How to Negotiate Your Auto Insurance Renewal Rates

Learn how to negotiate your auto insurance renewal rates. Get tips and strategies to secure a better deal when your policy is up for renewal.

How to Negotiate Your Auto Insurance Renewal Rates

Alright, let's talk about something that probably doesn't get you super excited, but it absolutely should: your auto insurance renewal. For many of us, that renewal notice just shows up in the mail or your inbox, and we either pay it without a second thought or grumble about the slight increase. But what if I told you that you don't have to just accept whatever number your insurance company throws at you? What if you could actually negotiate your auto insurance renewal rates and potentially save a significant chunk of change? Sounds pretty good, right?

The truth is, auto insurance is a competitive market, and companies want to keep your business. They also know that most people won't bother to shop around or challenge their renewal offer. This is where you, the savvy consumer, come in. By understanding a few key strategies and being prepared, you can turn that renewal notice into an opportunity for savings. We're going to dive deep into how you can do just that, covering everything from understanding your current policy to leveraging competitor quotes and even knowing when to walk away. Let's get started!

Understanding Your Current Auto Insurance Policy and Renewal Notice

Before you can effectively negotiate, you need to know what you're negotiating. Don't just glance at the premium amount. Take some time to really dig into your current policy and the renewal notice. This isn't just busywork; it's foundational to a successful negotiation. Think of it like preparing for a big presentation – you wouldn't go in without knowing your material, right?

Decoding Your Auto Insurance Coverage Details

First things first, pull out your current policy declaration page. This document outlines all the specifics of your coverage. Look for:

- Coverage Types: Are you paying for comprehensive, collision, liability, uninsured/underinsured motorist, personal injury protection (PIP), medical payments (MedPay), rental car reimbursement, roadside assistance? Understand what each one covers.

- Coverage Limits: These are the maximum amounts your insurer will pay for a covered loss. For liability, you'll often see numbers like 100/300/50, meaning $100,000 per person for bodily injury, $300,000 per accident for bodily injury, and $50,000 for property damage. Are these limits still appropriate for your assets and risk tolerance?

- Deductibles: This is the amount you pay out-of-pocket before your insurance kicks in for collision and comprehensive claims. A higher deductible usually means a lower premium, and vice-versa.

- Endorsements or Riders: These are add-ons to your policy, like new car replacement, custom parts and equipment coverage, or gap insurance. Do you still need them?

Analyzing Your Auto Insurance Premium Breakdown

Your renewal notice should provide a breakdown of your premium. It might show how much each coverage type costs, or it might just show the total. If it's not detailed enough, call your insurer and ask for a full breakdown. This helps you identify which parts of your policy are driving the cost. Sometimes, a specific coverage type might have seen a disproportionate increase.

Identifying Changes in Your Auto Insurance Renewal

Compare your new renewal notice to your previous policy. Has anything changed? Sometimes, insurers will automatically adjust coverage limits or add new features without explicitly highlighting them. Look for:

- Premium Increase/Decrease: Obviously, this is the first thing you'll notice. But don't just react to the number; try to understand *why* it changed.

- Coverage Changes: Did your liability limits go up or down? Did a deductible change?

- Discounts Applied: Are all your previous discounts still there? Have any new ones been added or removed?

- Vehicle Information: Is the mileage accurate? Is the vehicle information correct?

Understanding these details puts you in a much stronger position. You're not just saying, 'My premium went up, and I don't like it.' You can say, 'I noticed my comprehensive coverage increased by 15% this year, even though my car is a year older. Can you explain why, and what options do I have to reduce that?'

Assessing Your Current Driving Habits and Vehicle Information for Auto Insurance Savings

Your insurance premium isn't just about your car; it's also about you and how you use that car. Life changes, and your insurance policy should reflect those changes. Before you even talk to your current insurer or shop around, take a moment to assess if your current policy accurately reflects your current situation. This is a prime area for finding potential savings.

