The Role of a Public Adjuster in Auto Insurance Claims

Understand the role of a public adjuster in auto insurance claims. Learn how they can help you navigate complex claims and maximize your settlement.

Understand the role of a public adjuster in auto insurance claims. Learn how they can help you navigate complex claims and maximize your settlement.

The Role of a Public Adjuster in Auto Insurance Claims

Dealing with the aftermath of a car accident is stressful enough without having to battle your insurance company over a claim. You've got vehicle damage, potential injuries, and a mountain of paperwork. It's a lot to handle. This is where a public adjuster can step in and be a real game-changer. Think of them as your personal advocate, working solely for you, the policyholder, to ensure you get a fair and maximum settlement from your auto insurance claim. Unlike the adjusters employed by your insurance company, whose primary loyalty is to their employer, a public adjuster's only goal is to protect your interests.

What is a Public Adjuster and How Do They Help Auto Insurance Claims

A public adjuster is a licensed and regulated professional who works on behalf of policyholders to negotiate insurance claims. They don't work for insurance companies; they work for you. When it comes to auto insurance claims, their role is multifaceted and incredibly valuable, especially in complex situations. They handle everything from reviewing your policy to documenting damages, negotiating with your insurer, and ultimately striving for the best possible settlement. This can be particularly beneficial when dealing with significant damage, disputes over liability, or when your insurance company seems to be dragging its feet or offering a lowball settlement.

Why Consider a Public Adjuster for Your Auto Accident Claim

You might be thinking, 'My insurance company is supposed to help me, right?' And yes, they are. But their adjusters are also trained to protect the company's bottom line. This can sometimes lead to settlements that are less than what you truly deserve. Here's why a public adjuster can be a smart move for your auto accident claim:

