5 Ways to Lower Your Auto Insurance in the Philippines

Discover 5 ways to lower your auto insurance in the Philippines. Get local advice and discounts to save on your car insurance.

5 Ways to Lower Your Auto Insurance in the Philippines

Understanding the Philippine Auto Insurance Landscape

Navigating the world of auto insurance in the Philippines can feel a bit like driving through Manila traffic – complex, sometimes overwhelming, but ultimately necessary for your peace of mind and financial security. Unlike some other markets, the Philippine auto insurance scene has its own unique characteristics, driven by local regulations, common vehicle types, and prevalent driving conditions. Mandatory third-party liability (TPL) insurance is a given, but comprehensive coverage is where most drivers look for real protection. This typically covers own damage, theft, acts of God (like floods and typhoons, which are unfortunately common here), and additional third-party property damage and bodily injury. The cost of this comprehensive coverage can vary wildly, influenced by factors such as your vehicle's make, model, year, its market value, your driving history, and even where you primarily park your car. Understanding these foundational elements is the first step to intelligently reducing your premiums without compromising on essential protection. Many Filipinos are keen to save money, and auto insurance is often seen as a significant recurring expense. However, cutting corners on coverage can lead to much larger financial headaches down the road, especially given the high cost of vehicle repairs and potential medical expenses in the event of an accident. Therefore, the goal isn't just to find the cheapest policy, but the most cost-effective one that still provides robust protection tailored to your specific needs and the local environment.

Smart Shopping and Comparing Quotes for Philippine Car Insurance

One of the most effective ways to lower your auto insurance costs in the Philippines is by becoming a savvy shopper. Don't just renew with your current provider out of habit. The Philippine insurance market is competitive, with numerous local and international players vying for your business. Each insurer has its own underwriting criteria, risk assessment models, and promotional offers, which means quotes for the exact same coverage can differ significantly from one company to another. It's highly recommended to get at least three to five quotes from different providers before making a decision.

When comparing quotes, don't just look at the bottom-line premium. Dive into the details of what's included and excluded. Key aspects to compare include: the amount of coverage for own damage, theft, and acts of God; the limits for third-party bodily injury and property damage; the deductible amount (which we'll discuss more later); and any additional benefits like roadside assistance, personal accident coverage for passengers, or car rental reimbursement. Some insurers might offer a lower premium but with a higher deductible or fewer add-ons. It's crucial to weigh these factors against your personal risk tolerance and financial capacity.

Several platforms and agents can help you with this comparison. Online insurance aggregators are becoming more popular in the Philippines, allowing you to input your vehicle details once and receive multiple quotes. Examples include Moneymax.ph and eCompareMo.com. These platforms partner with various insurers like Pioneer Insurance, Malayan Insurance, Standard Insurance, and FPG Insurance, among others. They often provide a side-by-side comparison of policy features and prices, making it easier to identify the best value. Alternatively, working with an independent insurance agent can also be beneficial. They have access to multiple providers and can offer personalized advice, helping you understand the nuances of different policies and potentially negotiate better rates on your behalf. For instance, an agent might highlight that while Company A has a slightly higher premium, their claims process is notoriously faster and more efficient, which could be a significant advantage in the event of an accident. Always ask about any ongoing promotions or discounts that might not be immediately obvious on online platforms.

Maximizing Discounts and Bundling Opportunities for Philippine Drivers

Insurance companies in the Philippines, like elsewhere, offer a variety of discounts to attract and retain customers. However, these discounts aren't always automatically applied; you often have to ask for them. Being proactive about inquiring about available discounts can lead to significant savings.

One of the most common and impactful discounts is the No Claims Discount (NCD) or No Claims Bonus (NCB). If you haven't made any claims on your policy for a certain period (typically one year or more), your insurer will reward you with a percentage discount on your renewal premium. This discount usually increases with each consecutive year you remain claim-free, up to a maximum percentage. For example, Pioneer Insurance and Malayan Insurance are known to offer competitive NCDs. Maintaining a clean driving record is not just about safety; it's also a direct path to lower insurance costs.

