The Benefits of Multi Policy Discounts Beyond Home and Auto

Understand the benefits of multi policy discounts beyond home and auto. Explore bundling options for life renters and other insurance types.

Understand the benefits of multi policy discounts beyond home and auto. Explore bundling options for life renters and other insurance types.

The Benefits of Multi Policy Discounts Beyond Home and Auto

Hey there, savvy saver! We all know the classic advice for cutting down on insurance costs: bundle your home and auto insurance. It’s practically insurance 101, right? Most major carriers shout about it from the rooftops, and for good reason – it works! But what if I told you that the world of multi-policy discounts extends far beyond just your house and your car? What if there are even more opportunities to stack those savings and keep more cash in your pocket? Well, buckle up, because we’re about to dive deep into the often-overlooked universe of bundling other insurance types, from life insurance to renters, recreational vehicles, and even business policies. This isn't just about saving a few bucks; it's about smart financial planning and maximizing every dollar you spend on protection.

Beyond the Basics Exploring Diverse Bundling Opportunities

When most people think of bundling, their minds immediately jump to the dynamic duo: home and auto. And yes, that’s a fantastic starting point. Companies like State Farm, GEICO, Progressive, Allstate, and Farmers Insurance are famous for offering significant discounts when you combine these two. For example, State Farm often boasts savings of up to 17% when you bundle home and auto. GEICO frequently advertises up to 25% off your total premium. These are substantial savings that can add up to hundreds, if not thousands, of dollars annually. But let's broaden our horizons. Your insurance needs are likely more complex than just a car and a house. You might rent an apartment, own a motorcycle, have a boat, or even run a small business from home. Each of these assets or life stages presents a new opportunity for bundling.

Life Insurance and Auto Insurance A Powerful Pairing for Long Term Savings

This is where things get really interesting and often overlooked. Many people don't realize that combining your auto insurance with a life insurance policy can unlock some serious savings. Why do insurance companies do this? Because customers who purchase life insurance tend to be more financially stable, responsible, and therefore, lower risk. It’s a win-win: they get a loyal, low-risk customer, and you get a discount on your car insurance, plus the peace of mind that comes with life coverage.

Product Spotlight Leading Carriers Offering Life and Auto Bundles

- State Farm: A perennial favorite for bundling, State Farm offers competitive rates when you combine auto with their various life insurance options, including term life, whole life, and universal life. Their agents are known for personalized service, helping you find the right life policy to fit your budget and needs, while simultaneously applying a discount to your auto premium.

- Allstate: Allstate also provides attractive multi-policy discounts for bundling auto and life insurance. They have a range of life insurance products, from basic term policies to more complex universal life options. Their 'Good Hands' network means you often get a dedicated agent who can help you navigate both policies seamlessly.

- Nationwide: Nationwide is another strong contender, offering discounts for combining auto with their life insurance products. They often emphasize their financial strength and comprehensive coverage options, making them a reliable choice for long-term protection.

- Farmers Insurance: Farmers agents are well-versed in bundling strategies, and combining auto with one of their life insurance policies (term, whole, or universal) can lead to significant savings. They often have programs designed to reward customers who consolidate their insurance needs.

Real World Scenario Maximizing Your Life and Auto Bundle

Let's say you're a 35-year-old professional with a family, driving a 2020 Honda CR-V. You're currently paying $1,200 annually for auto insurance. You've been considering a 20-year term life insurance policy with a $500,000 death benefit, which might cost around $400-$600 per year on its own. If you bundle these with a carrier like State Farm, you could see a discount of 5-15% on your auto premium. That's $60-$180 in annual savings on your car insurance alone, effectively reducing the net cost of your life insurance. Over the 20-year term, that's a substantial amount of money saved, all while securing your family's financial future. The key is to get quotes from multiple carriers that offer both types of insurance and compare the total bundled price, not just the individual policy costs.

Renters Insurance and Auto Insurance Smart Savings for Non Homeowners

If you don't own a home, you might think you're out of luck when it comes to bundling. Think again! Renters insurance is an incredibly affordable and essential policy that protects your personal belongings from theft, fire, and other perils, and also provides liability coverage. The best part? It's a fantastic bundling partner for your auto insurance.

Why Renters Insurance is a Bundling Gem

Renters insurance is typically very inexpensive, often costing as little as $10-$20 per month. When you bundle it with your auto policy, the discount you receive on your car insurance can often be more than the cost of the renters policy itself! This means you essentially get renters insurance for free, or even come out ahead. Insurance companies love this bundle because it shows you're a responsible individual who takes steps to protect your assets, making you a lower risk overall.

Top Providers for Renters and Auto Bundles

- GEICO: Known for its competitive auto rates, GEICO also offers excellent renters insurance and significant multi-policy discounts when you combine the two. Their online quoting system makes it easy to see your potential savings instantly.

