Top 3 Things Your Auto Insurance Company Won't Tell You

Discover the top 3 things your auto insurance company won't tell you. Be informed to protect your rights during the claims process.

Discover the top 3 things your auto insurance company won't tell you. Be informed to protect your rights during the claims process. Navigating the world of auto insurance can feel like deciphering a secret code. You pay your premiums diligently, hoping you'll never need to use it, but when an accident happens, suddenly you're thrust into a complex system with its own rules and jargon. While insurance companies are there to provide coverage, it's also a business, and like any business, they have strategies to protect their bottom line. This means there are certain truths they might not openly share, things that could significantly impact your claim, your settlement, or even your future premiums. Understanding these unspoken realities can empower you, ensuring you're not just a policyholder, but an informed consumer ready to advocate for your best interests. Let's pull back the curtain and reveal the top three things your auto insurance company might not be eager to tell you, along with practical advice on how to use this knowledge to your advantage.

Top 3 Things Your Auto Insurance Company Wont Tell You

1. Your First Settlement Offer is Rarely Their Best Offer Understanding Auto Insurance Negotiations

When you've been in an accident, especially one that leaves you shaken and with a damaged vehicle, the first settlement offer from your insurance company can feel like a relief. It's money to fix your car, maybe cover some medical bills, and put the incident behind you. However, what many policyholders don't realize is that this initial offer is often just the starting point, not the final destination. Insurance companies, like any skilled negotiator, aim to settle claims for the lowest possible amount. Their first offer is calculated to be acceptable enough to you, but it often leaves room for them to pay more if you push back.

Why the First Offer is Low Auto Insurance Company Strategies

- Minimizing Payouts: It's a core business principle. Every dollar saved on a claim is a dollar that contributes to their profit margin.

- Testing the Waters: They want to see if you're informed and willing to negotiate. If you accept the first offer without question, they've achieved their goal.

- Underestimating Damages: The initial assessment might not fully account for all your losses, including diminished value of your vehicle, future medical costs, or pain and suffering.

How to Counter the First Offer Maximizing Your Auto Insurance Claim

Don't just accept the first offer. Here's how to prepare and negotiate:

- Gather Comprehensive Documentation: This is your most powerful tool. Collect everything: police reports, photos of the accident scene and vehicle damage (from multiple angles), medical records, repair estimates from multiple reputable shops, receipts for rental cars, and any other out-of-pocket expenses. Keep a detailed log of all communications with the insurance company.

- Get Multiple Repair Estimates: Don't rely solely on the insurance company's preferred body shop. Get at least two or three independent estimates. If your car is totaled, research the fair market value of similar vehicles in your area using resources like Kelley Blue Book or Edmunds.

- Understand Diminished Value: This is a big one that many people overlook. Even after repairs, a car that has been in a significant accident will often be worth less than an identical car that hasn't. This is called 'diminished value.' Your insurance company won't typically offer this upfront. You'll need to research how to calculate it and present a claim for it.

- Account for All Your Losses: Beyond vehicle damage, consider:

- Medical Expenses: Not just current bills, but potential future physical therapy, specialist visits, or medication.

- Lost Wages: If your injuries prevented you from working.

- Pain and Suffering: While harder to quantify, this is a legitimate component of many claims, especially for more serious injuries.

- Rental Car Costs: Ensure your policy covers a comparable rental for the entire repair period.

- Be Prepared to Justify Your Demands: When you counter, clearly explain why you believe their offer is insufficient, backing up each point with your documentation.

- Stay Calm and Professional: Emotional outbursts won't help your case. Be firm, polite, and persistent.

- Consider Legal Counsel: For serious accidents, significant injuries, or if you feel overwhelmed, consulting with a personal injury attorney can be invaluable. They are experts in negotiation and can often secure a much better settlement than you could on your own, even after their fees.