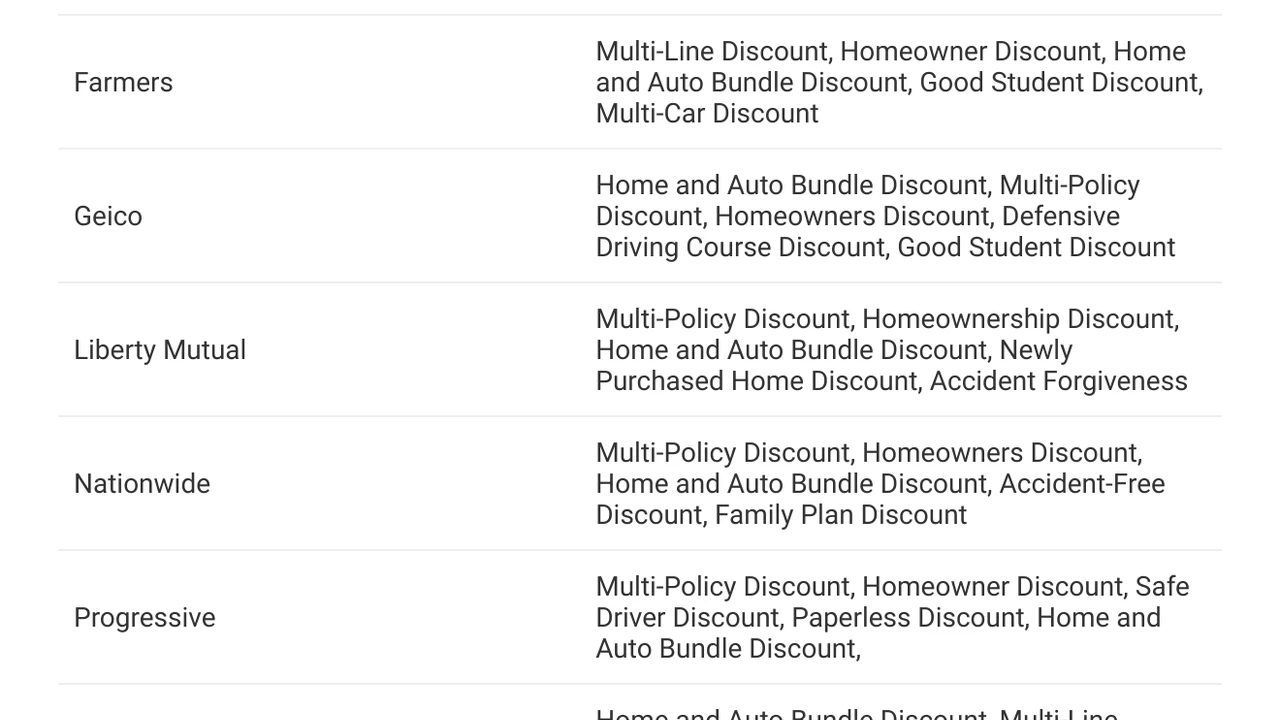

Another significant saving opportunity comes from bundling policies. If you have multiple insurance needs – for example, car insurance, home insurance, and even life insurance – consider purchasing them from the same provider. Many insurers offer multi-policy discounts. For instance, if you get your car insurance and home insurance from AXA Philippines or Prudential Guarantee, you might qualify for a substantial discount on both. This not only simplifies your insurance management but also often results in a lower overall premium than buying separate policies from different companies.

Other potential discounts to inquire about include: good driver discounts (beyond NCD, some insurers might offer additional discounts for drivers with a consistently clean record over many years), anti-theft device discounts (if your car is equipped with an alarm system, immobilizer, or GPS tracker, some insurers like Standard Insurance might offer a discount), and loyalty discounts (for long-term customers). Some insurers might also offer discounts for specific professions or affiliations, so it's always worth asking if your job or membership in certain organizations qualifies you for any special rates. For example, some companies might have partnerships with specific banks or credit card providers that offer exclusive insurance deals to their cardholders. Always be transparent about your vehicle's security features and your driving history, as these details can unlock further savings.

Adjusting Your Coverage and Deductible Wisely

While it's crucial to have adequate coverage, you might be paying for more than you actually need, or you could strategically adjust certain aspects of your policy to reduce premiums. This requires a careful assessment of your vehicle's value, your financial situation, and your risk tolerance.