- Progressive: Progressive is another major player that actively promotes renters and auto bundles. They often have tools that allow you to compare different bundling scenarios to find the best deal.

- Liberty Mutual: Liberty Mutual offers strong discounts for bundling renters and auto. They also provide a good range of coverage options for both policies, allowing for customization.

- Lemonade: While newer to the scene, Lemonade is a tech-forward insurer that offers incredibly affordable renters insurance and is expanding into auto. They are known for their user-friendly app and quick claims process, and their bundling options are becoming increasingly attractive.

Practical Application Getting the Most from Your Renters Bundle

Imagine you're paying $1,000 annually for auto insurance. You add a renters policy for $150 per year. With a typical bundling discount of 5-10% on your auto premium, you could save $50-$100. In this scenario, your renters insurance effectively costs you only $50-$100 per year, or even less if the discount is higher. It's a no-brainer for anyone renting an apartment or home.

Recreational Vehicle RV Motorcycle Boat Insurance and Auto Bundles

Do you love hitting the open road on your motorcycle, cruising the lake in your boat, or exploring the country in your RV? Great news! These recreational vehicles (RVs) also present fantastic bundling opportunities with your primary auto insurance.

Why Bundle Your Toys

Just like with home and auto, insurance companies see customers who insure multiple vehicles with them as more loyal and less likely to switch. This loyalty is rewarded with discounts. Plus, it simplifies your insurance management – one company, one bill, often one agent to deal with for all your vehicles.

Leading Insurers for RV Motorcycle and Boat Bundles

- Progressive: Progressive is a giant in the RV and motorcycle insurance market. They offer substantial multi-policy discounts when you combine these with your car insurance. They understand the unique needs of recreational vehicle owners.

- Foremost (a Farmers Insurance Group company): Foremost specializes in niche insurance products, including RVs, motorcycles, and boats. When purchased through Farmers, you can often bundle these specialized policies with your auto insurance for a comprehensive discount.

- Nationwide: Nationwide also offers competitive rates and bundling options for various recreational vehicles, making it a convenient choice for those with multiple modes of transport.

- Safeco (a Liberty Mutual company): Safeco is known for its strong bundling discounts, and this extends to recreational vehicles. They offer flexible coverage options for motorcycles, boats, and RVs that can be combined with your auto policy.

Scenario Planning Insuring Your Fleet of Fun

Let's say you have a car, a motorcycle, and a small fishing boat. Insuring each separately might cost you $1,200 for the car, $300 for the motorcycle, and $200 for the boat, totaling $1,700. By bundling all three with a single carrier like Progressive, you could potentially save 10-20% across all policies. That's $170-$340 in annual savings, making your hobbies even more affordable to protect.

Business Insurance and Auto Insurance Protecting Your Livelihood

For small business owners, especially those who use their vehicles for work or operate a home-based business, bundling business insurance with personal auto insurance can be a smart move. This is particularly relevant for freelancers, consultants, or those with a small commercial fleet.

The Synergy of Business and Personal Coverage

While personal auto insurance doesn't cover business use, many carriers offer commercial auto policies or endorsements that can be bundled with your personal auto and other business insurance (like general liability or professional liability). This creates a holistic protection plan for both your personal and professional assets.

Key Players in Business and Auto Bundling

- Travelers: Travelers is a strong provider of both personal and business insurance. They offer excellent multi-policy discounts when you combine your personal auto with various business insurance products, including commercial auto, general liability, and business owner's policies (BOPs).

- Hartford: The Hartford specializes in small business insurance and also offers personal auto. They are a great option for business owners looking to consolidate their coverage and benefit from bundling discounts.

- Liberty Mutual: With a robust commercial insurance division, Liberty Mutual can often provide attractive bundling options for small business owners who also have their personal auto with them.

- Farmers Insurance: Farmers has a strong presence in the small business market and can often bundle commercial auto policies with personal auto and other business coverages.

Case Study A Freelancer's Bundling Advantage

Consider a freelance photographer who uses their personal SUV for client shoots and has expensive camera equipment. They need personal auto insurance, but also a commercial auto endorsement for business use, and a business owner's policy (BOP) to cover their equipment and liability. If they get these policies from different providers, they might pay a premium for each. By bundling with a carrier like Travelers, they could see a significant discount across all policies, simplifying their insurance management and reducing their overall cost, while ensuring comprehensive protection for their livelihood.

The Art of the Bundle How to Maximize Your Savings

Bundling isn't just about picking two policies and hoping for the best. There's an art to it, and a few strategies can help you maximize your savings:

Shop Around and Compare Total Bundled Prices

Don't just look at the discount percentage. Get quotes from multiple carriers for all the policies you want to bundle. Compare the total annual premium for the bundled package, not just the individual policy prices. Sometimes, a carrier with a slightly lower individual auto rate might offer a less attractive bundle discount, making another carrier a better overall value.