Example Scenario Auto Insurance Claim Negotiation

Imagine your car, a 2020 Honda Civic with 40,000 miles, is involved in an accident. The insurance company offers $5,000 for repairs. You get two independent estimates: one for $6,500 and another for $7,000. You also realize your car's value has dropped by $1,500 due to the accident history (diminished value). You present these figures, along with photos of the damage and a police report, to the adjuster. Instead of accepting $5,000, you counter with $8,500 ($7,000 for repairs + $1,500 for diminished value). The adjuster might come back with $6,000, but you've already moved the needle significantly from their initial lowball offer. Persistence and solid evidence are key.

2. Your Loyalty Might Not Be Rewarded The Truth About Auto Insurance Premiums

Many people believe that staying with the same auto insurance company for years will automatically lead to better rates or special loyalty discounts. While some companies do offer minor loyalty perks, the harsh truth is that your long-term commitment might actually be costing you money. Insurance companies often offer their most attractive rates and discounts to new customers to entice them away from competitors. Existing customers, especially those who don't regularly shop around, can sometimes see their premiums creep up over time without a clear explanation.

Why Loyalty Can Cost You Auto Insurance Rate Increases

- New Customer Acquisition Focus: Insurers spend heavily on marketing to attract new clients. These acquisition costs are often offset by offering competitive introductory rates.

- 'Set It and Forget It' Mentality: They know many people don't bother to compare rates annually. If you're not actively looking for a better deal, they have less incentive to offer you one.

- Risk Reassessment: Even without claims, your risk profile can change (age, vehicle depreciation, changes in local accident rates), and your current insurer might adjust your rates accordingly, sometimes more aggressively than a new insurer would.

How to Ensure You're Getting the Best Rate Shopping for Auto Insurance

The best way to ensure you're not overpaying is to become a savvy shopper, even if you're happy with your current provider:

- Shop Around Annually: Make it a habit to get quotes from at least three to five different insurance companies every year, ideally a few weeks before your policy renewal. This is the single most effective way to find better rates.

- Compare Apples to Apples: When getting quotes, ensure you're comparing policies with identical coverage limits, deductibles, and endorsements. A lower premium might mean less coverage, which isn't a true saving.

- Leverage Comparison Websites: Sites like The Zebra, NerdWallet, and Policygenius allow you to input your information once and get multiple quotes from various providers.

- Consider Independent Agents: An independent insurance agent works with multiple carriers and can do the shopping for you, often finding deals you might miss.

- Ask for a 'Rate Review' from Your Current Insurer: Once you have competitive quotes from other companies, call your current insurer. Tell them you've received lower quotes elsewhere and ask if they can match or beat them. Often, they will, especially if you've been a good customer with no claims.