Expertise in Auto Insurance Policy Interpretation and Claim Valuation

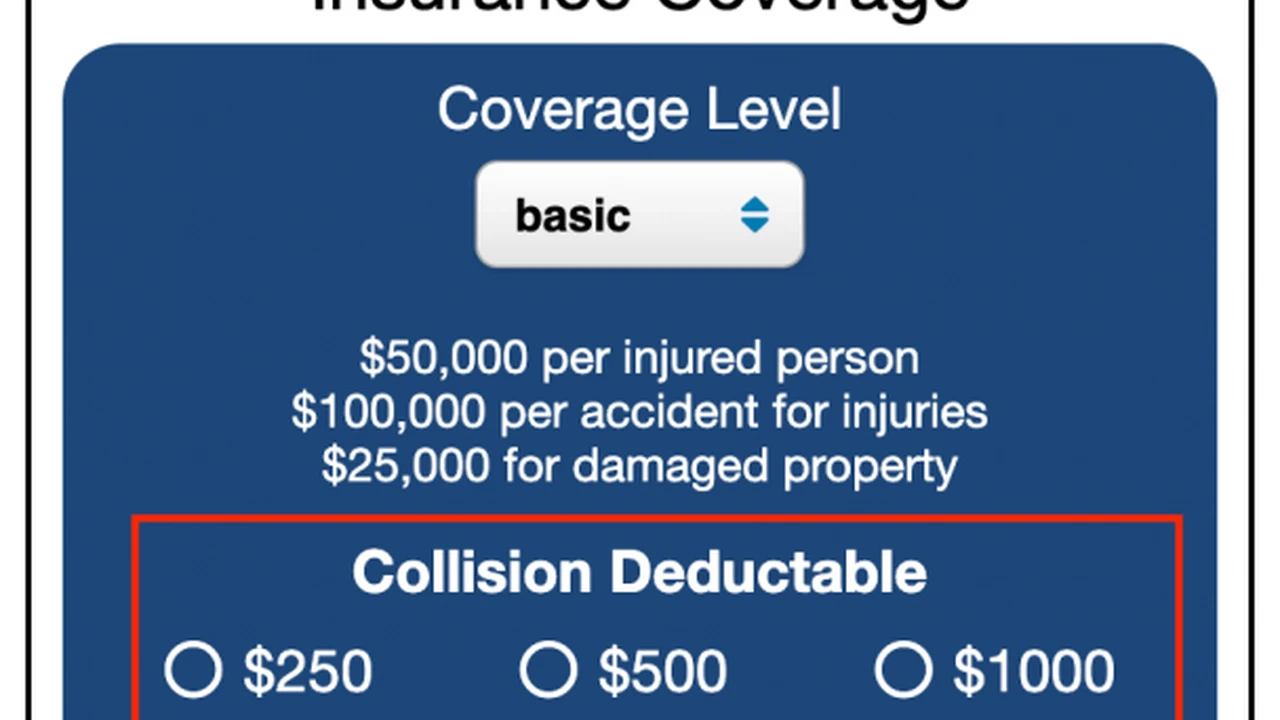

Auto insurance policies can be incredibly complex, filled with jargon and clauses that are difficult for the average person to understand. Public adjusters are experts in policy interpretation. They know exactly what your policy covers, what it doesn't, and how to leverage its terms to your advantage. They'll meticulously review your policy to identify all applicable coverages, ensuring no stone is left unturned. Furthermore, they have a deep understanding of vehicle repair costs, diminished value, rental car expenses, and other potential damages, allowing them to accurately value your claim. This expertise is crucial in countering any low offers from your insurer.

Time Savings and Stress Reduction in Auto Insurance Claim Process

Filing an auto insurance claim is a time-consuming process. There are forms to fill out, evidence to gather, phone calls to make, and negotiations to conduct. If you're also recovering from an accident or trying to manage your daily life, this can be overwhelming. A public adjuster takes all of this off your plate. They handle all communication with the insurance company, manage the paperwork, and coordinate with repair shops and other relevant parties. This frees up your time and significantly reduces the stress associated with the claims process, allowing you to focus on your recovery and getting back to normal.

Maximizing Your Auto Insurance Settlement for Vehicle Damage and Injuries

This is arguably the biggest benefit. Public adjusters are skilled negotiators. They know the tactics insurance companies use to minimize payouts and are prepared to counter them. They will present a well-documented and thoroughly researched claim, backed by evidence and expert opinions, to justify a higher settlement. This includes not just the cost of repairs or replacement for your vehicle, but also potential diminished value (the loss in market value of your car after an accident, even if repaired), rental car costs, and even medical expenses if applicable. Their goal is to ensure you receive every penny you're entitled to under your policy, often resulting in significantly larger settlements than policyholders would achieve on their own.

When to Hire a Public Adjuster for Your Auto Insurance Claim

While a public adjuster can be beneficial in many situations, there are specific scenarios where their services become almost indispensable:

Complex Auto Accidents and Disputed Liability Claims

If your accident involves multiple vehicles, unclear liability, or significant damage, the claim can quickly become complicated. When there's a dispute over who was at fault, or if the other party's insurance company is denying responsibility, a public adjuster can gather evidence, interview witnesses, and present a compelling case on your behalf. They can navigate the legal intricacies and ensure your side of the story is properly represented, preventing you from being unfairly blamed or receiving a reduced settlement.

Significant Vehicle Damage and Total Loss Auto Claims

When your vehicle is severely damaged or declared a total loss, determining its actual cash value (ACV) can be contentious. Insurance companies often use valuation methods that may undervalue your vehicle. A public adjuster will conduct their own independent valuation, considering factors like mileage, condition, and upgrades, to ensure you receive a fair payout for your totaled vehicle. They can also help you understand your options for replacement or repair and ensure all related costs, such as towing and storage, are covered.

Lowball Offers and Unresponsive Auto Insurance Companies

If your insurance company offers a settlement that seems too low, or if they are unresponsive and difficult to communicate with, it's a clear sign you might need a public adjuster. They can re-open negotiations, challenge the insurer's valuation, and apply pressure to get a fair response. They act as a buffer, taking on the burden of communication and negotiation, so you don't have to deal with the frustration of a stalled or unfair claim.

Diminished Value Claims After Auto Repair

Even after a vehicle is perfectly repaired, it often loses market value simply because it has been in an accident. This is known as diminished value. Many insurance companies are reluctant to pay diminished value claims, and proving it can be challenging. Public adjusters are skilled in calculating and negotiating diminished value, ensuring you are compensated for this often-overlooked loss. They can work with appraisers and provide expert testimony to support your claim for the reduced resale value of your vehicle.