Updating Your Annual Mileage for Lower Auto Insurance Rates

This is a big one! Many people overestimate their annual mileage when they first get a policy, or their driving habits change over time. If you're now working from home, have a shorter commute, or simply drive less than you used to, your insurer might be charging you for more risk than you actually pose. Call your insurer and update your estimated annual mileage. Even a small reduction can sometimes lead to a noticeable decrease in your premium. Some companies even offer low-mileage discounts or programs where you pay based on how much you drive (telematics, which we'll discuss later).

Reviewing Your Vehicle's Current Value and Coverage Needs

Cars depreciate, meaning they lose value over time. As your car gets older, the cost of collision and comprehensive coverage might start to outweigh the potential payout. For example, if your car is 10 years old and only worth $3,000, paying $500 a year for collision coverage with a $500 deductible might not make financial sense. In the event of a total loss, you'd only get $2,500 back (after your deductible). Consider if it's time to drop collision and/or comprehensive coverage, especially if you have an older vehicle that you could easily replace out-of-pocket.

Evaluating Changes in Your Personal Situation for Auto Insurance Discounts

Life happens, and these changes can often qualify you for new discounts:

- Marriage: Married individuals often pay less for auto insurance.

- Moving: A new zip code can significantly impact your rates, for better or worse.

- New Job: If your new job means a shorter commute or you no longer need your car for work, update your insurer.

- Children Leaving Home: If a young driver is no longer on your policy, your rates should decrease.

- Improved Credit Score: In many states, a better credit score can lead to lower premiums.

- New Safety Features on Your Car: Did you recently install an alarm system or get new tires with advanced safety features? Let your insurer know.

Don't assume your insurer knows about these changes. It's your responsibility to inform them. A quick call could unlock some unexpected savings.

Leveraging Discounts and Bundling for Auto Insurance Savings

Discounts are your best friends when it comes to lowering your auto insurance rates. Most insurance companies offer a wide array of discounts, but they won't always automatically apply them. It's up to you to ask and ensure you're getting every single one you qualify for. This is a crucial step in negotiating your renewal.

Exploring Common Auto Insurance Discounts You Might Be Missing

Let's break down some of the most common discounts. Go through this list and see if any apply to you:

- Multi-Car Discount: Insuring more than one vehicle with the same company.