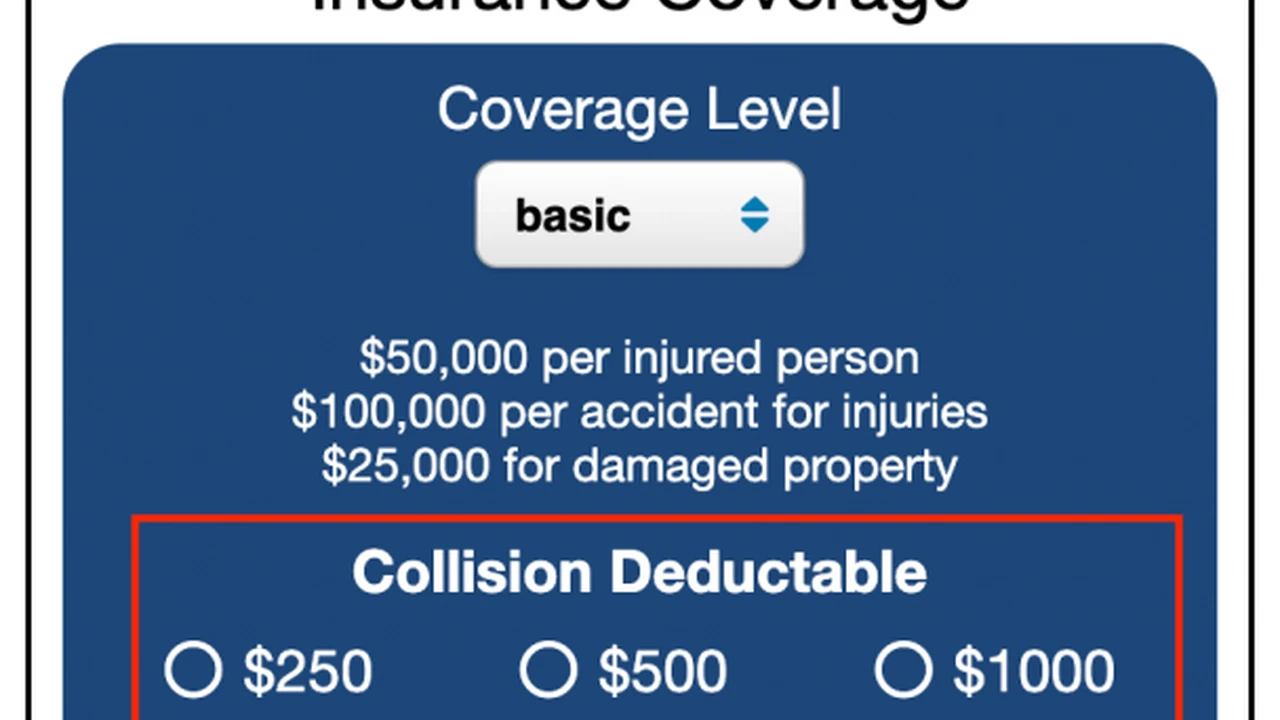

- Review Your Coverage Needs: As your car ages, you might not need the same level of comprehensive or collision coverage. If your car's value has significantly depreciated, raising your deductible or dropping certain coverages could save you money.

- Inquire About All Possible Discounts: Don't assume your insurer has applied every discount you qualify for. Proactively ask about:

- Good driver discounts

- Multi-car discounts

- Bundling discounts (home, renters, life insurance)

- Good student discounts

- Low mileage discounts

- Anti-theft device discounts

- Defensive driving course discounts

- Occupational discounts (e.g., for teachers, military, first responders)

- Payment method discounts (e.g., paying in full, automatic payments)

Recommended Comparison Tools and Providers Auto Insurance Shopping

While specific rates vary wildly by individual, location, and vehicle, here are some widely recognized platforms and providers known for competitive rates and ease of comparison:

- Online Comparison Platforms:

- The Zebra: Known for its comprehensive comparison of many carriers.

- NerdWallet: Offers detailed reviews and comparison tools.

- Policygenius: Provides personalized quotes and expert advice.

- Direct Insurers (often competitive for new customers):

- GEICO: Famous for its competitive rates and online convenience.

- Progressive: Offers tools like the 'Name Your Price' tool and Snapshot program for usage-based savings.

- State Farm: A large network of agents, often good for bundling.

- Allstate: Offers various discounts and a strong agent network.

- Liberty Mutual: Known for customizable policies and discounts.

- Specialty Insurers (depending on your profile):

- USAA: Exclusively for military members and their families, often with excellent rates and service.

- Amica Mutual: High customer satisfaction ratings, often for those with clean driving records.

Pricing Example: Let's say you're currently paying $1,200 annually with 'Company A'. After shopping around, 'Company B' offers the exact same coverage for $1,050, and 'Company C' for $1,100. You can then go back to 'Company A' and say, 'I've been offered $1,050 for the same coverage. Can you match or beat that?' Often, they will reduce your premium to retain your business, potentially saving you $150-$200 a year just for making a few phone calls or using an online tool.

3. Your Driving Data is a Goldmine for Them Understanding Telematics and Privacy

In the age of smart technology, your car isn't just a mode of transport; it's a data generator. Many auto insurance companies are increasingly offering 'telematics' programs, often marketed as 'usage-based insurance' or 'drive safe and save' programs. These involve installing a device in your car or using a smartphone app to monitor your driving habits: speed, braking, acceleration, mileage, and even the time of day you drive. While these programs promise discounts for safe driving, what they don't always emphasize is the sheer volume of data they collect about your every move behind the wheel, and how that data can be used.