How Public Adjusters Charge for Auto Insurance Claim Services

Public adjusters typically work on a contingency fee basis, meaning they only get paid if you get paid. This aligns their interests directly with yours, as they are motivated to secure the highest possible settlement for you.

Contingency Fees for Auto Insurance Claim Assistance

Their fee is usually a percentage of the final settlement amount. This percentage can vary, but it's typically between 10% and 20%. For example, if your public adjuster secures a $10,000 settlement for you and their fee is 15%, they would receive $1,500, and you would receive $8,500. It's important to discuss and agree upon the fee structure upfront, and ensure it's clearly outlined in a written contract before you engage their services. This transparency ensures there are no surprises later on.

No Upfront Costs for Auto Insurance Claim Representation

One of the significant advantages of working with a public adjuster is that there are usually no upfront costs. You don't pay anything out of pocket until your claim is settled. This makes their services accessible even if you're facing financial strain after an accident. They invest their time and resources into your claim, confident that their expertise will lead to a successful outcome that benefits both parties.

Choosing the Right Public Adjuster for Your Auto Insurance Needs

Selecting the right public adjuster is crucial. You want someone experienced, reputable, and who communicates well. Here are some tips:

Key Qualities of a Reputable Auto Insurance Public Adjuster

- Licensed and Bonded: Ensure they are properly licensed in your state and bonded, which provides financial protection.

- Experience with Auto Claims: Look for someone with specific experience in auto insurance claims, as this differs from property claims.

- Strong References and Reviews: Check online reviews and ask for references from previous clients.

- Clear Communication: They should be able to explain the process clearly and keep you updated regularly.

- Professionalism: A good public adjuster will be professional, ethical, and dedicated to your case.

Questions to Ask Before Hiring an Auto Insurance Public Adjuster

- What is your experience with auto insurance claims similar to mine?

- What is your fee structure, and is it negotiable?

- Can you provide references from past clients?

- How will you communicate with me throughout the process?

- What is your estimated timeline for resolving my claim?

- What specific strategies will you use to maximize my settlement?

Specific Public Adjuster Services and Products for Auto Claims

While public adjusters primarily offer a service, some firms might integrate or recommend specific tools and resources to enhance their claim handling. These aren't 'products' in the traditional sense of something you buy off a shelf, but rather methodologies, software, or partnerships that aid in their work.

Advanced Claim Documentation Software for Auto Accidents

Many modern public adjusting firms utilize specialized software for meticulous claim documentation. These tools help them organize evidence, photographs, repair estimates, medical records, and communication logs efficiently. For example, platforms like Xactimate (though primarily for property, some principles apply to vehicle damage assessment) or proprietary systems developed by larger adjusting firms allow for detailed, itemized damage reports that are difficult for insurance companies to dispute. These systems ensure every dent, scratch, and mechanical issue is accounted for, providing a comprehensive and undeniable record of loss. The use of such software ensures accuracy and consistency, which are vital when negotiating with insurers.

Independent Vehicle Appraisal Services for Diminished Value

When dealing with diminished value claims, public adjusters often partner with or recommend independent vehicle appraisal services. These services employ certified appraisers who specialize in assessing the pre-accident market value and post-repair market value of a vehicle. Companies like Collision Claims Associates or Diminished Value of Georgia (though state-specific, similar services exist nationwide and internationally) provide expert reports that quantify the financial loss due to an accident. These reports are crucial evidence when negotiating diminished value, as they offer an unbiased, professional assessment that carries significant weight. The cost for such an appraisal can range from a few hundred to over a thousand dollars, depending on the vehicle's value and complexity, but it's often a worthwhile investment if it leads to a significantly higher diminished value settlement.

Legal Consultation and Referral Networks for Auto Injury Claims

While public adjusters focus on the property damage aspect of auto claims, they often have strong referral networks with personal injury attorneys. If your auto accident involves injuries, a public adjuster can recommend reputable lawyers who specialize in personal injury law. This ensures that both the vehicle damage and any bodily injury claims are handled by experts in their respective fields. Firms like Morgan & Morgan or local personal injury law offices are examples of legal partners that public adjusters might recommend. The legal fees for personal injury cases are typically also on a contingency basis, usually around 33-40% of the injury settlement, but this ensures you have expert legal representation without upfront costs.