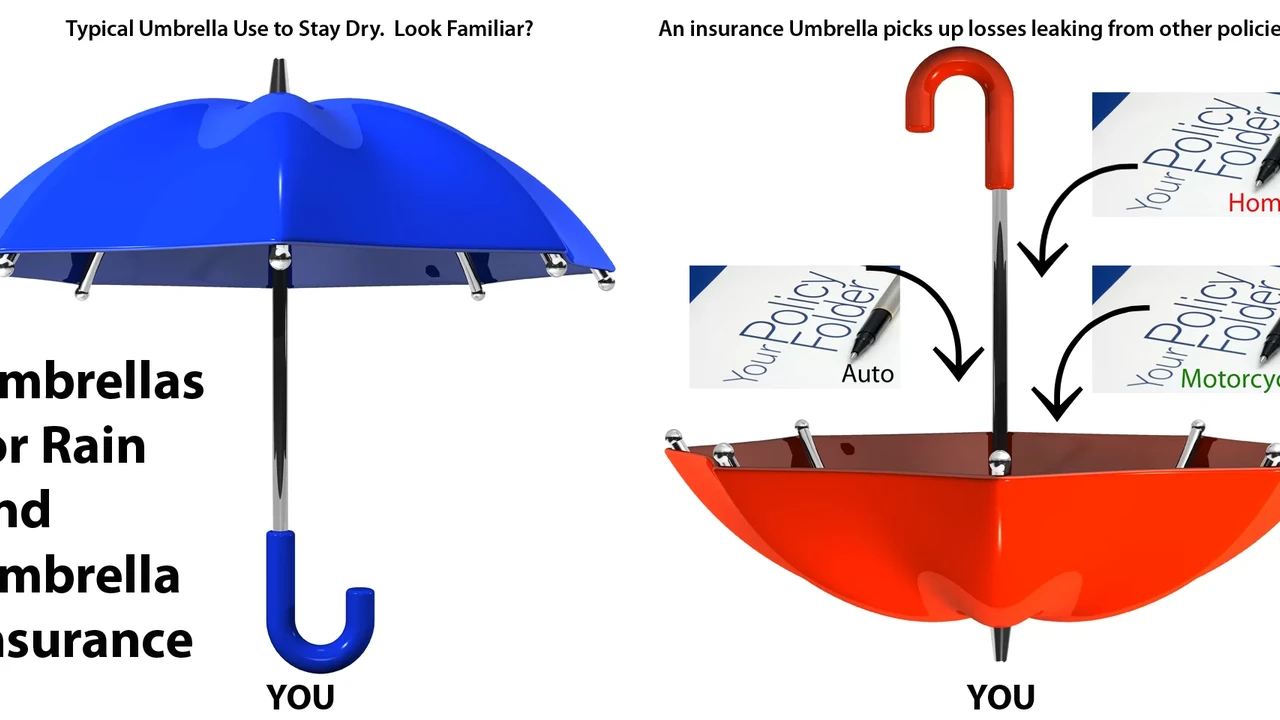

- Multi-Policy (Bundling) Discount: Combining your auto insurance with home, renters, life, or even umbrella insurance with the same provider. This is often one of the biggest discounts available.

- Good Driver Discount: For drivers with a clean record (no accidents or violations) for a certain period (e.g., 3-5 years).

- Defensive Driver Course Discount: Completing an approved defensive driving course. This is especially useful for older drivers or those with minor infractions.

- Good Student Discount: For young drivers (typically under 25) who maintain a certain GPA (e.g., B average or 3.0 GPA).

- Student Away at School Discount: If a student on your policy attends school more than a certain distance from home and doesn't regularly drive the insured vehicle.

- Anti-Theft Device Discount: For vehicles equipped with alarms, tracking devices, or other anti-theft systems.

- Safety Features Discount: For cars with features like airbags, anti-lock brakes (ABS), daytime running lights, electronic stability control, or advanced driver-assistance systems (ADAS) like lane departure warning or automatic emergency braking.

- Low Mileage Discount: If you drive fewer miles than the average driver.

- Payment Discounts: For paying your premium in full, setting up automatic payments, or choosing paperless billing.

- Loyalty Discount: For staying with the same insurer for a certain number of years.

- Occupation/Affinity Group Discounts: Some insurers offer discounts for certain professions (e.g., teachers, military personnel, first responders) or membership in specific organizations.

When you call your insurer, don't just ask, 'Are there any discounts?' Instead, go through this list and specifically ask, 'Do I qualify for a good student discount? What about a defensive driver discount? I recently installed a new alarm system, does that qualify for a discount?' Be proactive!

The Power of Bundling Auto and Home Insurance Policies

Bundling is often the single most effective way to save money on your insurance. When you combine multiple policies (like auto and home, or auto and renters) with the same company, insurers often give you a significant discount on both. This is because they want your entire business, and they're willing to reward you for it. If you currently have your home and auto insurance with different companies, this is a huge opportunity for savings.

Example Scenario: Let's say you pay $1,200 a year for auto insurance with Company A and $800 a year for home insurance with Company B. That's a total of $2,000. If Company A offers a 15% multi-policy discount, and Company B offers a 10% discount, you could potentially save $300 with Company A or $200 with Company B. It's worth getting quotes from both your current providers to see what they offer for bundling. Sometimes, even if one policy is slightly more expensive individually, the bundling discount makes the combined package cheaper.