Consolidate All Your Insurance Needs

Think about every type of insurance you have or might need: auto, home, renters, life, motorcycle, RV, boat, umbrella, pet, identity theft, business. The more policies you can consolidate with one carrier, the greater your potential for discounts. Some carriers offer a 'super bundle' discount for having three or more policies.

Review Your Policies Annually

Your insurance needs change over time. New car? New house? New family member? New business venture? Review your policies annually with your agent or online to ensure you still have the right coverage and are getting all available discounts. Don't be afraid to re-quote your bundle every few years to ensure you're still getting the best deal.

Ask About All Available Discounts

Beyond multi-policy discounts, ask your agent about every other discount you might qualify for: good driver, good student, defensive driving course, anti-theft devices, low mileage, paperless billing, automatic payments, professional affiliations, and more. Stack those discounts!

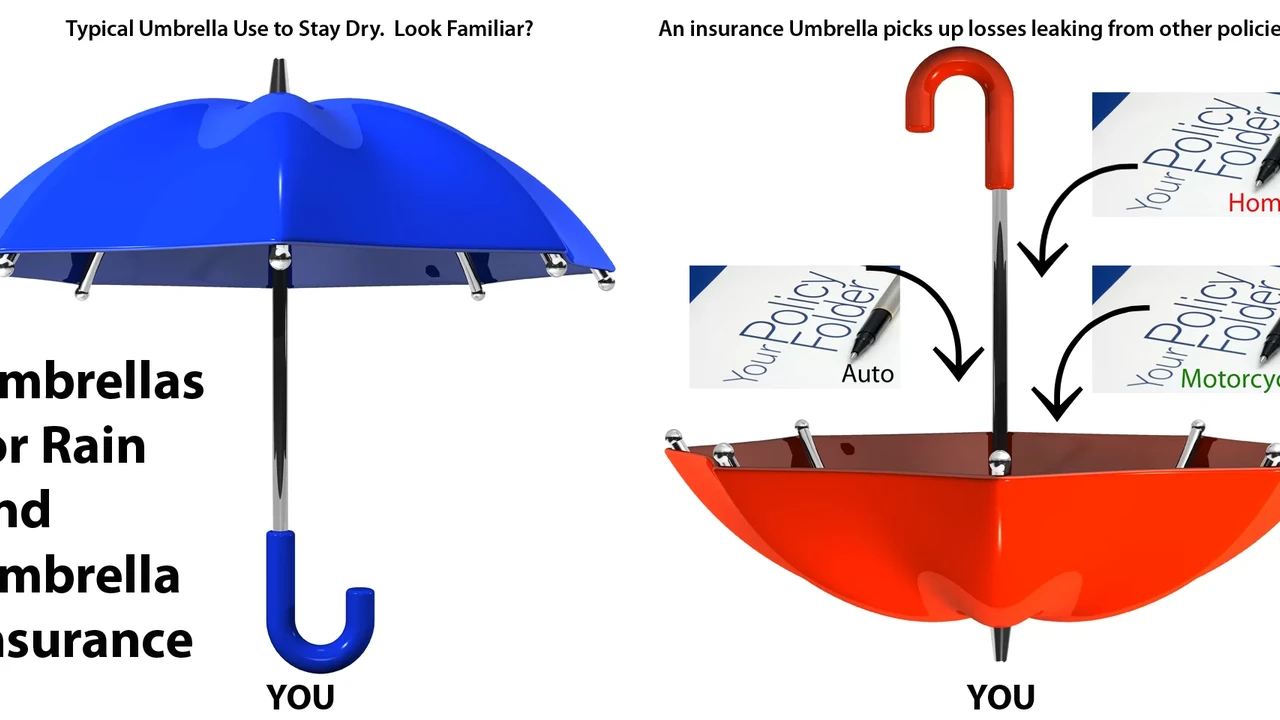

Consider an Umbrella Policy for Enhanced Protection

An umbrella policy provides additional liability coverage above and beyond your auto and home insurance limits. It's an excellent way to protect your assets from large lawsuits. Many carriers offer a discount on your auto and home policies when you add an umbrella policy, making it a smart financial move that also saves you money.

Final Thoughts on Smart Bundling

The world of multi-policy discounts is far richer and more diverse than just home and auto. By strategically bundling your life, renters, recreational vehicle, and even business insurance with your auto policy, you can unlock significant savings, simplify your financial life, and ensure comprehensive protection for all your assets. It's about being proactive, doing your research, and not being afraid to ask questions. So, take a moment to assess all your insurance needs, reach out to a few top carriers, and start bundling your way to smarter savings today!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)