencing two separate incidents of minor vandalism and a hit-and-run in a parking lot within a year (each costing around $1,000-$1,200 to repair), she realized she was effectively paying for these repairs herself, as they were below her deductible. She switched back to a $500 deductible. While her premium increased by $40/month, the peace of mind and the fact that her insurance now covers these more frequent, smaller incidents makes it a better value for her specific situation. For Maria, the higher premium was worth avoiding repeated out-of-pocket expenses.

Strategies to Make High Deductibles Work for You Maximizing Your Savings

If you've decided a high deductible plan is right for you, here are some strategies to ensure you get the most out of it and minimize potential risks:

Build and Maintain a Robust Emergency Fund

This cannot be stressed enough. Before you even think about a high deductible, make sure you have at least the amount of your chosen deductible readily available in a separate savings account. Ideally, have a bit more, just in case. This fund acts as your safety net, ensuring that an accident doesn't turn into a financial crisis.

Shop Around and Compare Quotes Regularly

Don't just stick with your current insurer. Get quotes from multiple providers (at least 3-5) every year or two, especially when your policy is up for renewal. Different companies have different pricing models, and the savings from a high deductible can vary significantly between them. Use online comparison tools and consider working with an independent insurance agent who can shop multiple carriers for you.

Bundle Your Insurance Policies

Most insurers offer significant discounts (often 10-20%) if you bundle your auto insurance with other policies like home, renters, or even life insurance. These savings can further reduce your overall premium, making a high deductible even more attractive.

Utilize Telematics Programs

Many insurers offer telematics programs (like Progressive Snapshot, Allstate Drivewise, or State Farm Drive Safe & Save) that monitor your driving habits (speed, braking, mileage, time of day). If you're a safe driver, these programs can lead to substantial discounts, further lowering your premium and making a high deductible even more financially beneficial.

Maintain a Clean Driving Record

This is fundamental for any insurance savings, but especially so with a high deductible. Avoiding accidents and traffic violations keeps your base premium low, maximizing the impact of your high deductible. Plus, it means you're less likely to need to pay that deductible in the first place!

Consider Accident Forgiveness

Some insurers offer accident forgiveness as an add-on or a loyalty perk. This means your rates won't increase after your first at-fault accident. While it doesn't eliminate your deductible, it protects your future premiums, which is a valuable consideration when you're taking on more risk with a high deductible.

Review Your Coverage Annually

Your life and your car's value change. What was a good deductible choice last year might not be this year. Review your policy annually. Has your car depreciated significantly? Have your financial circumstances changed? Are you driving more or less? Adjust your deductible and coverage as needed to ensure it still aligns with your needs and budget.

The Future of Deductibles and Auto Insurance Trends

The auto insurance landscape is constantly evolving, and deductibles are no exception. We're seeing several trends that could impact how high deductible plans are viewed and utilized in the future:

Increasing Vehicle Repair Costs

Modern cars are packed with advanced technology (sensors, cameras, ADAS features). While these make cars safer, they also make repairs significantly more expensive. This trend might push more drivers towards higher deductibles to keep premiums manageable, but it also means the out-of-pocket expense for a claim will be higher.

Personalized Pricing and Telematics

As telematics programs become more sophisticated and widespread, insurance pricing will become even more personalized. Safe drivers who opt for high deductibles could see even greater premium reductions, making this strategy even more attractive for those who consistently demonstrate good driving habits.

Parametric Insurance and Micro-Deductibles

While still niche, some innovative insurance products are exploring 'parametric' models where payouts are triggered by specific events (e.g., hail damage detected by a sensor) rather than traditional claims processes. We might also see 'micro-deductibles' for very specific, small claims, offering more granular control over out-of-pocket expenses.

The Rise of Autonomous Vehicles

As autonomous vehicles become more common, the nature of liability and claims will shift. This could lead to entirely new insurance models, potentially impacting how deductibles are structured or even if they are needed in the same way. However, this is still a long way off for most drivers.

Ultimately, choosing a high deductible auto insurance plan is a personal financial decision. It's about balancing the immediate savings on your premiums with your ability to cover a larger out-of-pocket expense if an accident occurs. By understanding how deductibles work, assessing your financial situation, and comparing options from various reputable providers, you can make an informed choice that protects your vehicle and your wallet. Drive safe, and make smart insurance choices!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)