The deductible is the amount you agree to pay out-of-pocket before your insurance coverage kicks in for a claim. Generally, choosing a higher deductible will result in a lower annual premium. This is a common strategy for drivers who are confident in their safe driving habits and have sufficient emergency funds to cover a higher deductible if an accident occurs. For example, if your current deductible is PHP 5,000 and you increase it to PHP 10,000, your premium could decrease by a noticeable percentage. However, be realistic about what you can comfortably afford to pay in an emergency. If a higher deductible means you'd struggle financially after an accident, it might not be the right choice for you. In the Philippines, standard deductibles often range from PHP 3,000 to PHP 10,000, but you can often opt for higher amounts.

Another area to review is the coverage for older vehicles. If you own an older car with a low market value, the cost of comprehensive coverage might sometimes approach or even exceed the car's actual worth over a few years. In such cases, you might consider reducing your comprehensive coverage or even switching to a third-party liability (TPL) only policy, perhaps with added third-party property damage. While this leaves you exposed to own damage costs, the savings on premiums could be substantial. For example, if your car is 10 years old and valued at PHP 150,000, paying PHP 15,000 annually for comprehensive insurance might not be the most cost-effective solution if you're a careful driver and have savings for minor repairs. However, always weigh the potential repair costs against the premium savings. For newer or more valuable vehicles, comprehensive coverage is almost always a wise investment.

Also, consider removing or reducing certain add-ons that you might not genuinely need. While roadside assistance and personal accident coverage are valuable, if you already have these benefits through other memberships (e.g., credit card perks or car manufacturer warranties), you might be duplicating coverage and paying extra. Review your policy annually and adjust coverage based on your current circumstances and vehicle value. For instance, if you've paid off your car loan, you might have more flexibility in adjusting your comprehensive coverage, as the bank's requirements for full coverage would no longer apply.

Maintaining a Good Driving Record and Vehicle Security

Your driving behavior is one of the most significant factors influencing your auto insurance premiums in the Philippines. A clean driving record, free of accidents and traffic violations, is your best friend when it comes to securing lower rates. Insurers view drivers with a history of claims or infractions as higher risk, and they price their policies accordingly.

Driving safely and defensively is paramount. Avoid speeding, reckless driving, and driving under the influence. Even minor traffic violations, if they accumulate, can signal to insurers that you're a higher risk driver. In the Philippines, traffic enforcers are becoming more vigilant, and violations are increasingly recorded and can impact your insurance eligibility or rates. A single at-fault accident can cause your premiums to jump significantly at renewal, and it can also affect your No Claims Discount, effectively costing you twice – once through the claim itself, and again through higher future premiums.

Beyond your driving habits, the security of your vehicle also plays a crucial role. Cars that are less likely to be stolen or vandalized are cheaper to insure. Investing in robust anti-theft devices can lead to discounts from many Philippine insurers. Common security features that can help include: a car alarm system, an engine immobilizer, a GPS tracking device, and even simply parking your car in a secure, well-lit garage or parking facility overnight. When getting quotes, always inform the insurer about any security features your vehicle has. For example, if your car is equipped with a factory-installed immobilizer, make sure to mention it. Some insurers, like FPG Insurance, might specifically ask about these features during the quotation process.

Furthermore, regular vehicle maintenance can indirectly contribute to lower insurance costs. A well-maintained vehicle is less likely to break down or be involved in an accident due to mechanical failure. While this doesn't directly translate to a discount, it reduces the likelihood of making a claim, which in turn helps you maintain your No Claims Discount and keeps your record clean. Consider installing a dashcam; while not a direct discount factor, it can be invaluable in proving your innocence in an accident, preventing an at-fault claim from being filed against you, and thus preserving your NCD.