Considering Telematics Programs for Usage Based Auto Insurance

Telematics, or usage-based insurance (UBI), is becoming increasingly popular. These programs involve installing a small device in your car or using a smartphone app that monitors your driving habits (speed, braking, acceleration, mileage, time of day you drive). If you're a safe driver, you can often earn significant discounts. Some popular programs include:

- Progressive Snapshot: A device or app that monitors driving for a short period (usually 6 months) to determine your discount.

- State Farm Drive Safe & Save: Uses a device or app to track driving and offer discounts.

- Allstate Drivewise: An app that rewards safe driving with cash back and policy discounts.

- GEICO DriveEasy: An app that monitors driving behavior to help you save.

Pros: Can lead to substantial savings for safe drivers. Encourages safer driving habits. Some programs offer an initial discount just for signing up. Cons: Your driving data is being collected. If you have aggressive driving habits, your rates could potentially increase (though many programs promise your rates won't go up, only down or stay the same). Not everyone is comfortable with the privacy implications.

If you consider yourself a safe driver and are comfortable with the data collection, asking your insurer about their telematics program is a smart move. It's a direct way to prove you're a lower risk and deserve a lower premium.

Shopping Around and Comparing Auto Insurance Quotes Effectively

This is arguably the most powerful tool in your negotiation arsenal. Your current insurer knows that if you haven't shopped around, they have less incentive to lower your rates. But if you come to them with competitive quotes from other companies, suddenly they have a reason to fight for your business. Don't underestimate the power of competition!

Getting Multiple Auto Insurance Quotes from Competitors

The golden rule of auto insurance savings is to get multiple quotes. Don't just get one; aim for at least three to five. You can do this in several ways:

- Online Comparison Sites: Websites like The Zebra, NerdWallet, or Compare.com allow you to enter your information once and get quotes from multiple insurers. This is a great starting point for efficiency.

- Directly from Insurer Websites: Visit the websites of major insurers (e.g., GEICO, Progressive, State Farm, Allstate, Liberty Mutual, Farmers, USAA if eligible) and get quotes directly. Sometimes, direct quotes can be different from those on comparison sites.

- Independent Insurance Agents: These agents work with multiple insurance companies and can shop around for you. They can be a great resource, especially if you have complex insurance needs or prefer a more personalized approach.

When getting quotes, ensure you're comparing apples to apples. Use the exact same coverage limits, deductibles, and endorsements as your current policy. This allows for a true comparison of pricing.

Comparing Auto Insurance Coverage and Pricing Side by Side

Once you have your quotes, create a simple spreadsheet or list to compare them. Look beyond just the bottom-line premium. Consider:

- Total Annual/Semi-Annual Premium: The most obvious comparison.

- Coverage Limits: Are they identical across all quotes?

- Deductibles: Are they the same for collision and comprehensive?

- Included Features/Endorsements: Does one company include roadside assistance or rental car reimbursement that another charges extra for?

- Discounts Applied: Which discounts did each company apply? Are there any you missed?

- Customer Service Reputation: While not directly a price factor, it's important. Check online reviews (J.D. Power, BBB, Google Reviews) for claims handling and overall satisfaction. A cheaper policy isn't worth it if the company is impossible to deal with after an accident.

Using Competitor Quotes as Leverage in Negotiation

This is where the negotiation really begins. Once you have a few lower quotes from reputable companies, call your current insurer. Be polite but firm. Start by saying something like:

"Hi, I'm calling about my upcoming auto insurance renewal. I've been a loyal customer for [X years], and I appreciate the service I've received. However, I've been shopping around, and I've received a quote from [Competitor Name] for similar coverage that's [X]% lower than my renewal offer. I'd really prefer to stay with you, but I need to see if you can match or beat that price."

Be prepared to provide the details of the competing quote. The representative might be able to find additional discounts, adjust your policy, or offer a loyalty discount to keep you. If they can't match it immediately, ask if there's anything else they can do. Sometimes, they might offer to re-rate your policy with slightly different parameters that still meet your needs but lower the cost. Don't be afraid to ask, "Is that the absolute best you can do?"