Drone and 3D Scanning Technology for Accident Scene Reconstruction

For very complex or severe auto accidents, some advanced public adjusting firms might employ or contract services that use drone photography or 3D laser scanning technology for accident scene reconstruction. This creates highly accurate, detailed visual records of the accident scene, vehicle positions, and environmental factors. While less common for standard fender-benders, for multi-vehicle pile-ups or accidents with significant infrastructure damage, this technology provides irrefutable evidence. Companies specializing in forensic accident reconstruction, often used by law enforcement or large legal firms, can be brought in. The cost for such high-tech services can be substantial, potentially thousands of dollars, but for high-value claims or those with significant liability disputes, the investment can be justified by the clarity and strength of evidence it provides.

Comparison of Public Adjuster Services vs. DIY vs. Insurance Company Adjuster

Let's break down the different approaches to handling an auto insurance claim:

DIY Do It Yourself Auto Insurance Claim

Pros: No cost for a public adjuster, full control over the process. You keep 100% of the settlement.

Cons: Requires significant time, effort, and understanding of insurance policies and negotiation tactics. High risk of undervaluation or missing out on entitled coverages. Can be very stressful and frustrating, especially if you're recovering from injuries or dealing with a complex claim. You might accept a lower settlement simply to get it over with.

Best for: Very minor accidents with clear liability and minimal damage, where the repair costs are straightforward and undisputed.

Insurance Company Adjuster Led Auto Insurance Claim

Pros: No direct cost to you (it's part of your premium). They handle the initial steps of the claim. Potentially quicker resolution for simple claims.

Cons: The adjuster works for the insurance company, not for you. Their primary goal is to settle the claim for the lowest possible amount while still fulfilling the policy's obligations. They may not inform you of all available coverages or potential avenues for compensation (like diminished value). Lack of transparency can be an issue.

Best for: Simple, undisputed claims where the damage is minor and the insurance company's initial offer seems fair and reasonable.

Public Adjuster Assisted Auto Insurance Claim

Pros: Expert representation focused solely on your interests. Maximizes your settlement, often resulting in a net gain even after their fee. Saves you time and reduces stress. Handles all communication and negotiation. Identifies all applicable coverages and potential compensation. Provides peace of mind.

Cons: They take a percentage of your settlement (typically 10-20%). Not always necessary for very minor, straightforward claims where the insurer is being fair.

Best for: Complex claims, significant damage or total loss, disputed liability, lowball offers, unresponsive insurers, diminished value claims, or when you simply don't have the time or expertise to handle the claim yourself.

In many cases, even after paying the public adjuster's fee, policyholders end up with a significantly larger net settlement than they would have achieved on their own or by relying solely on the insurance company's adjuster. The value they bring in expertise, time savings, and negotiation power often far outweighs their cost.

Real World Scenarios Where a Public Adjuster Made a Difference in Auto Claims

Let's look at a couple of hypothetical but common situations where a public adjuster's involvement proved invaluable:

Case Study 1 High Value Vehicle Total Loss Claim

Sarah owned a luxury SUV that was totaled in an accident. Her insurance company offered her $45,000, claiming it was the actual cash value. Sarah felt this was too low, as she had recently invested in premium upgrades and the vehicle was in pristine condition before the accident. She hired a public adjuster. The adjuster conducted an independent appraisal, factoring in the upgrades, low mileage, and regional market values, and determined the ACV was closer to $55,000. After several rounds of negotiation, backed by the adjuster's detailed report and market data, the insurance company increased their offer to $53,000. Even after the public adjuster's 15% fee ($7,950), Sarah received $45,050, which was still $5,050 more than the initial offer, and she didn't have to endure the stress of fighting the insurer herself.

Case Study 2 Disputed Liability and Diminished Value Claim

Mark was involved in an accident where the other driver claimed Mark was at fault, despite evidence to the contrary. Mark's car, a relatively new sedan, sustained significant damage but was repairable. His insurance company was hesitant to fully cover the repairs due to the disputed liability, and they completely dismissed his inquiry about diminished value. Mark engaged a public adjuster. The adjuster meticulously gathered witness statements, reviewed police reports, and even consulted with an accident reconstruction expert to clearly establish the other driver's fault. Simultaneously, they commissioned a diminished value appraisal. With this comprehensive evidence, the public adjuster successfully negotiated full coverage for the repairs and secured an additional $3,000 for diminished value, which Mark would have never received otherwise. The adjuster's fee was a percentage of the total settlement, but Mark felt it was a small price to pay for the peace of mind and the full compensation he received.