What Telematics Programs Track Auto Insurance Data Collection

- Speed: How fast you drive, and if you exceed speed limits.

- Braking: Instances of hard braking, which can indicate aggressive driving.

- Acceleration: Rapid acceleration, another indicator of aggressive driving.

- Mileage: How many miles you drive, which correlates with risk exposure.

- Time of Day: Driving during peak accident times (e.g., late night) can increase your risk score.

- Location: Some devices track your routes and locations, though this is often less emphasized.

- Cornering: How sharply you take turns.

The Unspoken Implications of Telematics Auto Insurance Privacy Concerns

- Potential for Rate Increases: While marketed for discounts, if your driving habits are deemed 'risky' by their algorithms, your rates could actually increase at renewal, or you might lose discounts.

- Data Sharing: The terms and conditions often allow the insurance company to share or sell anonymized (or sometimes even identifiable) driving data with third parties, including marketing firms, data brokers, or even law enforcement in certain circumstances.

- Behavioral Nudging: Knowing you're being monitored can subtly change your driving behavior, which might be good for safety but also means the insurer is influencing your actions.

- Dispute Resolution: In the event of an accident, your own telematics data could be used against you by your insurer or the other party's insurer to assign fault or dispute your claim.

- Lack of Transparency: The exact algorithms used to calculate your 'driving score' and subsequent discounts/penalties are proprietary and not fully disclosed.

Navigating Telematics Programs Making Informed Choices

Before signing up for a telematics program, consider these points:

- Read the Fine Print: Thoroughly review the terms and conditions, especially sections on data collection, usage, and sharing. Understand what data is collected, how long it's stored, and who it might be shared with.

- Understand the Impact: Ask your insurer directly if participation can lead to rate increases, or only discounts. Some programs guarantee no rate increase for 'poor' driving, only a lack of discount, while others might penalize you.

- Assess Your Driving Habits: If you know you're a consistently safe driver with low mileage, a telematics program might genuinely save you money. If you have a lead foot or frequently drive late at night, it might be a risk.

- Consider Alternatives: If privacy is a major concern, focus on other ways to save money, such as bundling policies, increasing deductibles, or shopping around annually.

- Check for Opt-Out Options: Understand if and how you can opt out of the program if you're not satisfied, and what the implications are for your policy.

Popular Telematics Programs and Their Features Auto Insurance Technology

Many major insurers offer telematics programs. Here are a few examples:

- Progressive Snapshot:

- How it works: Plugs into your car's OBD-II port or uses a mobile app.

- What it tracks: Hard braking, rapid acceleration, mileage, time of day.

- Potential savings: Up to a certain percentage, often advertised as significant for safe drivers.

- Key feature: Some versions guarantee no rate increase for poor driving, only a lack of discount.

- GEICO DriveEasy:

- How it works: Mobile app based.

- What it tracks: Phone use while driving, hard braking, acceleration, speed, time of day.

- Potential savings: Advertised discounts for safe driving.

- Key feature: Explicitly tracks phone distraction, a growing concern for insurers.

- State Farm Drive Safe & Save:

- How it works: Mobile app or OnStar/SYNC connection.

- What it tracks: Mileage, speed, braking, acceleration, cornering.

- Potential savings: Can offer substantial discounts, especially for low-mileage drivers.

- Key feature: Integrates with existing vehicle technology for seamless tracking.

- Allstate Drivewise:

- How it works: Mobile app.

- What it tracks: Hard braking, high speed, time of day.

- Potential savings: Offers cash back rewards and policy discounts.

- Key feature: Focuses on rewarding good habits with tangible benefits.

Consideration: While these programs can offer savings, weigh the potential discount against your comfort level with data collection and the possibility of your rates being negatively impacted if your driving isn't as 'perfect' as the insurer hopes.

By understanding these three often-unspoken truths about auto insurance, you can approach your policy, claims, and renewals with greater confidence and knowledge. Remember, your insurance company is a business, and while they provide a vital service, it's up to you to be an informed consumer and advocate for your own financial well-being. Don't be afraid to ask questions, negotiate, and shop around. Your wallet will thank you.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)