Strategies for Effective Communication with Your Auto Insurance Provider

Negotiation isn't about being aggressive; it's about being informed, polite, and persistent. How you communicate with your insurance provider can significantly impact the outcome. Remember, the person on the other end of the phone often has some discretion or access to tools that can help you, but they're more likely to use them if you're pleasant and clear.

Preparing Your Talking Points for Auto Insurance Negotiation

Before you pick up the phone, have your information organized. This includes:

- Your current policy number and renewal notice.

- Details of any lower quotes you've received from competitors (company name, coverage, premium).

- A list of any life changes or potential discounts you think you qualify for (e.g., reduced mileage, new anti-theft device, good student status).

- Specific questions about your premium breakdown or coverage.

Having these points ready will make you sound confident and prepared, which signals to the representative that you're serious about finding a better rate.

Being Polite but Firm in Your Auto Insurance Discussions

Start the conversation positively. Acknowledge your loyalty if you've been with them for a while. For example, "I've been a customer for five years, and I've generally been happy with your service." Then, clearly state your objective: "However, my renewal premium has increased, and I'm looking to see what options are available to lower it."

If they offer a small reduction, don't immediately accept. You can say, "I appreciate that, but I was hoping for a bit more. I have a quote from [Competitor] that's still significantly lower. Is there anything else you can do on my premium, perhaps by reviewing my discounts or adjusting my coverage slightly?"

Avoid ultimatums unless you're truly prepared to switch. Instead of "If you don't lower it, I'm leaving!" try "I'd really prefer to stay with you, but I need to make sure I'm getting the best value for my money."

Knowing When to Escalate or Switch Auto Insurance Providers

Sometimes, despite your best efforts, your current insurer just won't budge. Or, the best they can offer still doesn't beat a competitor's quote. At this point, you have a decision to make:

- Ask for a Supervisor: If the first representative can't help, politely ask to speak with a supervisor or someone in the retention department. These individuals often have more authority to offer discounts or make exceptions.

- Be Prepared to Switch: If your current insurer truly can't meet your needs, be prepared to switch. Don't let loyalty cost you hundreds of dollars a year. The process of switching is often much easier than people imagine.

Remember, your goal is to get the best coverage at the best price. If your current company can't provide that, there are plenty of others who will. Make sure you understand the cancellation process with your current insurer and the start date of your new policy to avoid any gaps in coverage.

Specific Product Recommendations and Comparison for Auto Insurance

While I can't give you a definitive 'best' product because insurance is so personalized, I can highlight some common scenarios and recommend types of products or features that might be beneficial, along with how they compare. The 'best' product for you will always depend on your specific needs, location, driving history, and vehicle.

Comparing Major Auto Insurance Providers and Their Strengths

Let's look at some of the big players in the US market and what they're often known for. Keep in mind, these are generalizations, and individual experiences can vary:

GEICO

- Strengths: Often very competitive rates, especially for good drivers. Strong online presence and easy quote process. Known for a wide array of discounts.

- Typical Scenario: Drivers looking for straightforward, affordable coverage, comfortable managing their policy online or via app.

- Consideration: While customer service is generally good, some prefer a more personalized agent relationship.

Progressive

- Strengths: Known for innovative tools like the 'Name Your Price' tool and Snapshot telematics program, which can offer significant discounts for safe drivers. Good for drivers with less-than-perfect records.

- Typical Scenario: Drivers who want to customize their policy, are open to telematics, or have had a few bumps in their driving history.

- Consideration: Rates can sometimes be higher for drivers who don't utilize their telematics program or have very clean records.

State Farm

- Strengths: Largest auto insurer in the US, known for its extensive network of local agents. Excellent customer service and claims handling reputation. Offers a wide range of products beyond auto.

- Typical Scenario: Drivers who prefer a local agent for personalized advice and support, value strong customer service, and might want to bundle multiple insurance types.

- Consideration: Rates might not always be the absolute lowest compared to some online-only insurers.