Considering Usage-Based Insurance and Specialized Policies

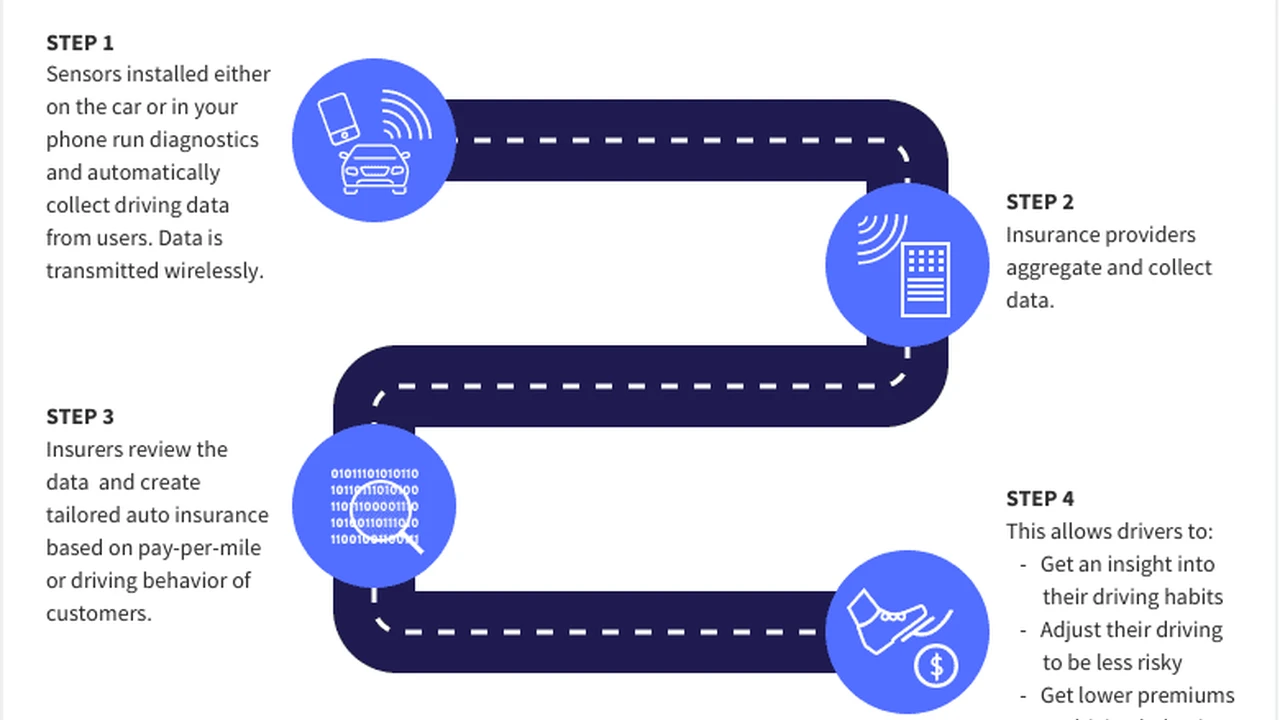

The Philippine insurance market is slowly but surely embracing technological advancements, including usage-based insurance (UBI) and specialized policies that cater to specific driving behaviors or vehicle types. While not as widespread as in some Western markets, these options are emerging and can offer significant savings for certain drivers.

Usage-Based Insurance (UBI), often referred to as 'pay-as-you-drive' or 'pay-how-you-drive' insurance, utilizes telematics devices (small devices plugged into your car's OBD-II port or smartphone apps) to monitor your driving habits. Factors like mileage, speed, braking patterns, acceleration, and even the time of day you drive are recorded. Safe drivers who drive less or exhibit good driving behavior can receive substantial discounts on their premiums. While still relatively new in the Philippines, some insurers are starting to pilot or offer such programs. For instance, some international players with a presence in the Philippines might offer UBI options, or local insurers might partner with telematics providers. If you're a low-mileage driver or consistently practice safe driving, inquire with insurers like Pioneer Insurance or Malayan Insurance if they have any UBI programs or plans to introduce them. This can be a game-changer for those who drive infrequently or are exceptionally careful on the road.

Beyond UBI, consider if you qualify for any specialized policies. For example, if you only drive your car on weekends or for very short distances, some insurers might offer specific low-mileage policies. While not always explicitly advertised, asking about such options can sometimes lead to a customized quote. Similarly, if you own a classic or vintage car, specialized classic car insurance policies might offer better coverage and rates than standard comprehensive policies, as they understand the unique risks and values associated with such vehicles. However, the market for classic car insurance is still niche in the Philippines.

Another area to explore is fleet insurance if you own multiple vehicles for a business. Insuring several vehicles under a single fleet policy can often be more cost-effective than insuring each car individually. This is particularly relevant for small businesses or families with multiple cars. Insurers like Standard Insurance and FPG Insurance, which cater to both individual and commercial clients, would be good starting points for such inquiries.

Finally, always remember that the insurance market is dynamic. New products and discount structures are constantly being introduced. Staying informed, asking questions, and being willing to switch providers when a better deal comes along are key to consistently lowering your auto insurance costs in the Philippines. Don't be afraid to leverage the competitive nature of the market to your advantage. A little research and negotiation can go a long way in keeping more money in your pocket while ensuring your vehicle remains adequately protected.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)