Navigating the Future of Auto Insurance Claims with Professional Help

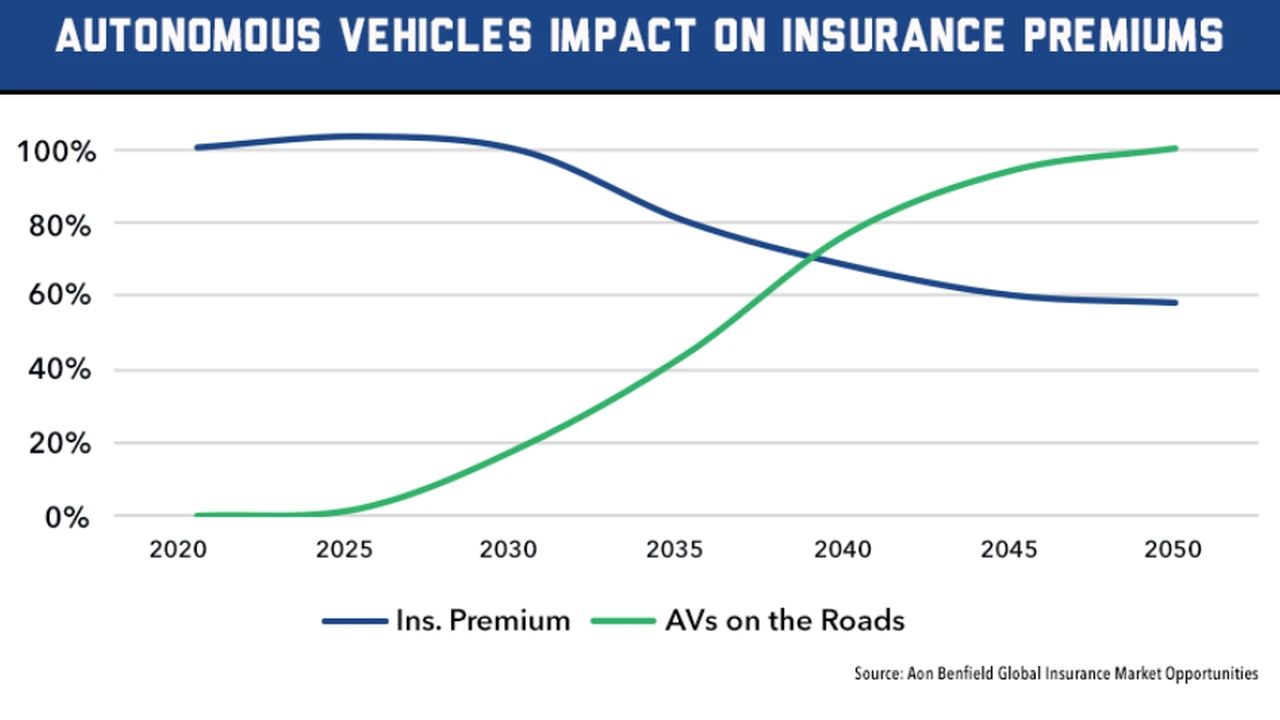

As vehicles become more technologically advanced, and accident scenarios grow more complex, the role of a public adjuster in auto insurance claims is likely to become even more critical. Features like Advanced Driver-Assistance Systems (ADAS) and autonomous driving capabilities introduce new layers of complexity in determining liability and assessing damage. Having an expert on your side who understands these evolving dynamics can be a significant advantage.

Ultimately, deciding whether to hire a public adjuster for your auto insurance claim comes down to the complexity of your situation, the value of your claim, and your comfort level with negotiating with insurance companies. If you're facing a significant loss, a dispute, or simply feel overwhelmed, a public adjuster can be an invaluable ally, ensuring your rights are protected and you receive the fair settlement you deserve.

Don't let the stress of an auto accident claim add to your burden. Consider the benefits of having a professional advocate in your corner. They can turn a frustrating experience into a successful resolution, allowing you to move forward with confidence.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)