Allstate

- Strengths: Strong local agent presence, good for bundling home and auto. Offers unique features like 'Drivewise' (telematics) and 'Claim-Free Bonus' for safe drivers.

- Typical Scenario: Similar to State Farm, good for those who value an agent relationship and bundling.

- Consideration: Can sometimes be pricier than competitors, so always compare.

USAA (for Military Members and Families)

- Strengths: Consistently ranks highest in customer satisfaction and claims handling. Very competitive rates and excellent service for its eligible members.

- Typical Scenario: Active military, veterans, and their eligible family members.

- Consideration: Eligibility is restricted.

Specialized Auto Insurance Products for Unique Needs

Beyond the standard policies, there are specific products that cater to particular situations:

Gap Insurance

- Use Case: When you finance or lease a new car. If your car is totaled or stolen, your standard insurance pays out its actual cash value (ACV). If you owe more on your loan/lease than the ACV, gap insurance covers the 'gap' between what you owe and what your primary insurance pays.

- Comparison: Often offered by dealerships (can be expensive) or directly by insurers (usually cheaper). Some credit unions also offer it.

- Pricing: Varies, but typically a small addition to your monthly premium or a one-time fee.

New Car Replacement Coverage

- Use Case: For new cars (typically within the first 1-3 years or first 15,000-20,000 miles). If your new car is totaled, this coverage replaces it with a brand new car of the same make and model, rather than just paying its depreciated value.

- Comparison: Offered by many major insurers as an add-on.

- Pricing: Adds a small amount to your comprehensive/collision premium.

Classic Car Insurance

- Use Case: For antique, classic, or collector vehicles. Standard auto insurance often doesn't adequately cover the unique value and usage of these cars.

- Comparison: Specialized insurers like Hagerty, Grundy, or American Collectors Insurance are often better than standard insurers. They offer 'agreed value' coverage (you and the insurer agree on the car's value upfront) and often have lower premiums due to limited mileage restrictions.

- Pricing: Can be surprisingly affordable compared to standard insurance, given the limited use of these vehicles.

Rideshare Insurance

- Use Case: If you drive for Uber, Lyft, or other rideshare services. Your personal auto policy typically won't cover you when you're actively working, and the rideshare company's insurance might have gaps.

- Comparison: Many major insurers (e.g., GEICO, State Farm, Allstate, Progressive) now offer rideshare endorsements or specific policies.

- Pricing: Adds to your personal policy, but essential to avoid coverage gaps.

The Role of Independent Agents in Finding the Best Auto Insurance Products

Don't forget about independent insurance agents! They are licensed to sell policies from multiple different insurance companies. This means they can do the shopping around for you, often finding competitive rates and identifying discounts you might not have known about. They can be particularly helpful if:

- You have a complex driving history (e.g., multiple accidents, DUIs).

- You own unique vehicles (e.g., classic cars, modified vehicles).

- You prefer a human touch and personalized advice rather than navigating online quotes yourself.

- You want to bundle multiple types of insurance (auto, home, life, business) and want one point of contact.

They get paid a commission by the insurance companies, so their services are typically free to you. It's always a good idea to get a quote from an independent agent alongside your direct quotes from major insurers.

Final Thoughts on Mastering Your Auto Insurance Renewal

So, there you have it. Negotiating your auto insurance renewal rates isn't some dark art; it's a straightforward process that requires a little bit of effort and preparation. By understanding your policy, assessing your current situation, leveraging every discount available, and most importantly, shopping around, you put yourself in a powerful position. You're not just a passive recipient of a bill; you're an active participant in getting the best value for your money.

Remember, your insurance needs change over time, and so do the rates offered by different companies. What was the best deal last year might not be the best deal this year. Make it a habit to review your policy and get new quotes every single year before your renewal. Even if you decide to stay with your current insurer, the process of negotiation ensures you're paying a fair price. Don't leave money on the table – take control of your auto insurance and drive smarter, not just safer!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)